Hi everyone—I’m so glad to have you here. What a week.

It’s worth remembering that in a game that’s rigged the cards don’t matter. And in a world of free money and arbitrary rules, the joker card is in play.

You ever wonder why it’s the villain in Batman (1989) who gives away free money? I do.

It’s 2022 and one question has become increasingly crucial and difficult to answer: who, and what, can be trusted?

Everything from price signals to public policies to health guidelines have been manipulated For Our Own Good™, and people like you and me have been left to resort to obeying rather than believing.

Consider that we are at the same moment in history when the following two things happened in quick succession:

the people in charge of the financial system dramatically inflated the money supply while assuring us that inflation would not be a problem and be “transitory” right before we experience record-high runaway price inflation

the people in charge of approving novel gene therapy injections were forced to release 55,000 pages of data only after battling in court to keep the data suppressed until the year 2076, and just as everyone's attention and emotion is being collectively pointed towards a war

All bets are off. The jokers have been unleashed. They can print money, invent laws, and lie with impunity. And there’s not really much you or I can do about it.

Well, there is one thing. And it is the heir apparent to a very old and helpful system that helped to prevent these types of situations from reaching escape velocity before. In the past (think World War II), war bonds combined with taxes proposed by candidates and put to a vote had been the only way to even afford to go to war. This worked to keep the government in check and financially unable to fight forever battles. This is the system that Ukraine is employing right now, and they have raised the equivalent of $241M simply by asking its citizens to pitch in. And the citizens have purchased these bonds because they agree that fighting against the Russian invasion is a good idea. Imagine that.

Today, we don’t have war bonds or war taxes or laws that get voted on in the United States anymore. But we do have that one thing: Bitcoin.

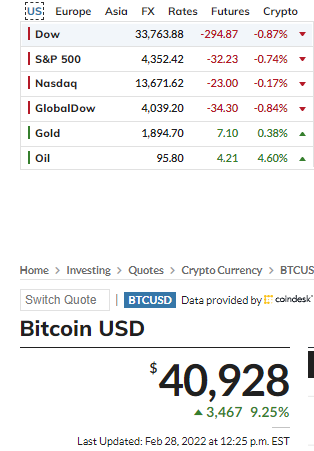

On Monday, everyone from traditional investors to newly-forged refugees appear to have decoupled their thinking from treating Bitcoin like a tech stock to treating it like the decentralized censorship-resistant, seizure-resistant, bearer asset it is. A safe haven hedge on a system gone mad.

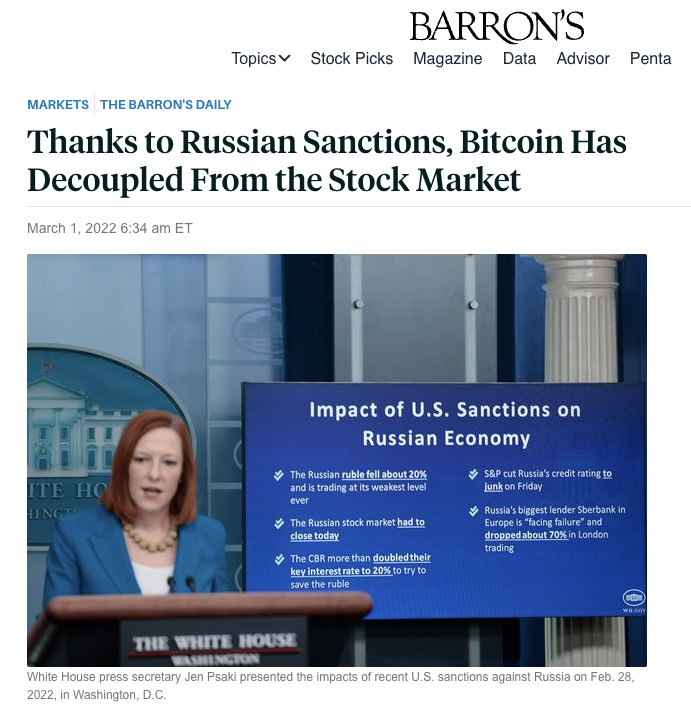

The US has wielded the financial system itself to send a strongly worded message in the form of sanctions to Russian president Vladimir Putin at the expense of all the people in Russia, which reminded market participants everywhere that the list of things they can truly hold and own outright is vanishingly small. This is no longer the marginal belief of a fringe group of cypherpunks, but increasingly the consensus view within the financial establishment.

As the Russian ruble plummeted in value and Russian citizens saw their life savings chopped in half overnight, Bitcoin has leapt ahead on the list of world’s most valuable currencies. And perhaps it’s no coincidence that the city of Lugano in the famously neutral nation of Switzerland announced a move to make Bitcoin legal tender in the same week that Federal Reserve Chair Jerome Powell made what is arguably the most historic and consequential admission ever by a sitting US central bank official:

"The question is if some want to move away from the dollar, what would be the effect on us? They would have to create an ecosystem whereby another currency becomes a better currency for them to use. It's also possible to have more than one large reserve currency." —Jerome Powell

(For the record, it’s not really possible to have more than one major reserve currency without defeating the purpose of such a notion in the first place, but perhaps this also reveals the level of critical thinking and economic acumen in play…)

For some people, this is not their first rodeo of watching the value of a sovereign medium of exchange be ravaged to virtual worthlessness. In a world that is increasingly digital and connected, there’s only one truly scarce asset that can remain dependably out of reach during times of trouble. It’s just a question of when, not if, the rest of the world catches on.

But this weaponization of money is no trivial thing, and carries with it enormous consequences.

Alex Gladstein released a piece on Wednesday that explores in very helpful detail how the cheap money of quantitative easing is used to fund today’s wars but carries with it a heavy and invisible cost as well.

The financial system is effectively used as a weapon and, as with all wars, it’s ordinary people trying to raise a family and put food on the table that get caught in the middle, their lives ruined and prospects dimmed.

It’s a weapon whose handle is also a blade. It may inflict damage, but it also leaves the wielder’s hand bloody.

You ever wonder why it’s the villain in The Dark Knight (2008) who destroys money to send a message? I do.

Just think about all the rhyming going on in the world today, and just how much financial dictatorship and theft is going on in the name of war.

Even the Wall Street Journal has been reflecting on what exactly money even is if its value and ownership can so arbitrarily change hands at the behest of elected leaders with no regard for permission or necessity: “Recent events highlight the error in this thinking: Barring gold, these assets are someone else’s liability—someone who can just decide they are worth nothing.”

Which, again, leads us back to this notion of trust. Who can you trust? What can you trust?

One of the virtues of Bitcoin is that it doesn’t require you to trust it, or anyone else for that matter. “Don’t trust. Verify.” A full copy of the entire ledger of transactions is replicated across tens of thousands of full nodes distributed across the globe, and not in the hands of a centralized government or small set of bank operators. You can trust Bitcoin because it doesn’t rely on trust. It relies on proof-of-work. Good, old-fashioned, work. Actual energy expenditure, and not capricious whims. Imagine that.

Banks, if you recall, used to be known as “trusts,” their massive marble exteriors and vaulted ceilings being architecturally unnecessary but metaphorically valuable for conveying a sense of security and protection. Imposing edifices that seemed to cry out, “You can trust us with your money—just look how thick these walls are! 😀”

Of course, we never trusted our money with buildings. Not really. We trusted it with people. And people, history has shown, are as notoriously difficult to trust as the systems and institutions they create & control.

The fact that foreign currency exchange reserves are now being demonetized has opened a Pandora's Box that cannot be re-shut. Most investors do not seem to fully grasp yet the implications of what has happened.

“The weaponization of FX reserves and the sinking realization from big powers that they don’t actually control most of their savings will be seen as a turning point in history” —Alex Gladstein

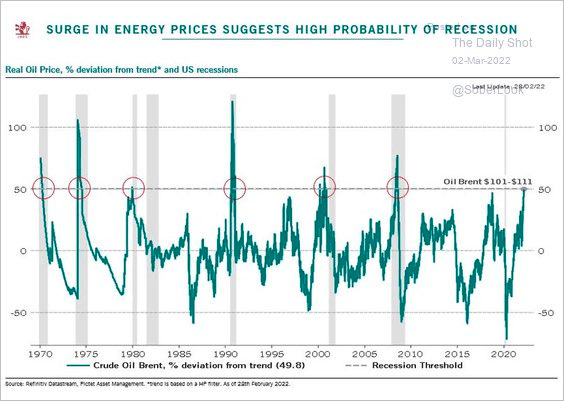

Things are just heating up, and it’s fair to expect them to become worse, especially as the knock-on effects hitting commodity exports and the resulting price inflations is only just now starting to propagate into public consciousness. Metals, grain, oil, natural gas… these things become valuable during wartime because they are things that cannot be printed out of thin air.

And consider that, in the past, every surge in energy prices of this magnitude has triggered a recession:

The jokers are running wild and there are precious few trustworthy sources to go by, which means everyone’s sense of reality is clouded by doubts and understanding is becoming harder to apprehend by the day.

In times like these it’s important to remember that the same people who told you not to worry about inflation two years ago are the same people telling you who, and what, to think about the geopolitical climate and resulting financial implications today.

Exercise extreme skepticism when reading opinion pieces, watching news footage, or listening to professional news broadcasters, and remember that the content they’re pushing is literally called Programming, and their business models depend on advertising revenue provided by the very corporations they’re responsible for investigating.

As you turn the page from old crisis to new crisis, it’s helpful to remember that the same jokers are in charge of telling you what’s going on, and to consider how reliable they were the first time around. Don’t trust—Verify. And when in doubt, stay in doubt.

Jokers are in the business of fooling, and they don’t stop at once.

Until next time 🤙,

Recommended Resources For Plan ₿

Swan. I became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 in bitcoin for free ✨

Fold Card. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨

Surf Report: Jokers wild