Hi everyone—I’m so glad to have you here. What a week.

I’ve heard questions circulating recently with regard to the literally absurd level of national debt the U.S. has racked up: does it really matter? Can’t they just keep racking it up indefinitely? Why should I care?

All good questions really. I’ll try to answer them simply, but first a quick history lesson:

“Interest rates is probably the backbone—probably the most important thing you can know when you’re trying to understand the stock market, because that interest rate goes right into the discounted cash flow model and it’s a very big variable.”

—Jurrien Timmer, Fidelity’s Head of Global Macro

There was a paper published by the International Monetary Fund (IMF) back in 2015 called The Liquidation of Government Debt that presaged our current global situation of excessively negative inflation-adjusted interest rates. In it, they said there are 3 tools that governments can wield to manage the situation:

Hold interest rates below inflation, directly or indirectly ✔

Use regulation to force market participants to hold cash and bonds even if they lose money on them by using capital controls or banning escape hatches outside the system (e.g. Bitcoin)

Monetize the debt directly or indirectly with the central bank as needed ✔

“It would do investors well to be familiar with these concepts. They were in use from the 1940s into the 1950s (and in some ways, continuing to the 1970s) in dozens of developed countries, and the debt levels are now in a similar position again, with signs that the same thing is happening all over again.”

—Lyn Alden

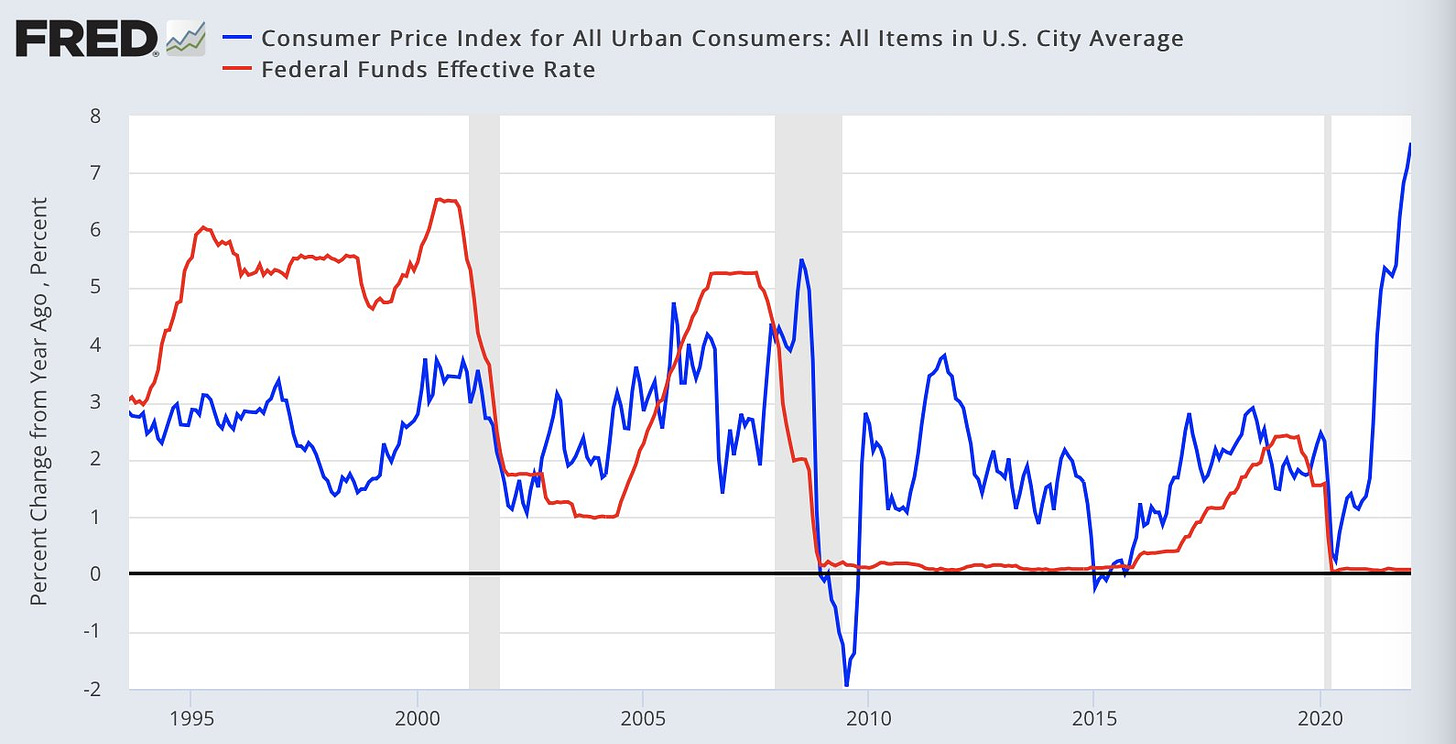

When government debt is high but not excessive, central banks can use tools like raising rates to manage the situation and prevent debt from ballooning and inflation from hitting escape velocity. But they can’t use those tools after the debt has rocketed out of the atmosphere. The math just doesn’t work. After a certain point they simply can’t tax everyone enough or cut spending enough while still funding mandatory government programs and obligations like Social Security.

In a country whose massive government debt is not denominated in their own currency, this leads to an explicit default in nominal terms. These nations can’t pay back obligations and need to go through the bankruptcy process or become indebted to new creditor nations. They are also at risk of bank “bail ins” where national banks take a certain percentage of customer deposits and convert it to shareholder equity to avoid complete insolvency. This leads to your average Joes and Janes losing a portion of their savings. Lovely.

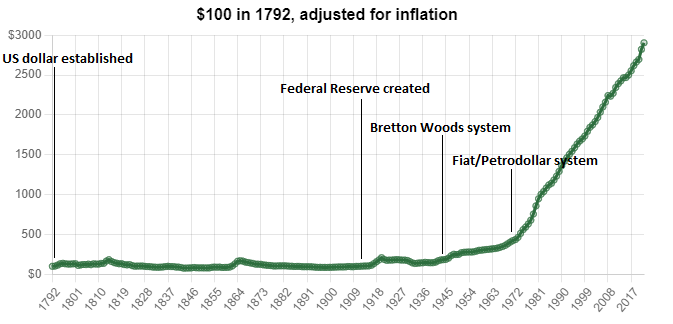

But what about countries who issue their own currency and denominate their government debt in that unit, such as the United States? They go through an implicit default instead of an explicit one. They “default” by devaluing their own currency through inflation and institute financial repression—meaning they keep interest rates low, make their central bank money printer go brrrr, and use that new—now-weakened—money they printed to pay back bond holders, and let inflation “run hot.” Did you see what happened? Now bond holders got their money back (yay) but lost purchasing power (hey wait a minute).

When you issue your own money and you need to deal with a huge debt-to-GDP ratio you can just slowly inflate it away while your citizens are paying $50 for deli sammiches and buying tins of sardines off the black market at $20 a pop.

The Federal Reserve is going to raise rates in an attempt to tighten and taper and fix everything? Um, no. They literally cannot.

Here’s the thing: “You can’t taper a Ponzi."

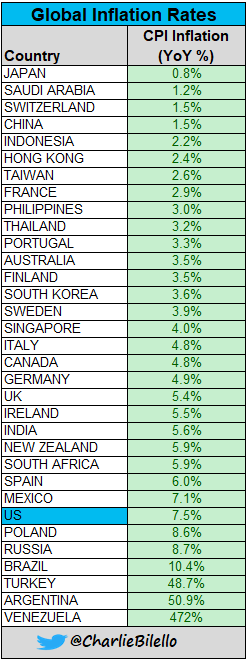

The Consumer Price Index is manipulated to look as good as possible and now it’s at a 39-year high of 7.5%.

The gap between the official CPI inflation and short term interest (i.e. savings) rates is the biggest since 1951. In other words, people who held cash or Treasury bills over the past year lost over 7% of their purchasing power.

But what about the inflation rate for all the things you want and need to live a decent life that are not included in the CPI metric?

(Now consider the truthfulness of all the other numbers they’re telling you…)

It’s no coincidence that the legacy corporate media is out here banging the gongs of war and trying to draw everyone’s attention to a Russia-Ukraine conflict just when the war on a virus is drawing to a close.

Here’s how it has worked in the past:

Big existential threats sold as "war" are funded using debt + supplemental or emergency appropriations approved outside the official budget

This means they have a hidden set of books to cook with + debts can be written off later as a necessary exemption

i.e. a threat large and nebulous and scary enough justifies "wiping the slate clean," "forgiving" debts, starting fresh, Great Reset™️, etc. because obviously they had to do it, it wasn't a choice, so why should anyone be held responsible?

This is how you transition from an inflationary environment you mismanaged and now can’t escape and onto a fresh new system entirely. I think we’re undergoing such a transition as we speak. Exciting! 😐

Consider that this is all occurring at the same time Russia made the following announcement and is talking openly with China about denominating trade in a currency other than the U.S. dollar:

Some believe that this year will see an “Everything Bubble”—a massive melt-up in the stock market that also sees a Fed balance sheet go from the current $9 trillion to anywhere from $20 - $30 trillion… followed by the biggest downturn bust in 80 years. Others agree on the general trajectory but see it playing out in relative slow motion over the next several years. There are lots of guesses and theories to just how bad it will be and how it will unfold, but no real disagreement that it’s going to be bad.

Here’s what Jerome Powell and the Federal Reserve and the U.S. government don’t get or don’t care to accept: you can't control the uncontrollable.

Some people think they can tinker with complex systems and expect them to behave linearly, with a single desired outcome. If this, then that. Shut down entire economy, print money, send it to people. Problem solved.

But a complex system such as an entire world economy conducting trade priced using a single global reserve currency behaves exponentially and unpredictably. All you can do by trying to control or tame things from your own purview is set into motion 100 new rippling consequences to deal with.

You may be thinking, “This is outrageous! We must not stand for this! Why isn’t there an uprising?” Well, maybe some folks at the The Federal Reserve are way ahead of you: the Fed is currently in the process of growing its primary campus with a massive subterranean expansion, upgrading windows to anti-ballistic material, adding perimeter security barriers & a visitor screening facility. The deck I just linked to is dated August 2020, shortly after they printed 10,000,000,000,000 of new currency.

It might also bother you to know that Fed Chair Powell illegally traded stocks during a restricted blackout period, failed to disclose most trade dates, and apparently lied about municipal bond investment conflicts while directing massive Wall Street bailouts.

The debt is starting to matter to individuals as more than just an abstract number on a piece of paper, and people are starting to respond.

Remember that 2nd tool I mentioned on the IMF list that hasn’t been checked yet? “Use regulation to force market participants to hold cash and bonds even if they lose money on them by using capital controls or banning escape hatches outside the system (e.g. Bitcoin)”? Perhaps now it won’t surprise you to hear that this week one of the 'Big Four' accounting organizations in the world announced holding Bitcoin in their treasury. Will this open more floodgates for more corporations to do the same? Who’s to say. But probably.

This is what happens when you spare no expense: life finds a way.

Until next time 🤙,

Recommended Resources For Plan ₿

Swan. I became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 in bitcoin for free ✨

Fold Card. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨

Surf Report: Brrrassic Park