‘‘As a rule, any loan that had been turned into an acronym or abbreviation could more clearly be called a subprime loan, but the bond market didn't want to be clear.’’

Michael Lewis in The Big Short.

Let’s face it: the bond market can be deceptive for many.

Plenty of incomprehensible jargon and technicalities, which often lead to the opposite outcome: over-simplified narratives, easy to grasp but…outright wrong.

This article will provide you with the tools to approach the fixed income market like a seasoned professional investor. In plain English.

Ok, perhaps with my funny Al-Pacino accent…but you get what I mean.

We will decompose bonds into their basic components, discuss the importance of the repo market, and touch upon regulation constraints for the biggest whales in this market - e.g. banks, pension funds, and Central Bank reserve managers.

A helicopter view of how to approach one of the biggest and most misinterpreted markets in the world.

Ah, and at the end of the article…two surprises, too!

Without further ado, let’s jump right in!

Piece By Piece

Before we start, a quick shoutout to Andreas Steno Larsen’s new Substack - his content is always fantastic, go and check him out!

There are two important ways to deconstruct bond yields such that you really understand what’s going on under the hood.

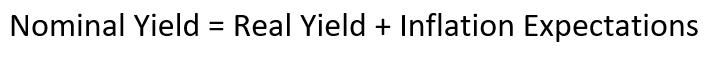

The first one is:

(Risk-free) real yields represent the barometer of how cheap/expensive is the inflation-adjusted cost for incurring into more leverage.

Borrowing at 2% nominal yields with inflation reducing the real amount of your due liabilities by 3% per year sounds good for borrowers, but bad for lenders/investors.

As our monetary system relies on ever-increasing leverage to bring forward future consumption and oil the ‘‘wealth illusion’’ mechanism, keeping a close eye on the real borrowing costs is paramount important.

Not only in absolute terms, but especially in relative terms.

Relative to R-star.

R-star represents the equilibrium risk-free real yields at which the economy runs at potential growth rate: with those prevailing real yields, the economy doesn’t overheat or excessively slows down.

The chart below shows US 5y forward, 5y real yields against my estimate for equilibrium real yields: every time observed real yields approach or cross the equilibrium levels…ouch for risk assets and the economy.

Inflation expectations play an important role, too: Central Bankers often have a mandate to keep inflation around 2%, and hence they pay close attention to the fixed income market expectations for medium-term inflationary pressures.

Why the obsession with 2%? Simple: incentive schemes.

As we rely on increasing debt to produce some decent cyclical growth, deflation is very scary: the real value of your liabilities would increase over time, making debt-servicing costs unaffordable and leading to a toxic deleveraging exercise.

On the other hand, high level of inflation potentially de-anchoring expectations on the upside are tricky, too: the private sector might reprice their perceived inflation risk premium and demand higher wages to compensate for that, which in turn might boost aggregate demand and lead to a vicious spiral.

Policymakers love the status quo, so guess where they set their targets?

Far enough from each scary tail scenario.

So, when you see 10y Treasury yields moving up or down always ask yourself: is it real yields, or inflation expectations moving?

Are they moving in the same or opposite directions, and why? Are real yields above or below r-star, and how fast are they moving in which direction?

Don’t worry: I’ll help you answering all these questions in one of my next pieces here on The Macro Compass!

The second way to decompose bond yields is the following:

I promised plain English with an Italian accent, so let’s get in there.

In our monetary system, the purest proxy for a risk-free investment is an overnight deposit at the domestic Central Bank - after all, that’s the clearing house for all commercial banks and an entity fully backed by the government.

For instance, if you have access to a Fed account you’re lucky enough to get this risk-free investment outlet and ‘‘earn’’ around 0% per year at this stage.

But bonds have a maturity longer than overnight, and the fixed income market is very much forward looking: the long-term expectations for the overnight Central Bank deposit rate are captured by OIS swaps, which tell you where the fixed income market consensus expects Central Bank deposit rates to move over a fixed period of time.

If you want to grasp what the market expects Federal Funds rate to be in the future, don’t look at Treasury yields: focus on OIS swaps (for more, see here).

Cool, now let’s move to credit spreads.

What the heck is an Asset Swap Spread (ASW)?

That’s the difference between Treasury yields and OIS swap rates.

Wow, a positive ASW spread: Treasury yields (blue) are above OIS swap rates (green).

Does this mean that long-end Treasury bonds have some sort of embedded credit risk that makes them riskier than depositing money at the Fed over time (OIS swaps)?

No, not really.

Asset swap spreads on safe government bonds are mostly driven by regulation, balance sheet constraints, the repo market and (in the short-term) flows.

ASW spreads are important as they are tightly connected with the functioning of the repo market, and because they influence the investment allocation and risk taking attitude of large fixed income investors (e.g. banks, pension funds) - I’ll cover the Asset Swap Spread market in depth soon on The Macro Compass.

Ok, so Treasury yields = OIS swap rates + ASW spread.

The private sector financing costs are unfortunately higher than Treasury yields though, and hence we need to overlay credit spreads over Treasuries.

Credit spreads are a very important component of the Financial Conditions index: if they widen quick enough, the private sector starts facing higher and higher costs to refinance their large debt loads and hence faces restrictive conditions.

If credit spreads widen too much, the access to credit becomes prohibitively expensive and the private sector moves into a painful and forceful deleveraging.

Here is how High Yield credit spreads are trading:

We learnt how to decompose bond yields into real yields + inflation expectations, but also into risk-free rates + ASW + credit spreads and why those decompositions are relevant. Now, time to talk repo and regulation.

Repo & Regulation: Boring, but Important

The repo market and regulatory developments are by far the most overlooked (yet super important) aspects of the bond market.

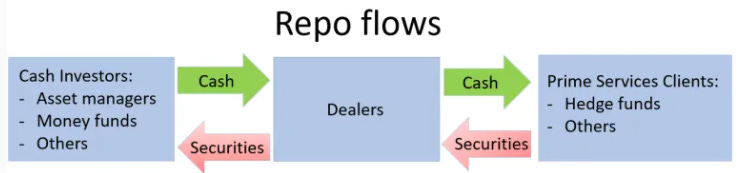

A repurchase agreement (repo) is a short-term secured loan: one party borrow cash from another and lends bonds in exchange, with the agreement to repurchase them later once the secured loan expires.

The bond serves as collateral for the transaction.

The repo market is huge: trillions of securities are exchanged in repo every single day.

This market allows cash-rich (e.g. money market funds) and bond-rich counterparts (e.g. banks, pension funds) to exchange cash for securities (and vice versa), but most importantly it allows hedge funds to run leveraged trades at a relatively cheap cost.

When a hedge fund manager “shorts” a security, she receives cash for selling a security she…doesn’t own. Wait, what?

The hedge fund just borrowed (reverse repo) that security from another counterparty promising to buy it back at a later stage, and sold it to the market.

On the other hand, hedge funds can also post the securities they own as collateral (repo) transaction whereby they borrow cash.

Basically, a leverage machine: with little capital, repo allows for large positions.

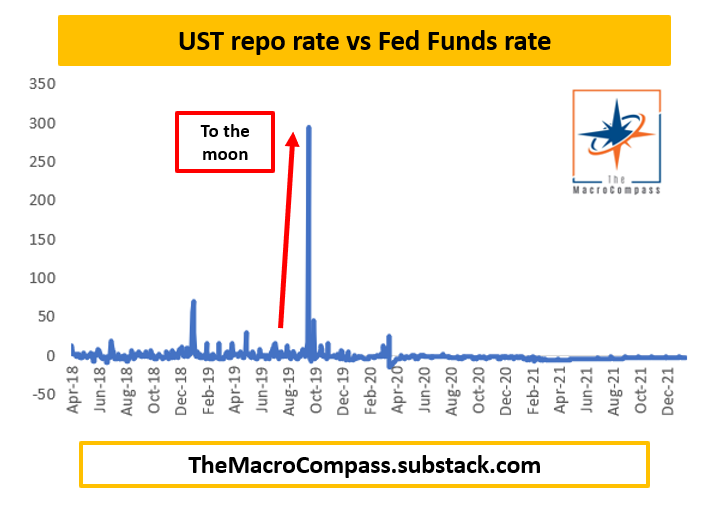

When the repo market functions smoothly, repo rates are very close to the Central Bank deposit rate: after all, an overnight transaction fully collateralized by risk-free government bonds shouldn’t yield materially higher than a mere overnight deposit at the Central Bank.

This allows leveraged players to take additional risks without much trouble: even if your leverage is large, as long as its costs are low and predictable…all good.

What if not?

If not, it’s September 2019 and Central Banks panic - watch the repo market closely!

Yes, I hear you: I’ll write an in-depth article about the repo market too.

Last but not least: regulation.

The largest bond investors in the world are the so-called ‘‘real money’’: pension funds, bank treasuries, Central Bank reserves managers etc.

All those players are highly regulated, and this matters: see this, for example.

Post GFC, commercial banks were asked to keep a Liquidity Coverage Ratio (LCR) above 100%. This means they always must have enough High Quality Liquid Assets (HQLA) to meet deposit outflows in a stressed scenario.

They can’t choose: it’s a regulatory imposition which became effective around 2013.

This effectively means that banks around the world are forced to keep around 10-15% of the asset side of their balance sheet invested in HQLA. That’s big!

And guess what qualifies for HQLA? Bank reserves and bonds, mostly.

Effectively, banks were asked to own a large amount of liquid assets and were told government bonds were the most obvious choice - they are essentially risk-free and often yield more than a simple overnight deposit at the domestic Central Bank.

A huge, relatively low price-elastic demand for bonds was created by a mere regulatory change.

So, how can you ignore regulatory developments when assessing the bond market?

Conclusion (and the gifts!)

The bond market can be deceptive for many, with incomprehensible jargon and obscure technicalities blurring the big picture.

But once you learn how to decompose bond yield moves into their prime building blocks and appreciate the importance of the repo market and regulatory developments, it all starts to make sense.

Now, two gifts!

You probably got it already but…this article kicks off a Bond Market 101 Series!

We just went through a panoramic tour on how to approach and understand the bond market, touching upon several topics I will then cover in depth over the next weeks here on The Macro Compass.

Specifically, we will talk about: r-star and real yields, inflation expectations, curve shapes, asset swaps, the repo market, regulatory constraints and incentive schemes for big bond investors and more!

If you want to receive those pieces directly in your inbox, you can subscribe here (free).

Listen to this interview!

I recorded a very educational conversation with Cullen Roche for Real Vision: we talked about why QE prints ‘‘financial economy money’’ while commercial banks and fiscal deficits create ‘‘real economy money’’, and dispelled few more myths about money.

If you enjoy my work, please consider clicking on the like button and share the article.

It costs you literally nothing, but it would really make my day!

Are you looking for any other kind of partnership or collaboration?

Are you an institutional investor who likes The Macro Compass and would be interested in a bespoke, pro-to-pro coverage?

Feel free to get in touch at themacrocompass@gmail.com.

See you again on Thursday already, this time!

The Bond Market in Plain English