The Daily Shot: 07-Dec-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

1. Let’s begin with some additional updates on the US labor market.

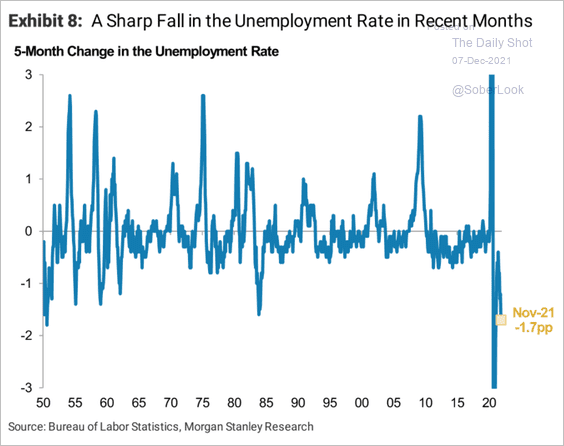

• The decline in unemployment was unusually sharp over the past five months.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

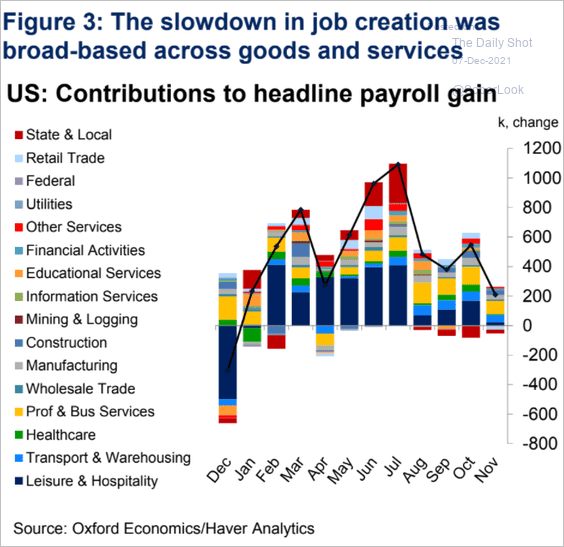

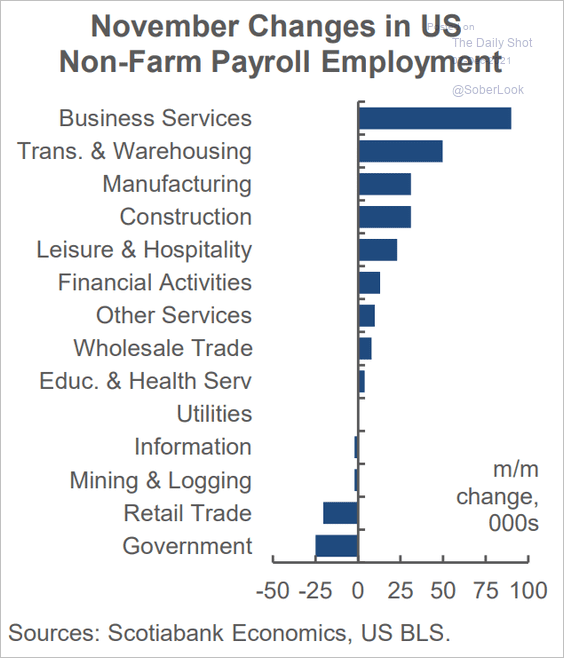

• Here are the contributions to payroll gains by sector (2 charts).

Source: Oxford Economics

Source: Oxford Economics

Source: Scotiabank Economics

Source: Scotiabank Economics

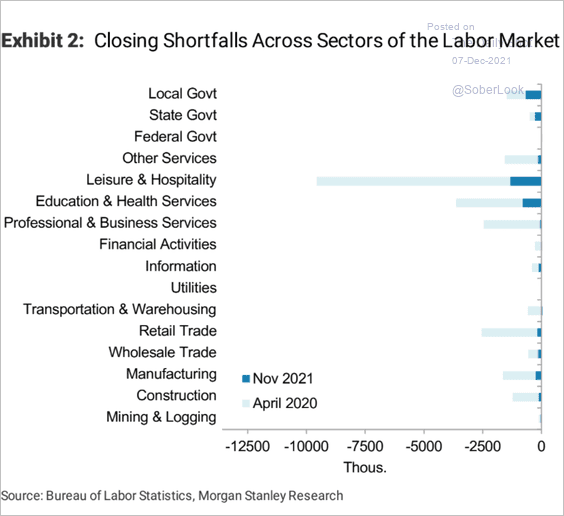

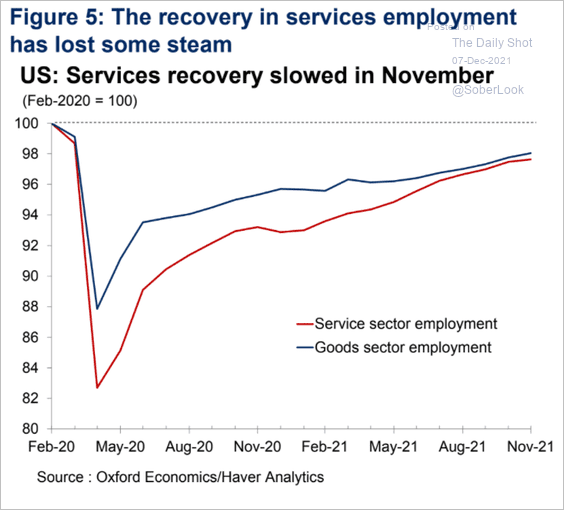

• Employment shortfalls by sector vs. pre-pandemic levels (2 charts):

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Oxford Economics

Source: Oxford Economics

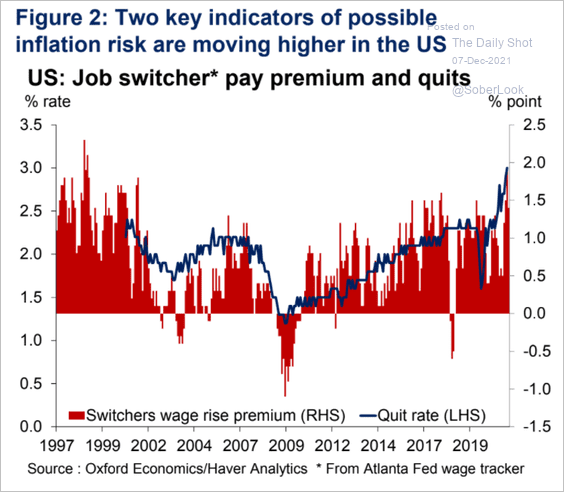

• The quits rate rises as switching jobs becomes more lucrative.

Source: Oxford Economics

Source: Oxford Economics

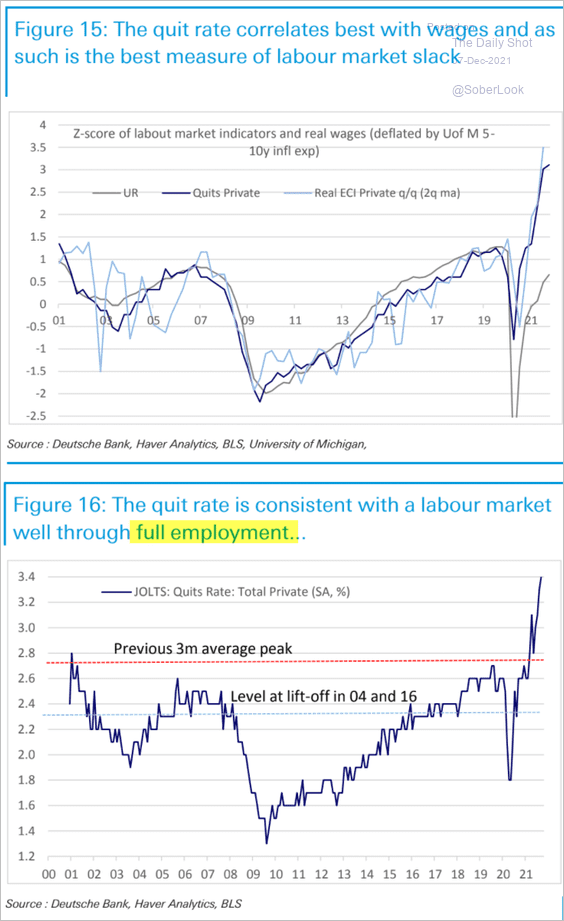

• Payrolls are not a good measure of labor market tightness. The quits rate is a better indicator and it suggests that the US is near “full employment.”

Source: Deutsche Bank Research

Source: Deutsche Bank Research

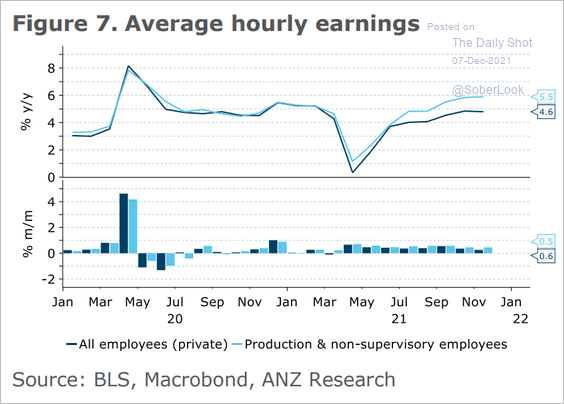

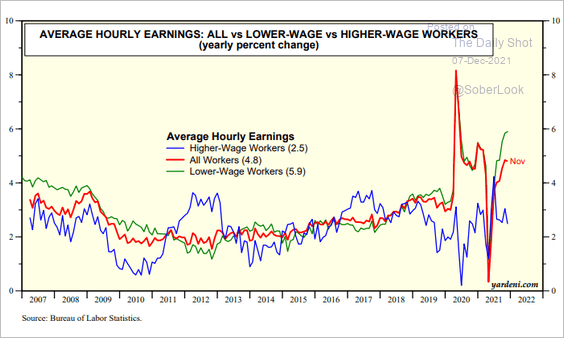

• Production employee wages have been outpacing the overall workforce (2 charts).

Source: ANZ Research

Source: ANZ Research

Source: Yardeni Research

Source: Yardeni Research

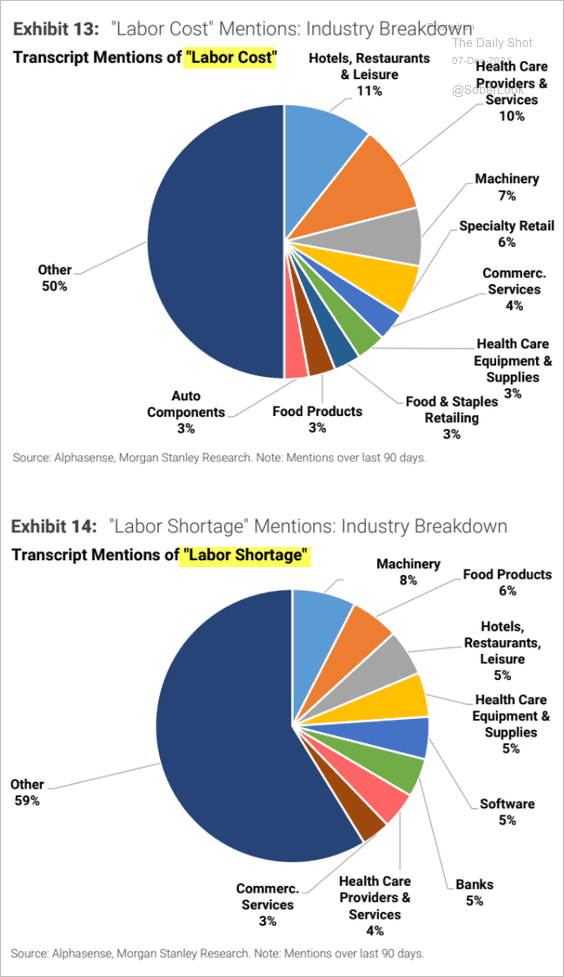

• Which industries are most concerned about labor shortages and labor costs?

Source: Morgan Stanley Research

Source: Morgan Stanley Research

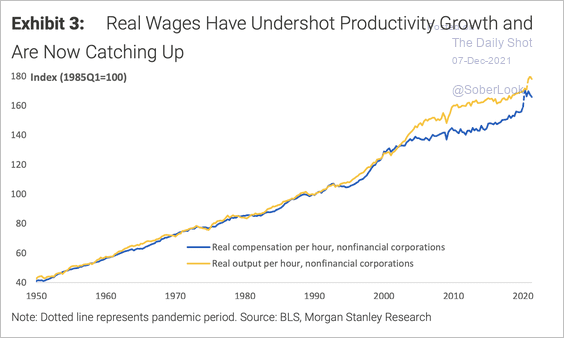

• Real wages are starting to catch up with productivity growth, potentially pressuring corporate margins.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

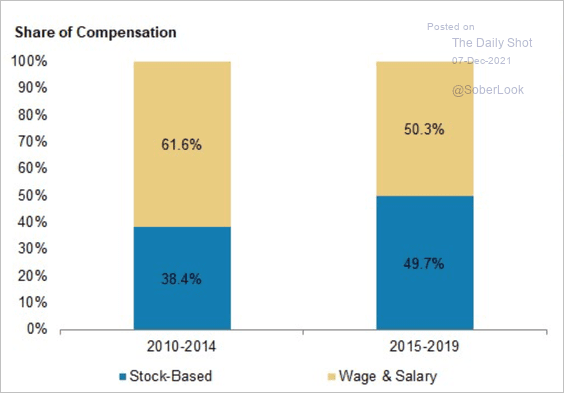

The rise of tech has meant that a bigger portion of compensation is in the form of stock. This is not captured in the employment cost index and explains in part the divergence between wages and productivity.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

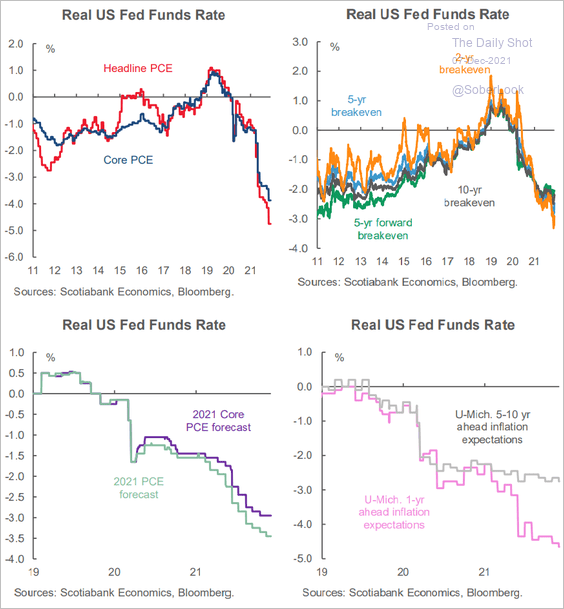

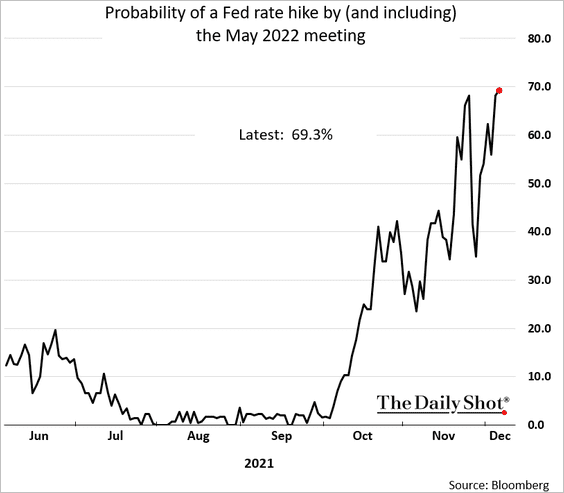

2. The real fed funds rate is at extremes no matter which index is used to measure inflation. It points to extraordinary levels of monetary accommodation.

Source: Scotiabank Economics

Source: Scotiabank Economics

The market is now assigning a decent probability that the Fed will hike rates by May.

——————–

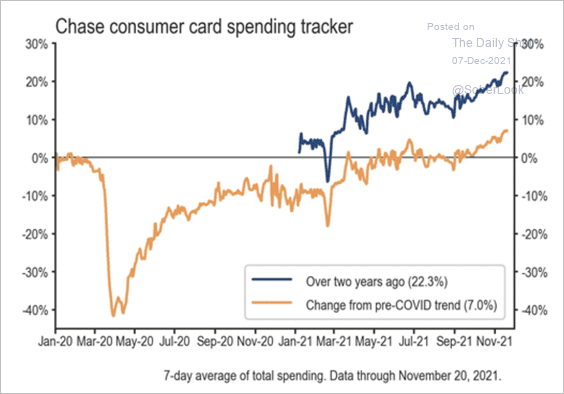

3. Consumer credit card spending continues to rise.

Source: JP Morgan Research

Source: JP Morgan Research

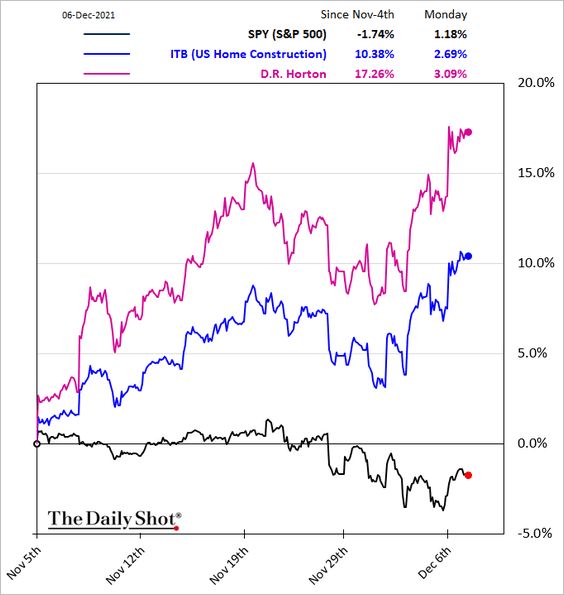

4. High-frequency indicators point to an acceleration in residential construction activity.

• Homebuilder shares:

• Lumber futures:

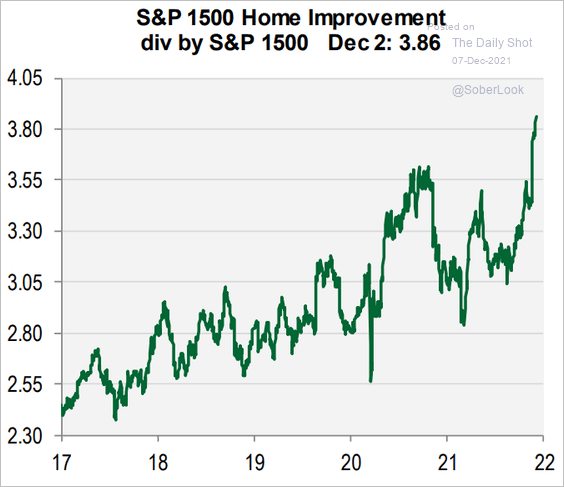

Home improvement stocks have been outperforming sharply as well.

Source: Cornerstone Macro

Source: Cornerstone Macro

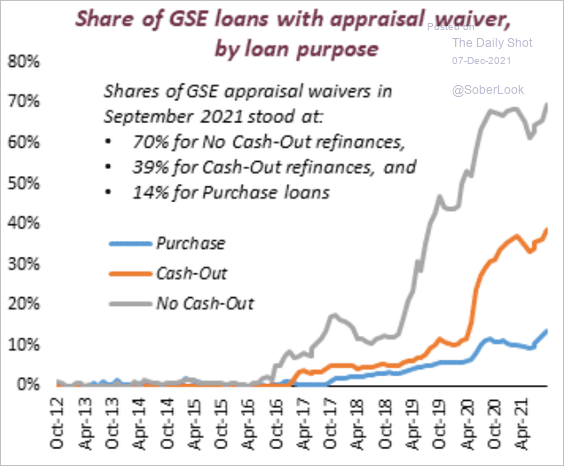

Separately, Fannie Mae and Freddie Mac increasingly waive home appraisals in mortgage financing transactions.

Source: AEI Center on Housing Markets and Finance

Source: AEI Center on Housing Markets and Finance

——————–

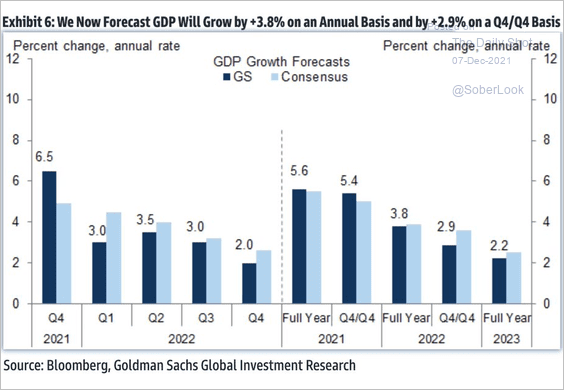

5. Goldman downgraded its US GDP growth estimates due to omicron.

Source: Goldman Sachs; @GunjanJS

Source: Goldman Sachs; @GunjanJS

Back to Index

Canada

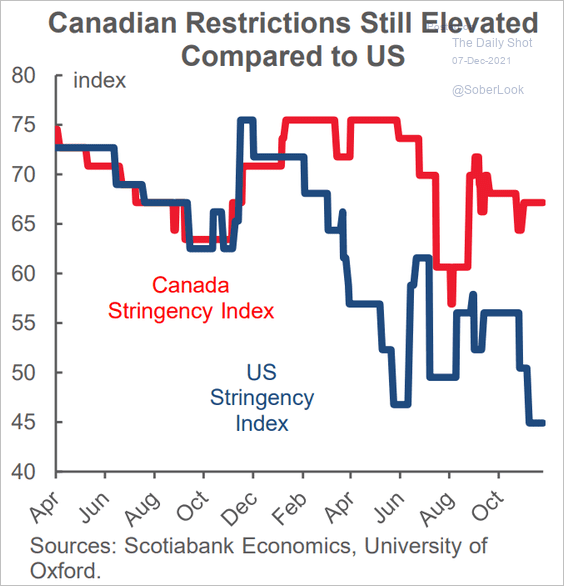

1. COVID restrictions remain elevated relative to the US.

Source: Scotiabank Economics

Source: Scotiabank Economics

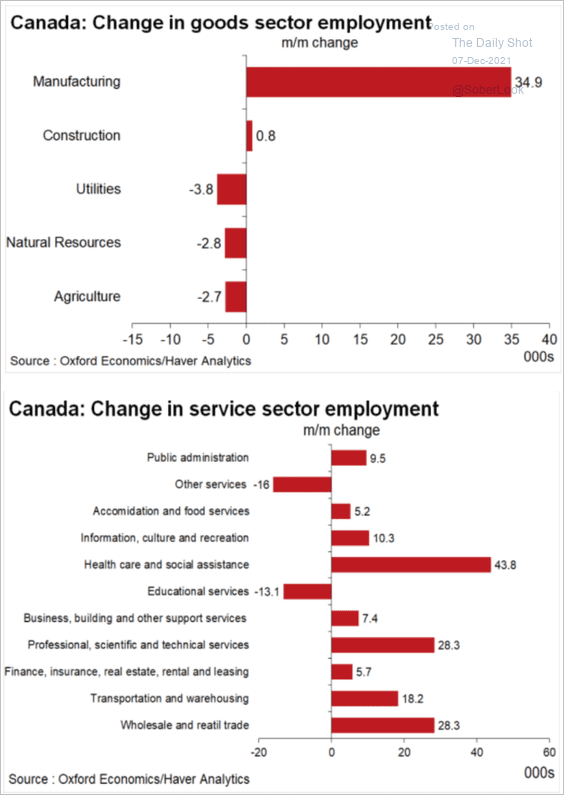

2. Manufacturing employment surged in November.

Source: Oxford Economics

Source: Oxford Economics

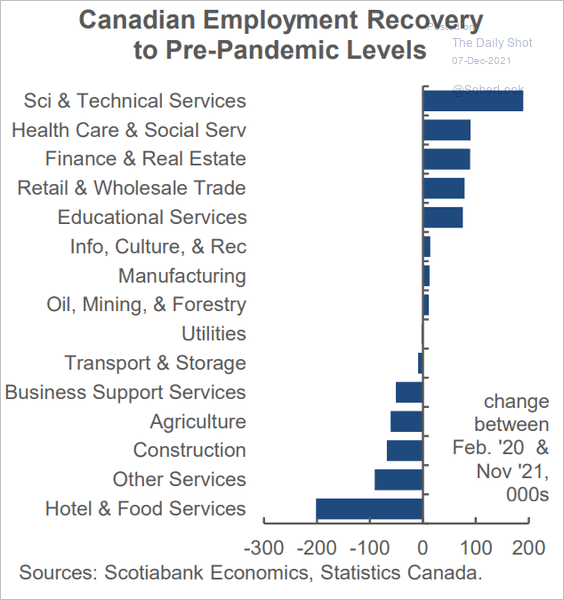

Here are the changes in employment vs. pre-pandemic levels.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

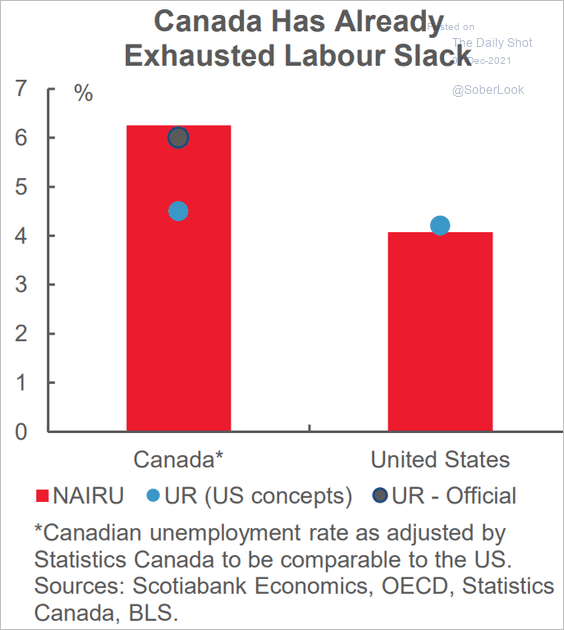

3. Canada is well into full employment.

Source: Scotiabank Economics

Source: Scotiabank Economics

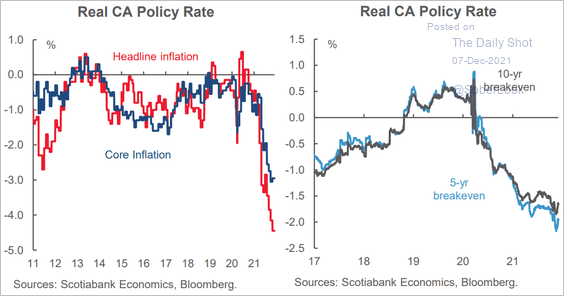

4. The BoC policy is extraordinarily accommodative.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The United Kingdom

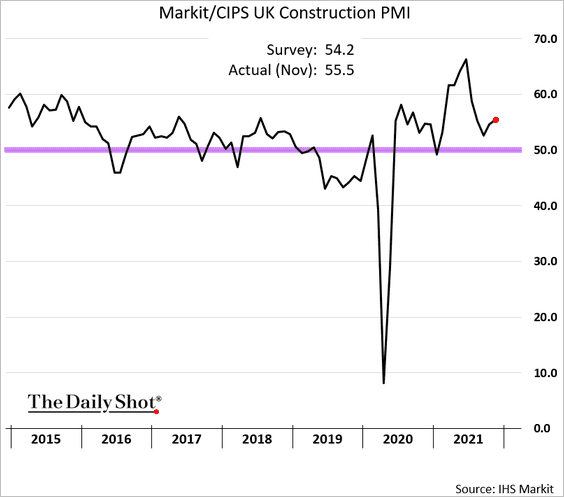

1. Construction activity firmed in November.

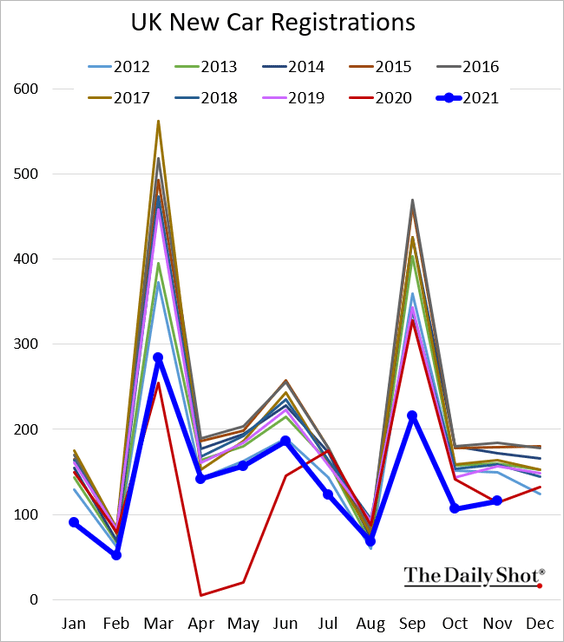

2. New car registrations remain soft (units = ‘000).

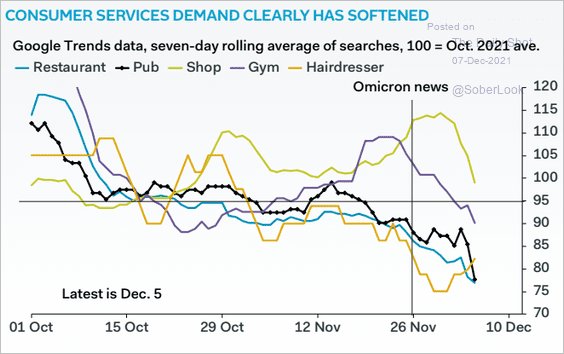

3. Google search trends point to weakening consumer services demand.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

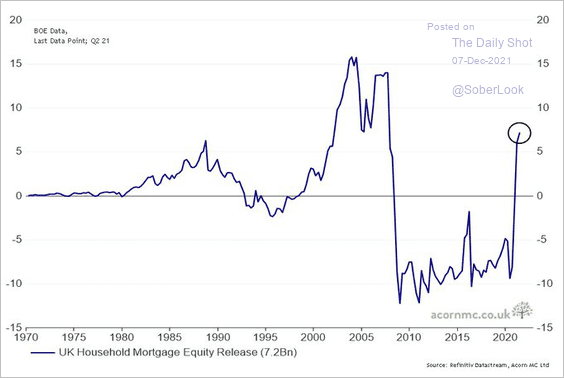

4. Households are drawing on their home equity again.

Source: @RichardDias_CFA

Source: @RichardDias_CFA

Back to Index

The Eurozone

1. Let’s begin with Germany.

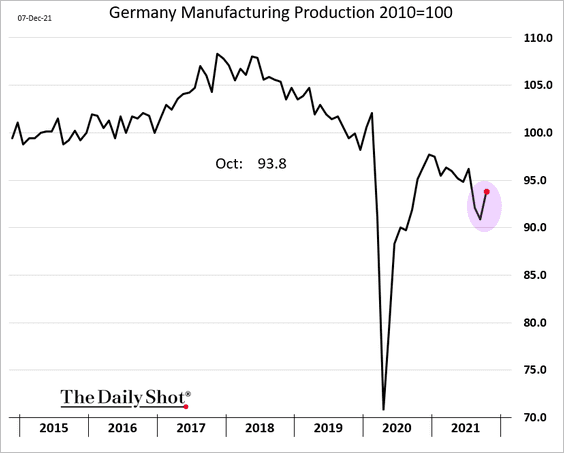

• Industrial production rebounded in October. This chart shows just the manufacturing component.

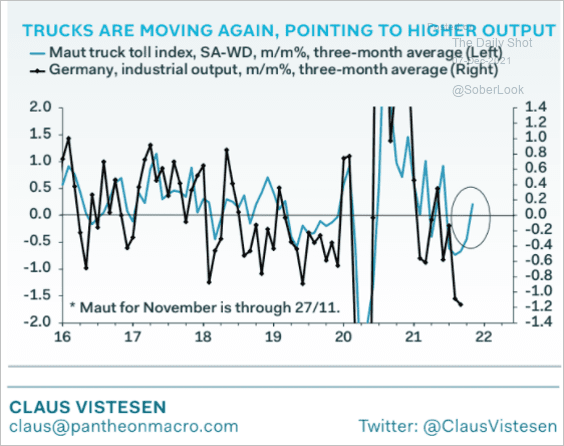

• Truck movements show further gains for industrial activity.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

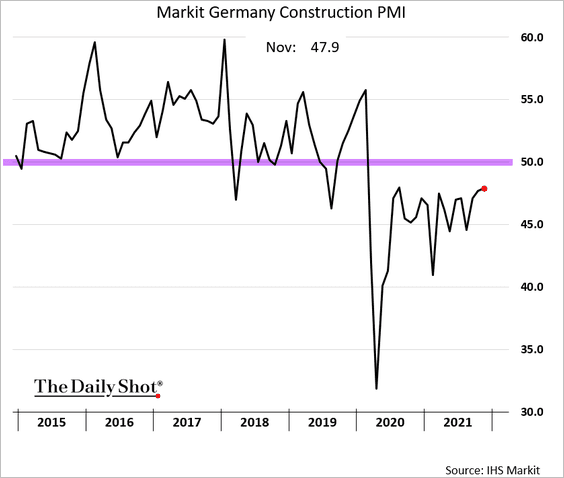

• Construction activity remains soft.

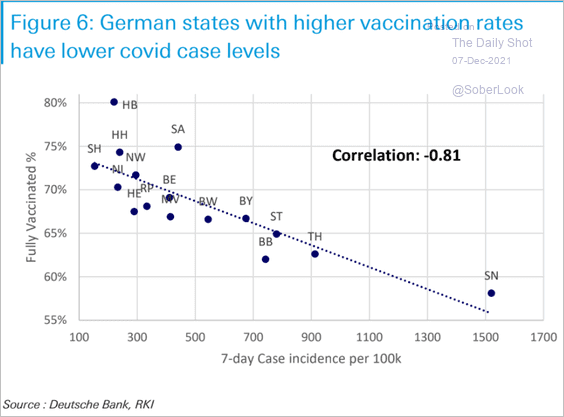

• This scatterplot shows vaccination rates vs. COVID cases.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

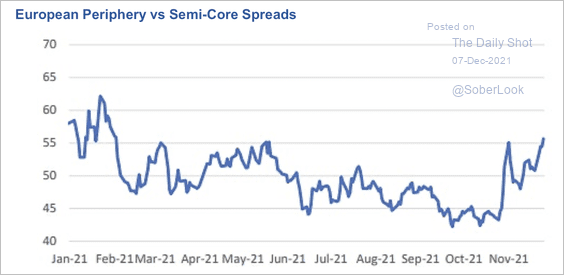

2. Eurozone sovereign spreads have been widening over the past month (relative to Germany).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

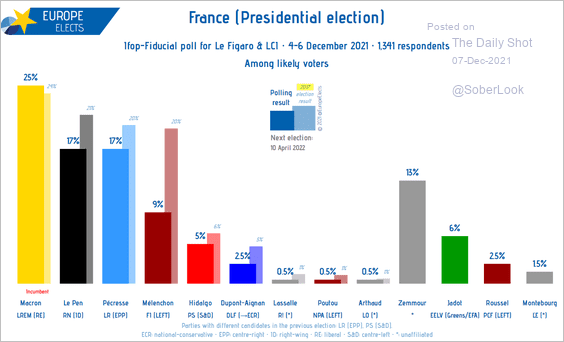

3. Here are the latest French presidential election polls.

Source: @EuropeElects Read full article

Source: @EuropeElects Read full article

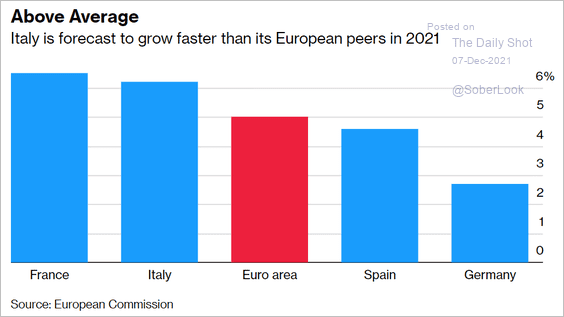

4. The economies of Italy and France are expected to outperform this year.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

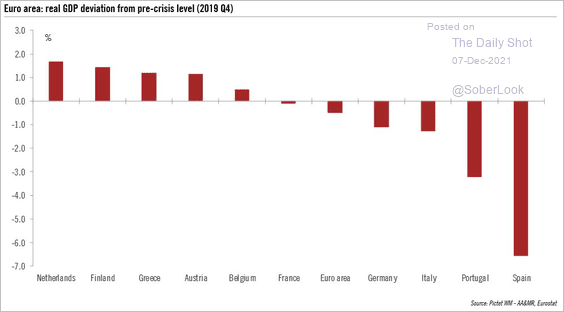

5. Finally, we have the GDP deviations vs. pre-COVID levels.

Source: @nghrbi

Source: @nghrbi

Back to Index

Japan

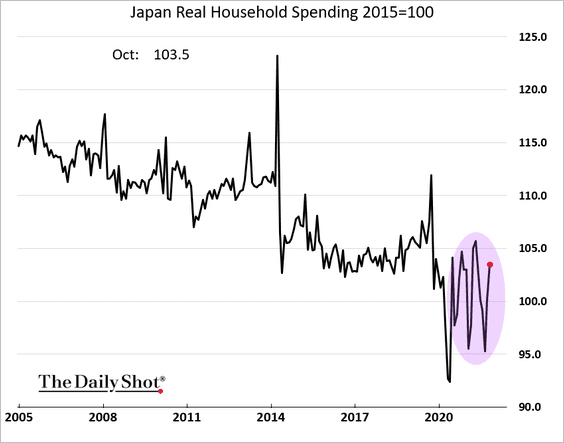

1. Household spending rebounded in October, but the index has been volatile.

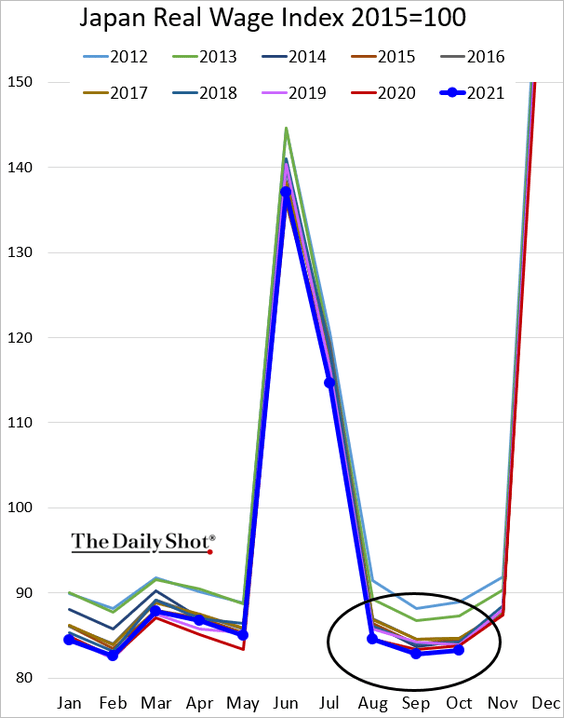

2. Real wages remain depressed.

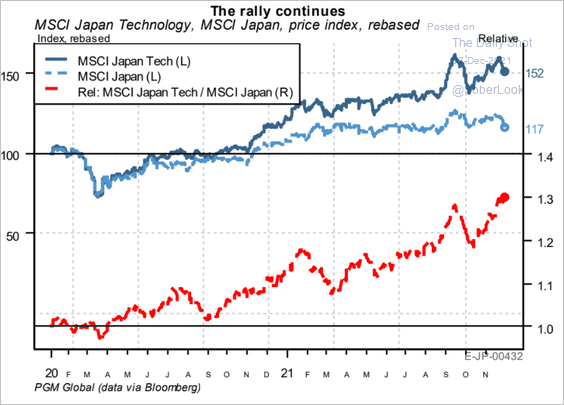

3. Japan’s tech shares have been outperforming.

Source: PGM Global

Source: PGM Global

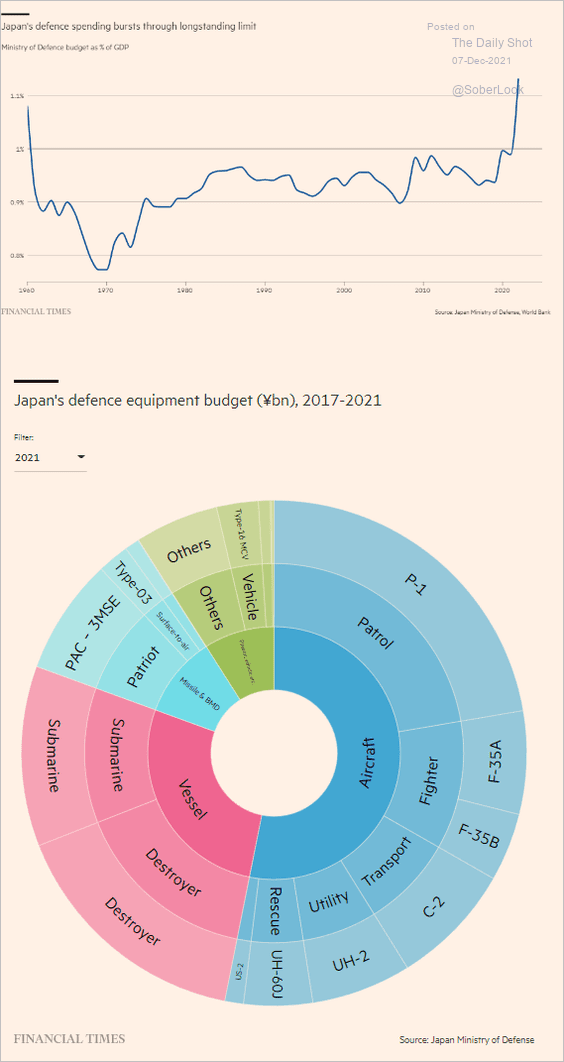

4. Defense spending is surging.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Asia – Pacific

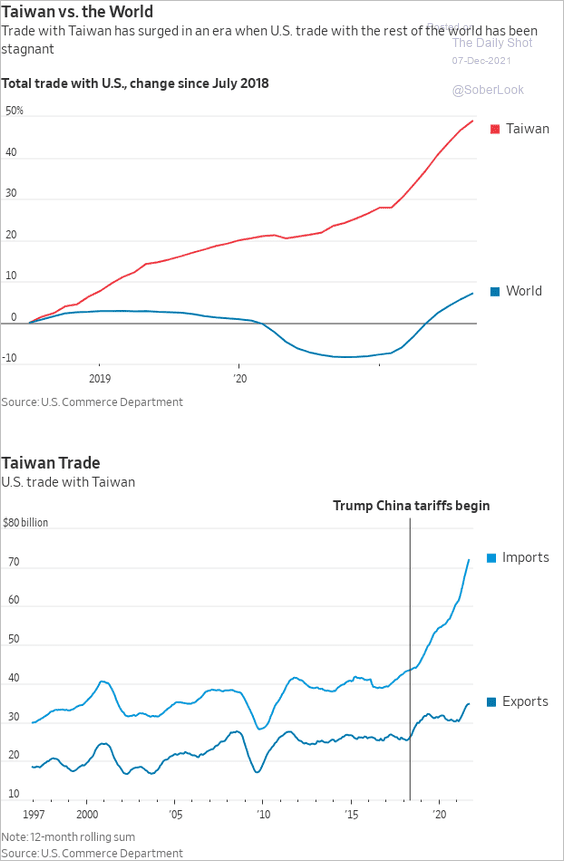

1. US trade with Taiwan has accelerated.

Source: @WSJ Read full article

Source: @WSJ Read full article

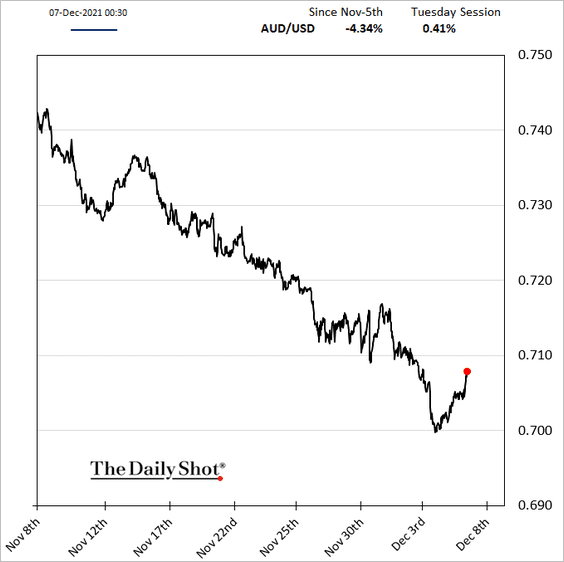

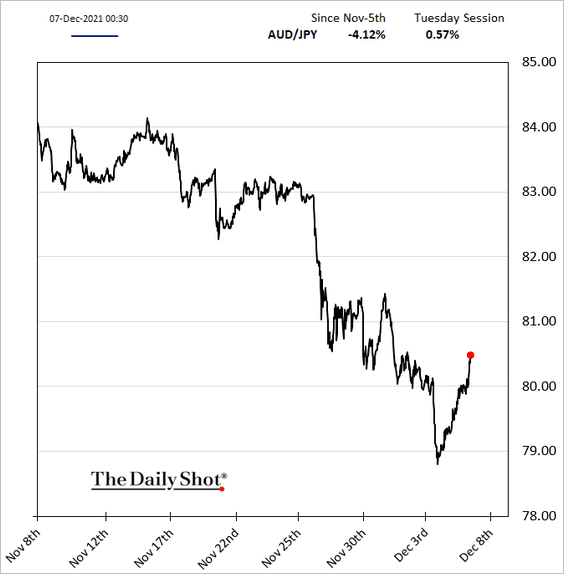

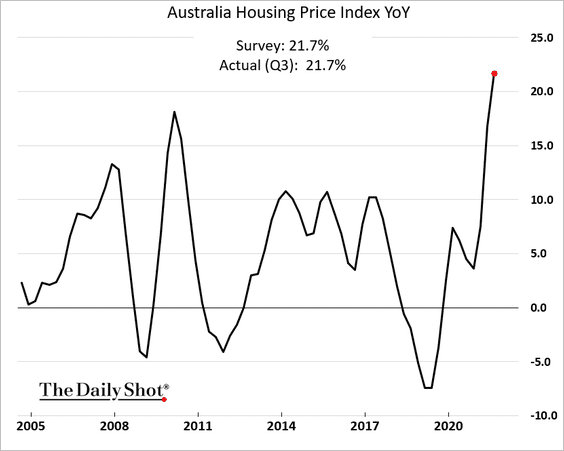

2. Next, we have some updates on Australia.

• As expected, the RBA left rates unchanged. Some analysts see the central bank ditching QE as soon as February.

The Aussie dollar found support at USD 0.70.

Here is Aussie-yen.

• Home price appreciation hit a record high.

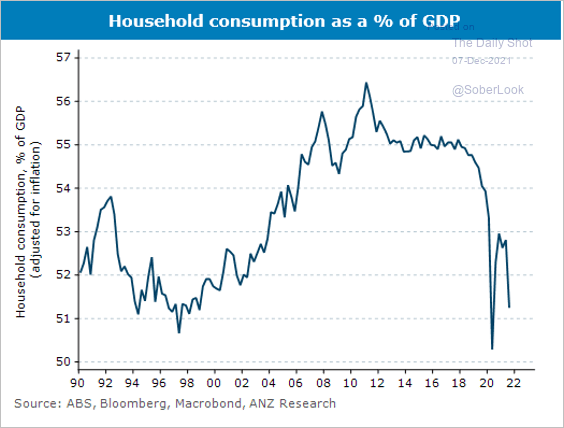

• This chart shows household consumption as a share of GDP.

Source: @ANZ_Research, @AdelaideTimbrel

Source: @ANZ_Research, @AdelaideTimbrel

Back to Index

China

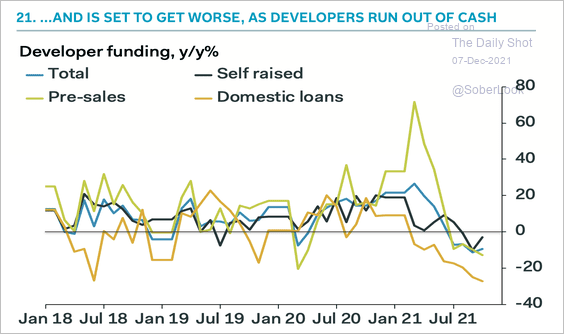

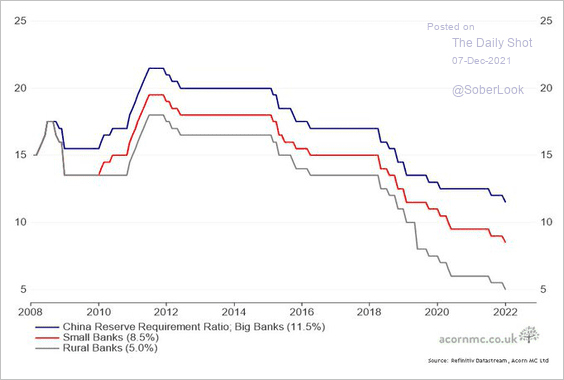

1. Despite all the bluster about staying the course on monetary policy, Beijing got spooked by the ramifications of the property sector credit crisis, especially Evergrande.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

The PBoC went ahead and eased monetary policy by boosting liquidity in the financial system (cutting RRR).

Source: @RichardDias_CFA

Source: @RichardDias_CFA

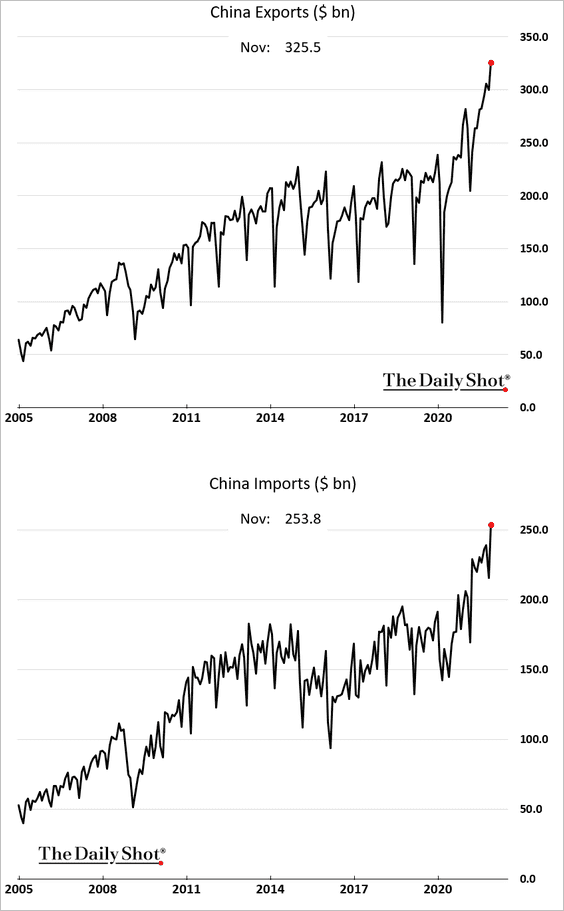

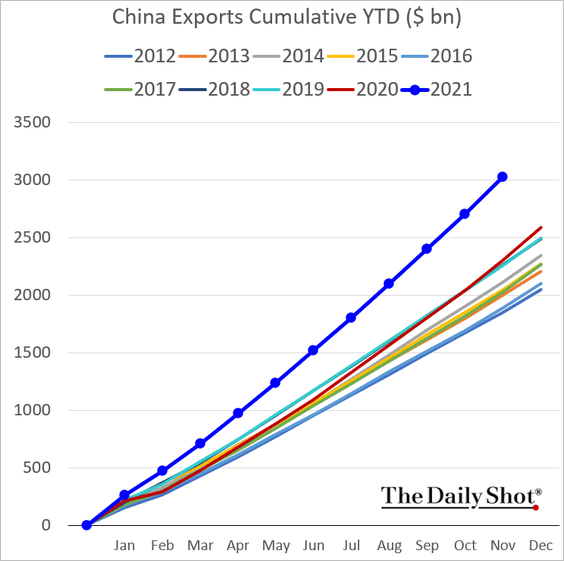

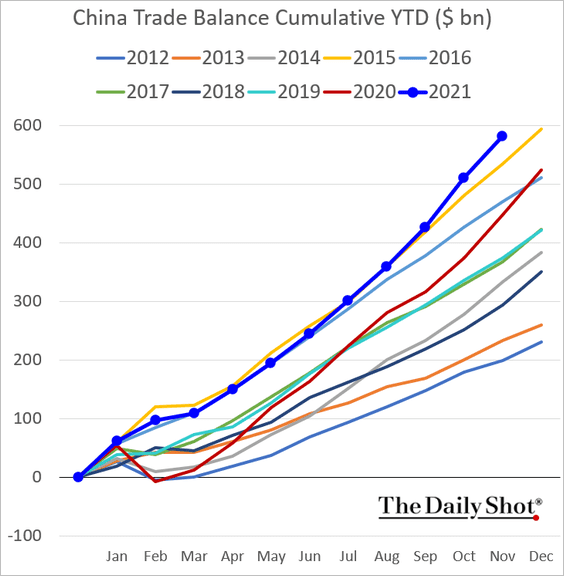

2. China’s exports hit another record high. And so did imports.

This chart shows cumulative year-to-date exports.

And here is the cumulative trade surplus.

——————–

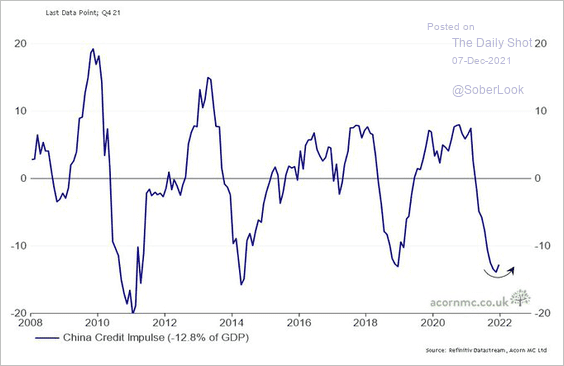

3. Has China’s credit impulse bottomed?

Source: @RichardDias_CFA

Source: @RichardDias_CFA

Back to Index

Emerging Markets

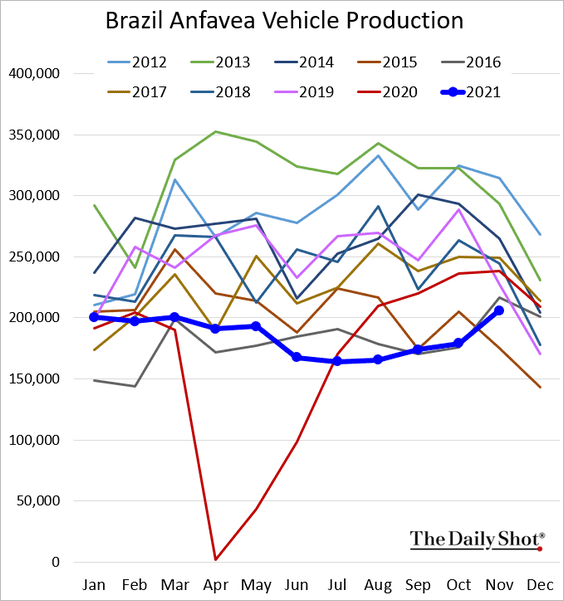

1. Brazil’s vehicle production seems to be recovering.

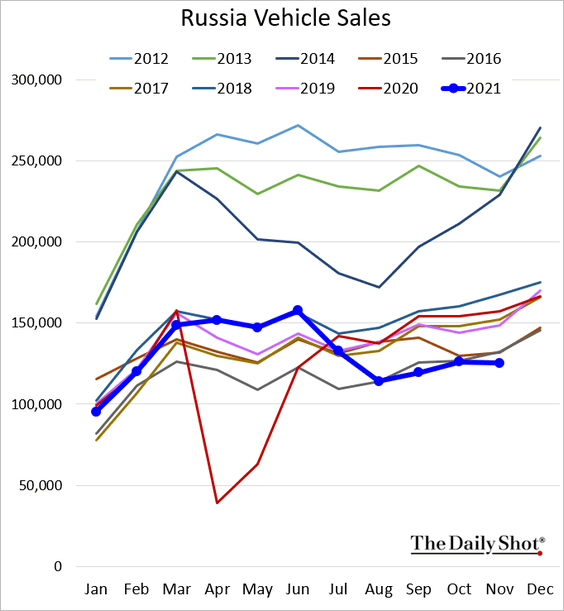

2. Russia’s vehicle sales remain depressed.

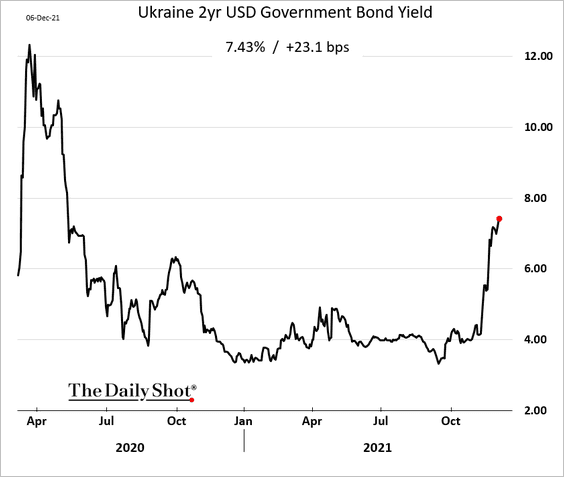

3. Ukraine’s bonds are selling off amid geopolitical uncertainty.

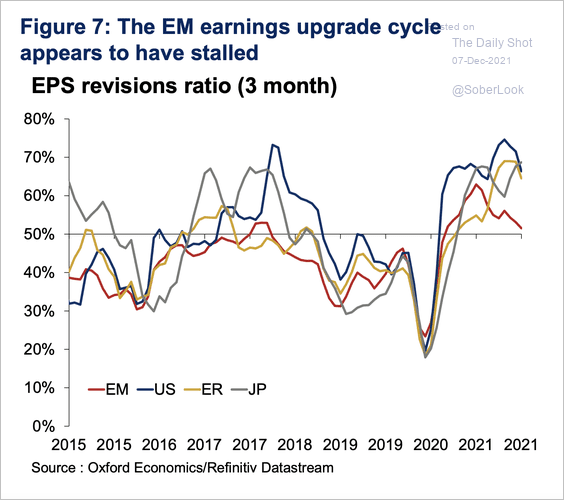

4. Emerging market earnings upgrade cycle has turned down.

Source: Oxford Economics

Source: Oxford Economics

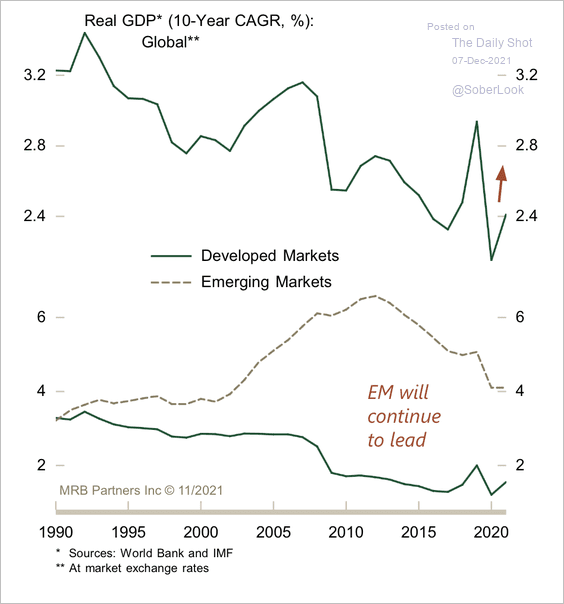

5. MRB Partners expects global growth to outpace the previous cycle with EM in the lead.

Source: MRB Partners

Source: MRB Partners

Back to Index

Cryptocurrency

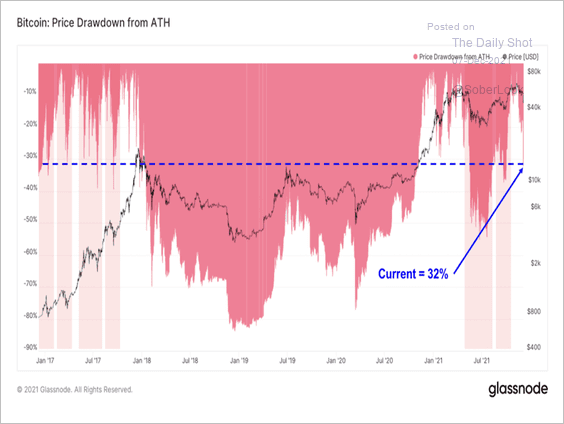

1. Bitcoin declined nearly 30% from its all-time high of around $69K, which was the largest drawdown since September.

Source: Glassnode Read full article

Source: Glassnode Read full article

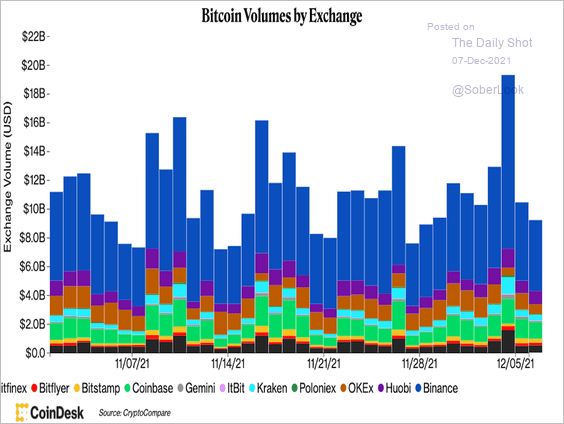

2. Bitcoin’s trading volume was down for the second consecutive day as the BTC price stabilized around $50K.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

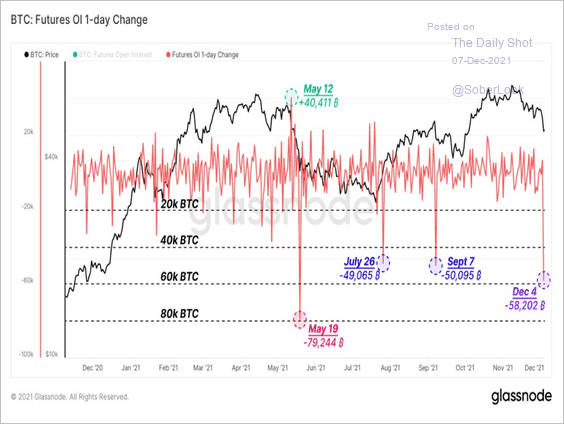

3. The weekend sell-off also triggered the largest one-day decline in BTC futures open interest since September 7th.

Source: @glassnode

Source: @glassnode

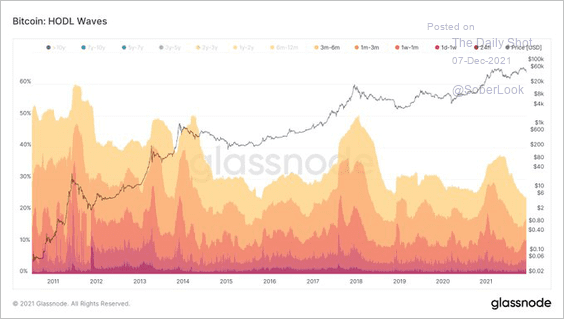

4. Short-term bitcoin holders now account for a lower percentage of the total BTC supply.

Source: Glassnode; @MichaelRinko

Source: Glassnode; @MichaelRinko

5. DeFi tokens have been under pressure.

Source: CoinMarketCap

Source: CoinMarketCap

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Commodities

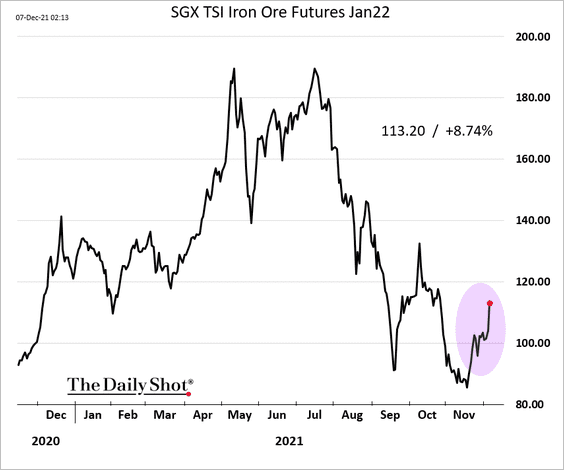

1. Iron ore futures are rebounding.

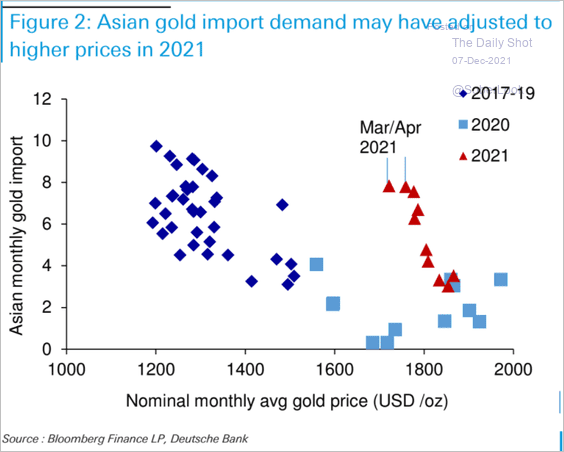

2. There is a new regime in Asia’s gold imports in response to price changes.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

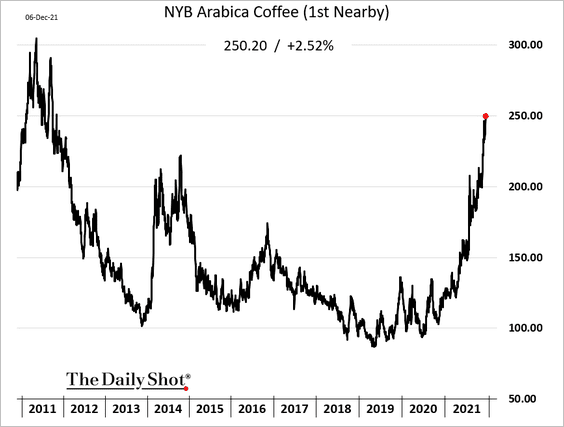

3. Coffee futures hit the highest level in over a decade.

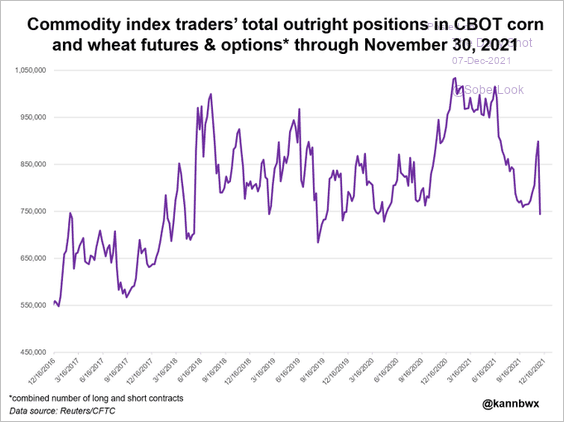

4. US index traders have been unloading their corn and wheat positions.

Source: @kannbwx

Source: @kannbwx

Back to Index

Energy

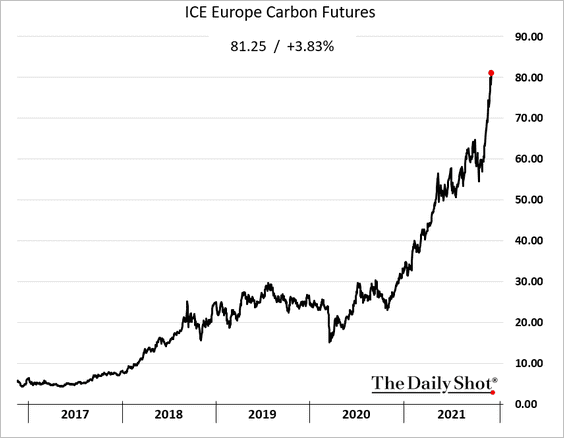

1. With European natural gas prices at exorbitant levels, coal plants will be burning coal through the winter. They are buying carbon allowances to stay in compliance with emissions restrictions. European carbon futures are soaring.

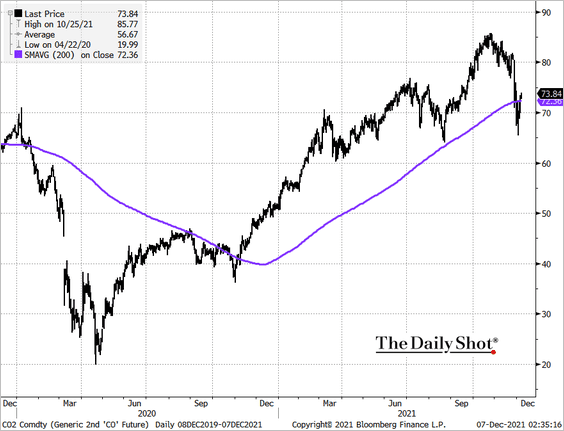

2. Brent is back above the 200-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

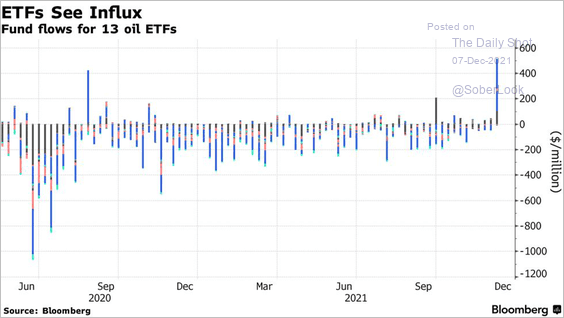

3. Energy ETFs saw significant inflows in recent days.

Source: @markets Read full article

Source: @markets Read full article

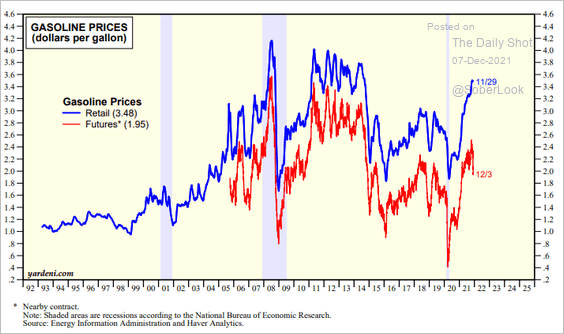

4. US retail gasoline and gasoline futures have diverged sharply.

Source: Yardeni Research

Source: Yardeni Research

Back to Index

Equities

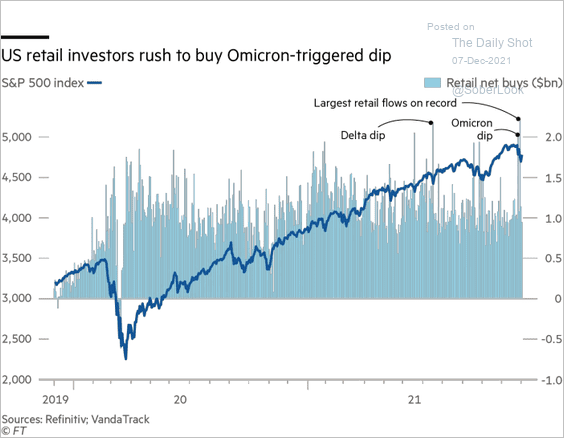

1. Who needs the Fed put when we have the retail dip buyers’ put …

Source: @financialtimes Read full article

Source: @financialtimes Read full article

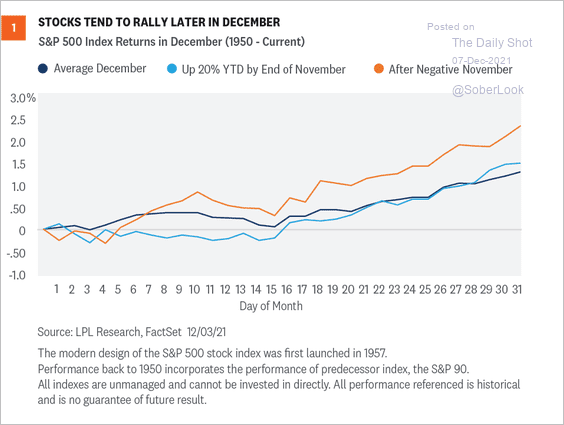

2. Here comes the Santa rally.

Source: LPL Research

Source: LPL Research

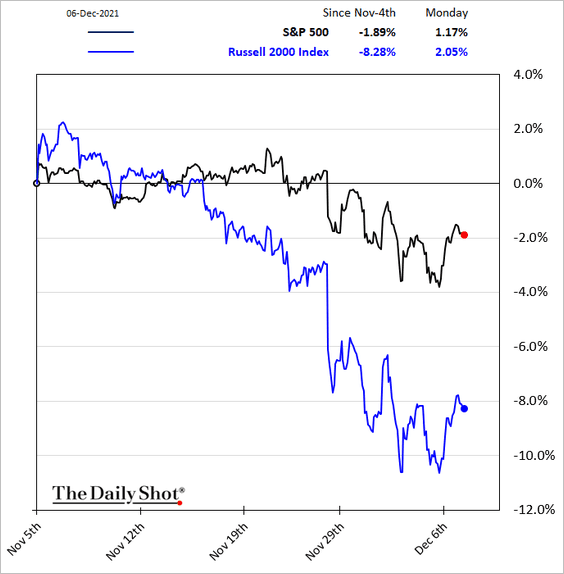

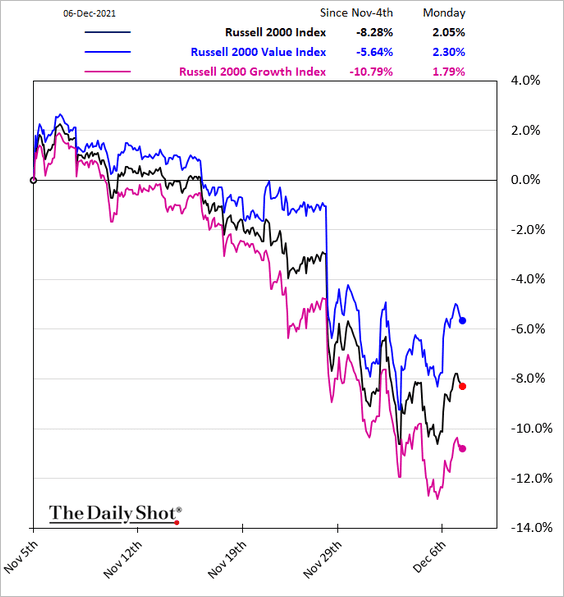

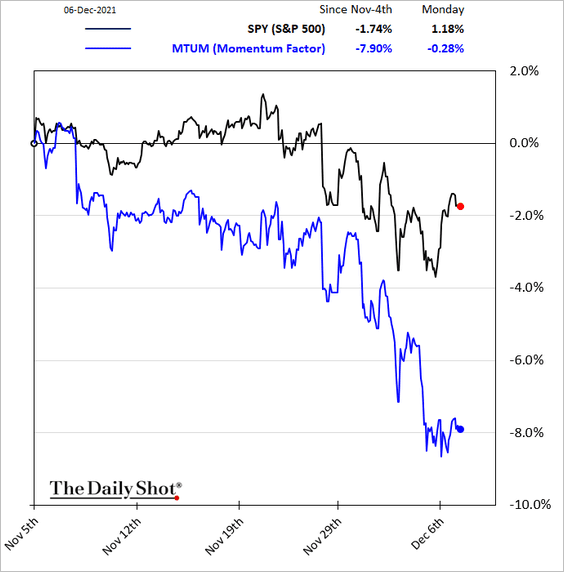

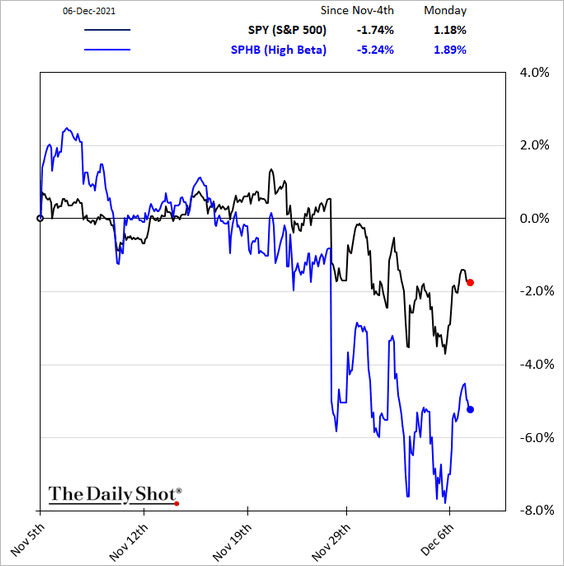

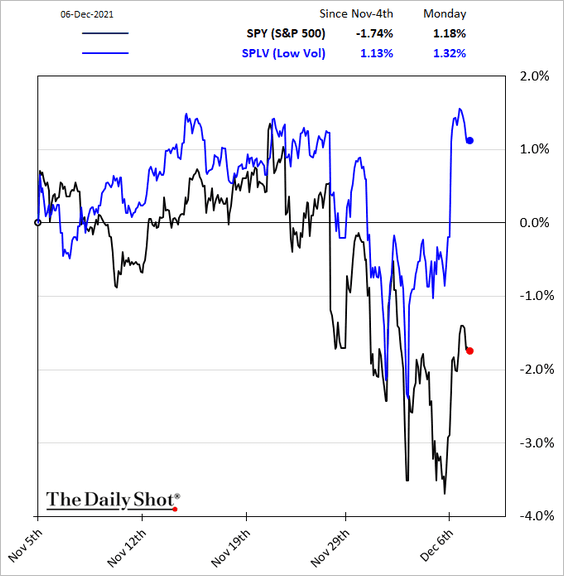

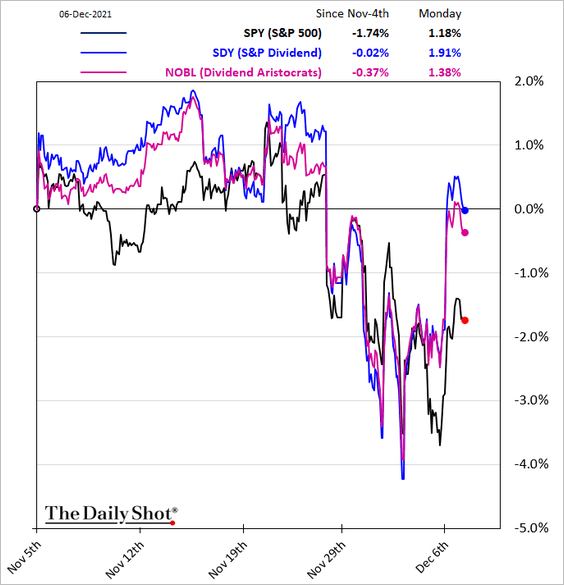

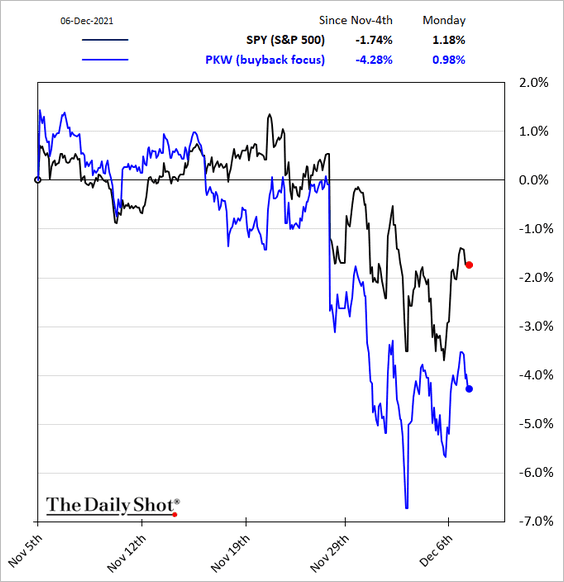

3. Let’s take a look at some equity factor/style trends.

• Small caps:

• Small-cap growth vs. value (value has been outperforming):

• Momentum:

• High-beta:

• Low-vol:

• High-dividend and dividend growers:

• Companies known for share buybacks:

——————–

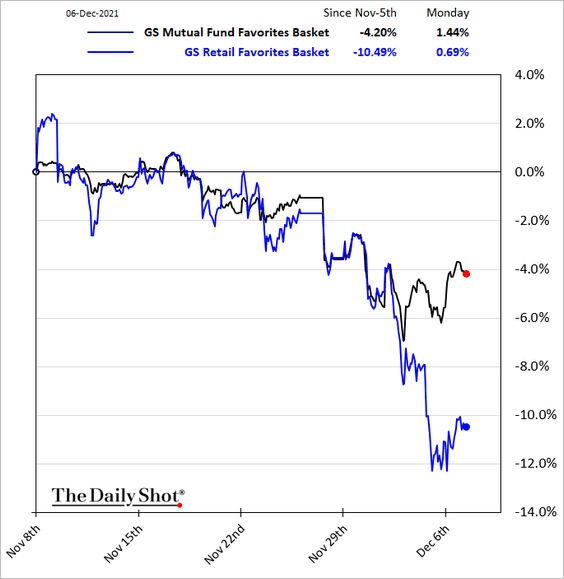

4. Mutual funds’ favorite stocks have outperformed retail favorites.

h/t @lena_popina

h/t @lena_popina

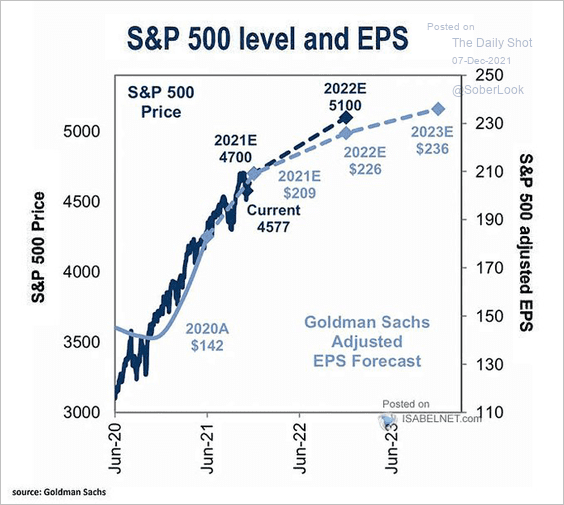

5. Goldman sees the S&P 500 at 5100 by the end of next year.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

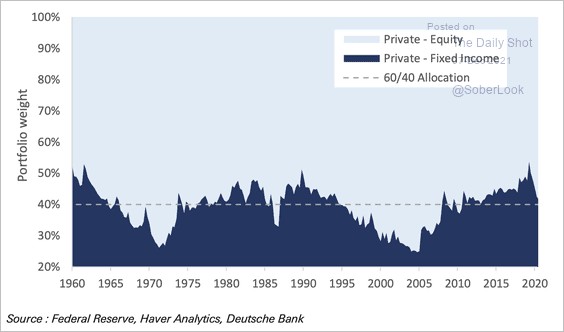

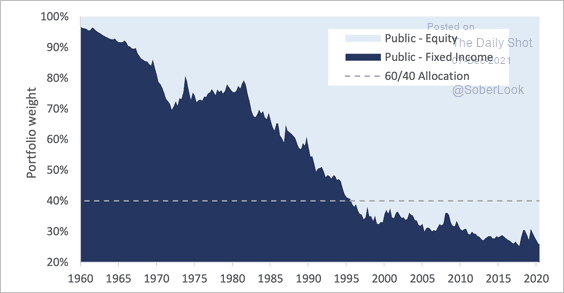

6. Private pension plans have largely maintained a 60/40 allocation to equities

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Public pension plans have spent the past 60 years rotating into equities, largely due to a rapid expansion of unfunded liabilities.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

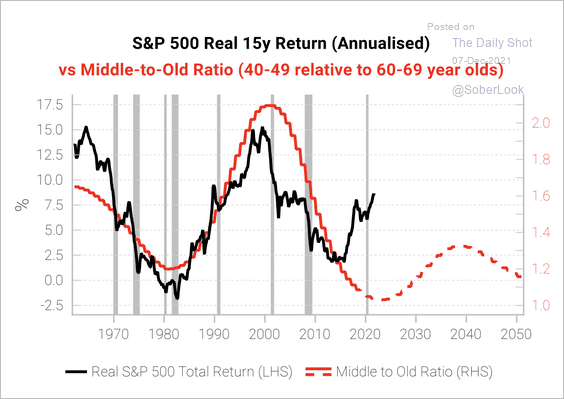

7. Demographics matter for very long-term stock returns.

Source: Variant Perception

Source: Variant Perception

Back to Index

Rates

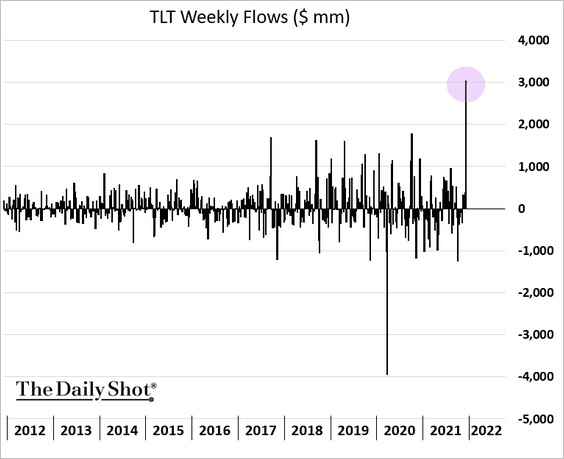

1. Flows into TLT (long-term Treasury ETF) hit a record high over the past few days.

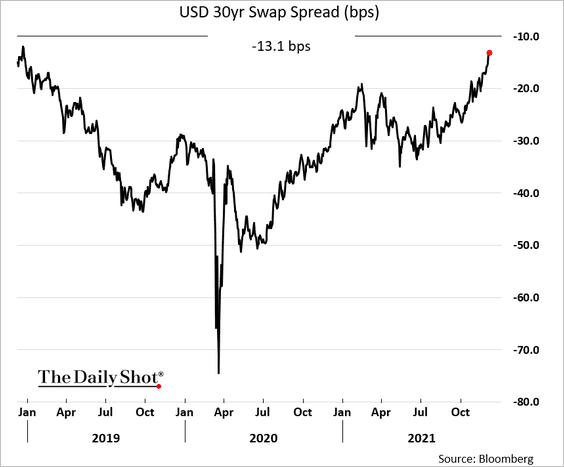

2. Longer-dated swap spreads have been climbing as the Treasury curve flattens.

——————–

Food for Thought

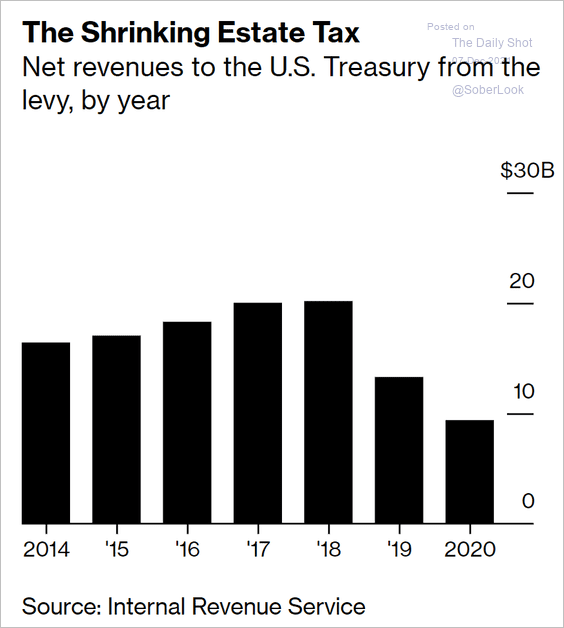

1. US federal government’s estate tax revenues:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

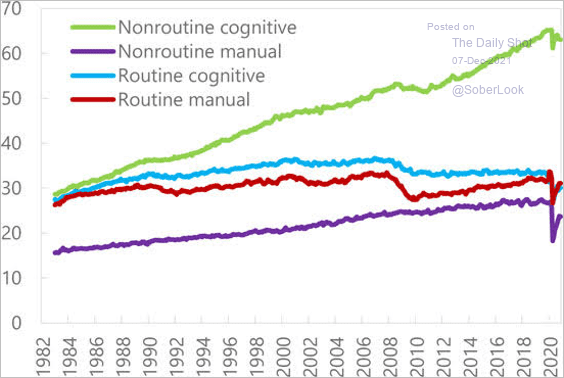

2. Wage growth polarization:

Source: IMF Read full article

Source: IMF Read full article

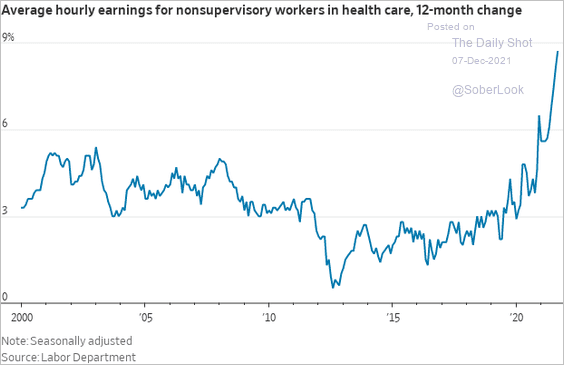

3. Healthcare workers’ wage growth:

Source: @WSJ Read full article

Source: @WSJ Read full article

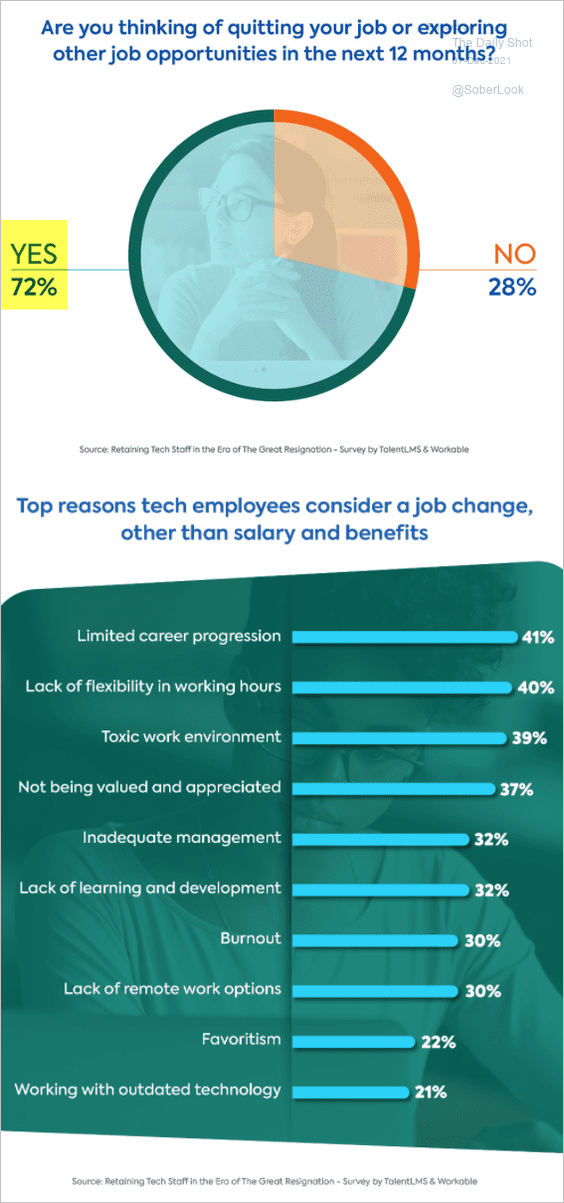

4. Tech employees considering a job change:

Source: TalentLMS Read full article

Source: TalentLMS Read full article

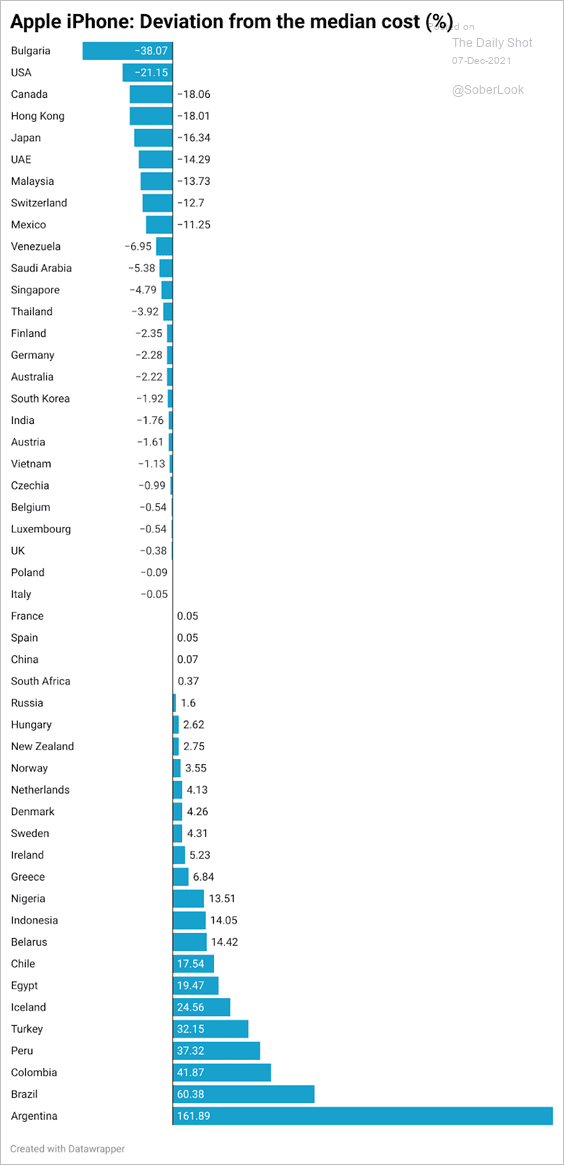

5. iPhone relative costs globally:

Source: Grover, The Electronics Price Index 2021 Read full article

Source: Grover, The Electronics Price Index 2021 Read full article

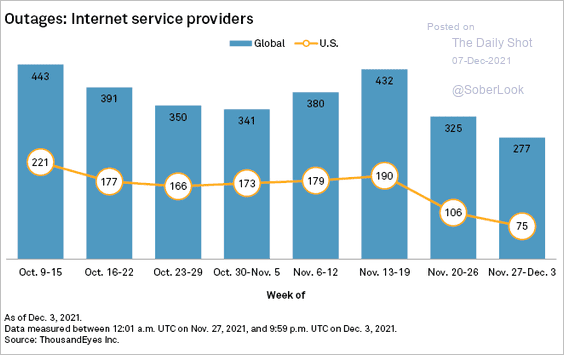

6. Internet outages:

Source: @SPGMarketIntel Read full article

Source: @SPGMarketIntel Read full article

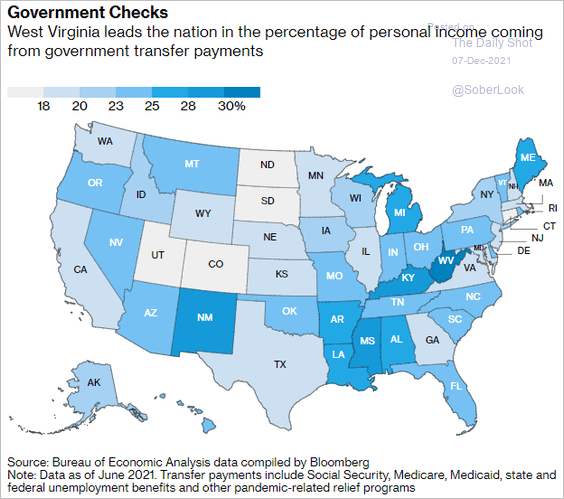

7. Personal income coming from government payments:

Source: @bpolitics Read full article

Source: @bpolitics Read full article

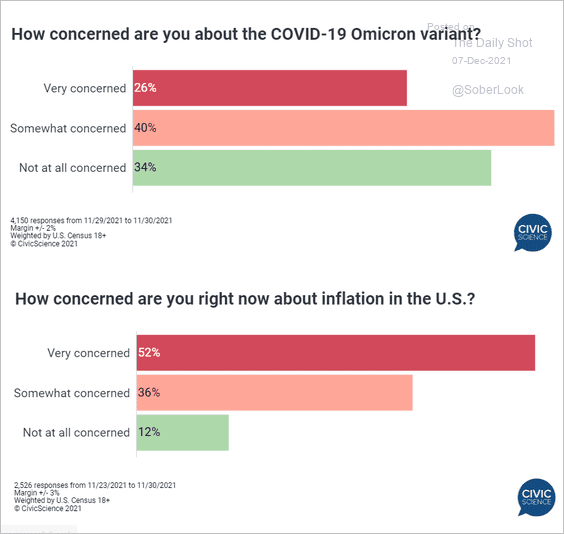

8. Inflation vs. omicron:

Source: @CivicScience

Source: @CivicScience

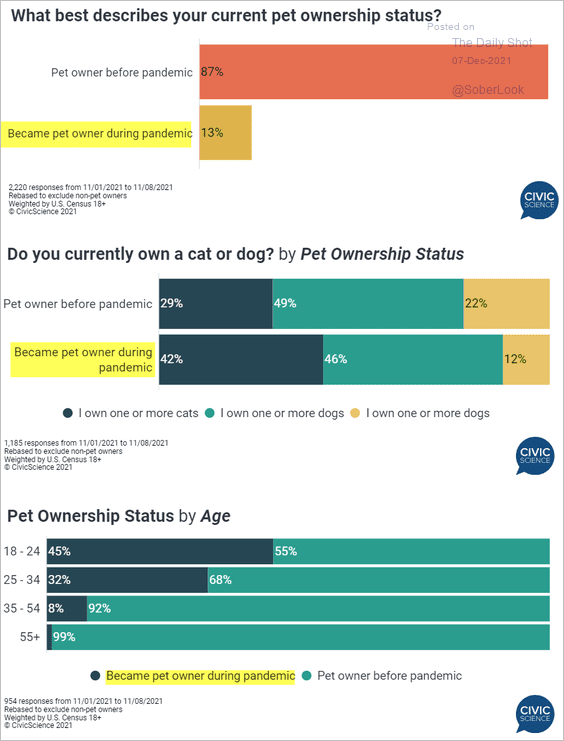

9. Becoming a pet owner during the pandemic:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

——————–

Back to Index