“Normal is an illusion. What is normal for the spider is chaos for the fly.”

―Morticia Addams

Hi everyone—I’m so glad to have you here. What a week.

Macro investor Luke Gromen quoted Morticia Addams in a recent interview while trying to explain the current economic climate, and said that in a time of chaos such as today he’s just trying to be the spider.

How’s that for some big investor energy ✨

Chaos may not be fully underway yet, but things are moving quickly. The United States spent decades of Good Years optimizing supply chains for efficiency instead of resiliency, producing and exporting dollars while the rest of the world produced stuff. And now we’re getting hit with the bill.

We’re also seeing firsthand how bound up the monetary system is with energy, basic supplies, and war.

One thing Gromen points out is that war is essentially, fundamentally, logistics planning. i.e. supply chains. Ensuring enough resources are produced and distributed to the right places and people at the right time. And when you can print your own money you can fight Forever Wars, inflating the supply and sticking citizens with the bill in the form of reduced purchasing power—price inflation.

So when the money is broken and supply chains break down, what we really have is a defense problem.

And if someone can’t afford to pay for the gas that they use to drive to work where they earn the money to put food on the table, people start missing meals. And then, as Alfred Henry Lewis said in 1906, “There are only nine meals between mankind and anarchy.”

That’s what I mean by chaos.

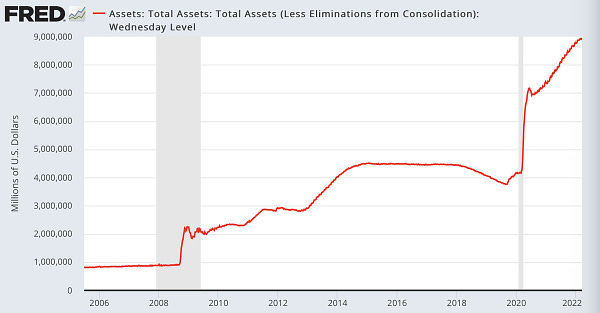

Right now global debt is sky high and we’re seeing major commodity shortages, yet are in a disastrously unique position—precipitated by the introduction of quantitative easing (QE) after the 2008 financial crisis—where the only thing central banks can do about it is somewhere between nothing and making it worse.

I know I started this newsletter off on a dark note but it felt fitting: this week we saw what is called a Death Cross in multiple market indexes, including the S&P 500.

In trader parlance, a death cross is when a short term moving average line crosses below a long term moving average line signaling a bearish reversal downward, which becomes a self-fulfilling prophecy as traders use it as one of their indictors and sell accordingly.

And since the stock market is where people are putting their money to try to escape crippling inflation, you can add this to the chaos pile.

Stock buybacks are also on course for another record, which reduces the amount of available shares outstanding amid worries about Fed rate hikes, war, and inflation. When inflation and debt are both systemically high it makes for a very fragile balance sheet, and buying back shares is a way to reduce the assets—and cash—on that balance sheet.

It may not just be inflation that has companies fleeing cash and dollar-denominated investments. It could also be the fact that the petrodollar system that was set up in the wake of Nixon removing the gold peg in 1971 is all of a sudden… not a thing anymore.

The petrodollar system had been creating artificial demand for USD by making it required for transacting in oil markets, and is now a thing of the past:

Welcome to Bretton Woods III.

The first Bretton Woods system pegged the world to the dollar, and the dollar was in turn redeemable for gold

The second “Bretton Woods” system removed gold altogether (this was the “Nixon Shock”), and forced market participants to use dollars for buying energy

The Russia-Ukraine crisis and resulting sanctions ushered in a third “Bretton Woods” moment, where dollars are no longer the global standard for energy markets. And now that it’s been demonstrated that the US will freeze foreign reserves and individual bank accounts when they feel like it, people and businesses and sovereign nations don’t really want to hold it anymore.

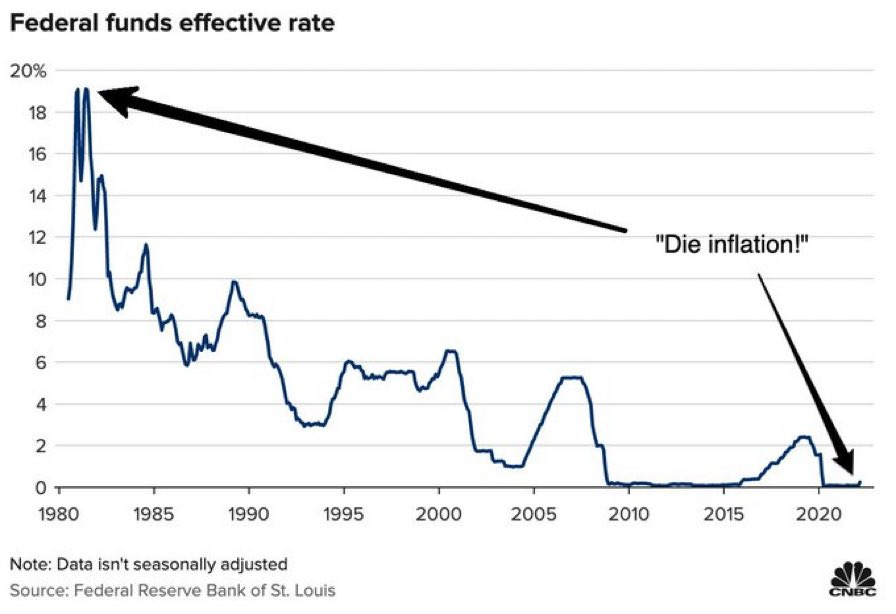

The Fed hiked rates by a hilariously insignificant .25% this past week, as expected. They have to do something to show they’re taking inflation seriously, but that thing can’t actually be effective or else they will trigger a recession or full-on depression, so:

Back in the 1980’s, Fed Chair Paul Volcker could afford to raise rates significantly to quell inflation because the government wasn’t underwater in a syrupy bog of debt (remember: interest rates represent money the government has to pay out to bond holders). Volcker had the luxury of operating in a world where the US had a low debt/GDP ratio. Imagine that.

Suffice to say, despite the adage, this time it is indeed different.

Inflation is hitting levels not seen since the late 70s and early 80s but as Marty Bent has said: the Fed's quiver is empty. The math has them trapped. What we are witnessing is reality hitting these losers in the face: you can’t run an economy on an unpegged fiat figment forever. The bill is now due, and We The People are the ones who end up paying.

“After decades of extreme reserve currency privilege and an increasing amount of unfounded hubris that has driven our political class drunk with perceived esteem and power, the rest of the world is beginning to call our bullshit.”

—Marty Bent

Chaos for the fly.

The world’s commodity markets are also starting to seize up, with oil prices up 36.9% and the price of metals like nickel up 107.7%, and countries are engaging in “food protectionism” in anticipation of hard times, low supplies, and high demand ahead. (“Argentina Halts Soy Exports As Food Protectionism Soars”). Meanwhile, you and I are being told by Bloomberg to pay hundreds of dollars to read articles that tell you to get used to poverty.

So what are the spiders doing right now? What’s the move?

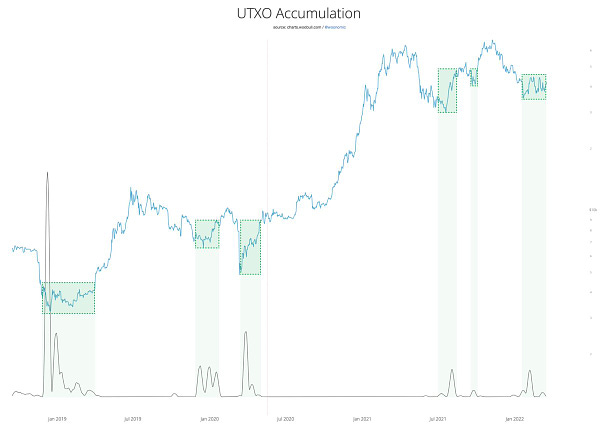

Here’s an on-chain algorithmic filter that crypto analyst Willy Woo uses to look at the magnitude of bitcoin being sold by weak investors at a loss during times of sufficient demand to mitigate downside price moves. 🧐

Bitcoin was designed, and is uniquely suited, to accrue value against this macro backdrop. Not simply because it’s a hard (as in, hard to produce) money with a verifiably finite and scarce supply, but because it is so closely tied to energy.

Steve Barbour wrote this overview of how bitcoin mining solved the 160-year-old problem of natural gas venting back in 2019, demonstrating how the addition of an energy money backed by proof of work aligns incentives in such a way that makes wasting energy unprofitable, and investing in alternative or previously unusable energy sources far more profitable.

“There’s enough flared gas to power 5 bitcoin networks, all while converting CH₄ to CO₂. CH₄ is 80x as warming as CO₂ over 20 years. CH₄ is responsible for ⅓ of all warming. Huge win for the climate.”

—Troy Cross

This week EU Parliament struck a provision in their Markets in Crypto Asset (MiCA) legislation that would have banned Proof of Work due to environmental concerns, an indication that people are starting to catch on to the fact that, upon investigation, the energy demands of bitcoin mining may actually be good for environmental responsibility and future sustainability goals.

The list of countries like El Salvador (and, rumor has it, maybe Honduras?) showing serious interest in bitcoin also continues to grow. This week Prince Phillip of Yugoslavia explained during an interview:

“Not crypto, but bitcoin. It's only about bitcoin. Bitcoin is freedom... We need to take the money away from the state... We need hard money again, without inflation."

Practically speaking, though, Bitcoin isn’t the only move, and hard money certainly isn’t enough to weather the approaching chaos.

What are governments doing? The same thing it would make sense for individuals to be doing: buying things that are hard to produce, hard to get, and necessary. Namely, energy. Food (body energy) and oil/gas (transportation and heat energy). But also the things that are used to preserve or make use of these energy stores: metals, cars, land/property.

Put in those terms it sounds quite simple doesn’t it?

To be the spider is to situate yourself in such a way that you can see the entanglement and confusion of chaos happening without being ensnared in it yourself.

To be a spider is to practice patience by building, and save what you catch for the future.

Even in times of trouble, when it’s too late to prepare, we can still try our best to be the spider.

Until next time 🤙,

Recommended Resources For Plan ₿

Swan. I became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 in bitcoin for free ✨

Fold Card. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨

Surf Report: What's normal for the spider