NFTs and the Money/Status Exchange Rate

There's always an iffy exchange rate between money and social status:

- When J. P. Morgan died in 1913, he left behind an estate worth roughly $80 million ($2.3bn today), of which three quarters was financial assets and a quarter was Morgan's vast art collection. John D. Rockefeller's response was "And to think he wasn't even a rich man." Morgan had plowed a substantial share of his profits from banking into purchasing artwork from painting-rich but cash-poor European aristocrats, which slowed down his accumulation of wealth. (Owning art has been a good investment at various times, but owning as much J.P. Morgan & Co. as possible in the late 19th century was an extraordinarily good one.)

- In 1895, Consuelo Vanderbilt, great-granddaughter of Cornelius Vanderbilt and thus the descendant of three different people who were present-value billionaires, became Consuelo Spencer-Churchill, Duchess of Marlborough. (Two decades before, the same Churchill family had another such union, between Lord Randolph Churchill and Jennie Jerome, daughter of a wealthy speculator. That union produced Winston.)

- In 1969, Long Island-based Leasco, founded in 1961 by Saul Steinberg just two years after he finished school, attempted to buy Chemical Bank, founded in 1824. (The deal failed, and afterwards Steinberg lamented: "I always knew there was an establishment in this country. I just thought I was part of it.")

- And, in 2021, celebrities like Eminem, Madonna, and Jimmy Fallon, not to mention large brands like Visa and Adidas, started buying NFTs.

What all of these stories have in common is an uncertain transition between different kinds of status, whose correlation with money is uneven over time. The older status markers used to be the ones associated with money and power, but either aren't any more or are worried that they won't be. The brief stories above are a mix of the two; Adidas is still worth more than OpenSea (at least for now) and Leasco never did manage to snag Chemical. But marriages between American plutocratic families and European aristocratic ones did keep some estates in better repair and some art collections intact, at least for a little while. And this happens in less purely economic terms, too; when governments change, they often keep the trappings of whatever they replace, even if those no longer make any sense—the Roman Senate kept meeting after Rome was ruled by emperors, and then kept on going after it fell. When the USSR fell, Russia rewrote the lyrics to their national anthem but kept the melody.

People who think a lot about social status usually don't have as much of it as they'd like. Status competition is usually happening one layer beneath the surface—social approval and peer approval affect what people do, but not why they say they do it. NFTs, though, make the old mechanisms that have always governed status games more transparent than before. It’s the most efficient market for converting money into status (and vice versa) at favorable rates. And the richer humanity gets, the more incremental spending is determined by such concerns, rather than by questions of food and shelter. As Sam Altman argues:

But this is only true if a) status can be bought, and b) NFTs, especially secondary purchases at high prices, are a way to transfer status.

I've been reluctant to write much about NFTs because the bull and bear cases are both coherent but never intersect. On the positive side, they are a purified version of collectibles; part of what we're buying when we purchase art, rare books, vacations in obscure places, etc. is the ability to have something other people can't have. "Collectibles" are also "Excludables," where a finite supply means a finite number of collectors have bragging rights. An $800 copy of Margin of Safety on a bookshelf says something that a $0 PDF of it on a hard drive doesn't, even if the PDF is perfectly good and even lets you ctrl-F.1 NFTs can also theoretically be used to instantiate different versions of the same digital object in different places—so, in theory, owning a wizard's staff in one crypto-friendly game would give you access to a rocket launcher in another. (Why the game companies would be willing to give up their high margins on in-game purchases is a discussion for another time.)

On the negative side, NFTs' purity also means that there isn't much there; social norms rather than code currently prevent people from pretending to own a particular NFT on most platforms, and the content associated with them is usually found with OpenSea's API, not with something native to the NFT itself. Moxie Marlinspike has done a thorough takedown of NFTs as they currently exist, although there's still room for the basic concepts to be the tools behind something great. Most overhyped concepts fail, but for some of them the hype is what provides enough energy to make something real.

NFTs might fall out of fashion, be the victim of environmental regulation, get hit with even more hacks, or run into some unforeseen problem—though that last one is unlikely given that foreseeing problems for NFTs is a big growth industry. For now, though, collectors are buying them and it's worth analyzing why.

What do they think they're getting?

The Altman tweet is roughly right. An NFT drop is an attempt to create a new status ladder, and to profit from auctioning off every single rung. There are two general ways to think about NFTs and status:

It is, inarguably, cool to have bought a Bored Ape at the initial price of ~$190. That was a very good prediction about what speculators and celebrities would think was impressive! Granted, the marginal buyers pricing apes at $376k or so may not be rational, but that makes it even more impressive: predicting future rational behavior is just a matter of tediously gathering better data than anyone else and designing a better model. Somebody was going to be best at it. But predicting irrational behavior means implicitly modeling a complex interactive system, and understanding something about not just the fans but how they'd respond to haters.

It is much harder to argue that the same quantum of coolness can be acquired for that $376k by buying a Bored Ape from an early adopter. It does, technically, buy membership in a club disproportionately weighted to such people, but over time the market price can only be sustained if more and more Bored Ape owners are late arrivals with money rather than early adopters with either great judgment or amazing luck.2

Arguably, the high-status move right now is to have a Bored Ape with a low cost basis, and not sell it even though that's the strictly rational move. That shows commitment.

In the meantime, NFT creators and traders are making a very unstable market. It's a bit like trading Russian sovereign debt: you don't know what the payoff will be, or what it's denominated in, or what rules will apply. While that happens, it does have a price, but the fluctuations in that price reflect fundamental uncertainty about the underlying model rather than more prosaic and easy-to-analyze questions.

It's important to remember that any kind of fashion rides these waves: the goal is always to do something that's out of the ordinary enough that the average person thinks it's somewhat ridiculous, while those in the know understand that it's not. But that means constantly running the risk of overshooting. Signaling games are highest-stakes when they're about being an early adopter of a signal that later becomes popular. What makes NFTs important is that they've created a purer version of that game. But if it's pure enough that everyone involved knows exactly what the game is, will they still want to keep playing?

A Word From Our Sponsors

How 100+ SaaS companies onboard customer data

96% of our surveyed respondents report running into issues when importing customer data, AKA data onboarding.

Invalid fields, messy CSV templates, Excel files that are emailed back and forth, this critical stage in customer onboarding can stifle time-to-value, and creates friction when onboarding customers.

We interviewed over 100+ companies to learn how product and engineering teams of all sizes are tackling this critical, yet broken, stage of the customer onboarding process.

Elsewhere

Demand Management

Electrical utilities, like banks, are in an industry that is periodically quite lively due to strenuous efforts to make it boring. A utility needs to manage fuel needs and continuously operate immensely complex machinery, often decades old, in order to supply a product to a market that continuous clears and where demand fluctuates every time someone turns on a blender.3 Meanwhile, consumers don't like variability in their bills, which creates an ecosystem of providers and regulations that move the variability somewhere else. This is not just true for their power operations, but also true for their marketing: a scheduled rise in Britain's utility bill cap created such a surge in demand for new power providers that their websites have been crashing ($, FT). Any industry that has underlying variability and tries to smooth it out will find that the variability still shows up, in spikier and less expected ways.

Influencers

The Economist has a look at the growth of influencer marketing, with estimates that 75% of marketers will spend money on influencers this year ($). The general rule in online marketing is that there's steady consolidation as winning platforms scale fast, which subsidizes their efforts to grow ad inventory. There are two useful models for why influencer marketing is growing so fast:

- Optimistically, it's a way to target very narrow audiences without ultimately giving all of the economics to the platforms. As long as influencers' endorsements aren't being bought through a continuous second-price auction, there will be exploitable bargains.

- More cynically, influencer marketing is labor-intensive—each one needs to be contacted, given a marketing message, and paid. So focusing on this kind of marketing creates job security for marketers at a time when consolidation is threatening it. If the industry won't give them a useful level of fragmentation, they'll find it on their own.

Downsides to Scaling

This Lillian Li analysis of Chinese consumer Internet company layoffs makes some useful points about how companies are structured. When companies were growing, they could expand fast by hiring very cheap labor, but had to deal with the fact that jobs at startups were less prestigious than roles at state-owned enterprises. More recently, these jobs have become targets for top graduates of competitive programs. As a result, senior employees are much higher-variance—some brilliant, some lucky. As wages rise, growth through scaling headcount gives way to a more judicious model, and layoffs are one way to start that process.

Look-Through Emissions

A new proposal calls on banks to publish emissions estimates for their borrowers ($, FT). Heavy polluters are not a growth industry, and depending on the cadence of decline, bank finance can be optimal—cash flows are much more predictable and thus much more worth lending against if they're gracefully heading to zero. What may happen over time, as public companies run into more reporting inconvenience from emissions disclosure, is that the market will split: state-owned energy companies in countries with lax emissions rules will still buy dirty assets, as will private funds. And those funds will specialize entirely in doing so. If there's going to be a reputational cost to that kind of investment, it lowers the marginal cost of going all in. So mandates that favor transparency in the short term may reduce it in the long run.

For previous Diff coverage of what emissions reporting will do, see here ($).

Lore

When a media company is only producing one kind of content, it's on a constant treadmill to invent something that's simultaneously new enough for its audience to stay interested but derivative enough that they don't feel betrayed. Managing this can be difficult. The most valuable media franchises are the ones that can work in as many different kinds of media as possible (two examples written up in The Diff are Garfield ($) and Warhammer ($)). World Wrestling Entertainment is pursuing a new variant on this, with openly fictional scripted TV shows ($, WSJ) set in, essentially, the same fictional universe as their regular attractions. One of the underappreciated assets media companies create over time is lore—wrestling fans spend a lot of time debating and parsing out storylines, and that means there's raw material for other kinds of content.

Diff Jobs

- A company solving a big time sink for developers is looking for a senior ML researcher. (Washington DC)

- An emerging market bank is looking for people to do payments operations and account operations. Experience with finacle core preferred. (Worldwide, remote)

- A company giving emerging market retail investors access to US equities is looking for a Staff Server Engineer. (US time zones, remote)

- A company in the alternative data space is looking for people in various functions across their data team. (NYC, remote)

- An emerging market bank is looking for their first Head of Product to offer financial services to underbanked SMBs and their employees. (London)

Don’t see a specific match, but still thinking about your next career move? We’re happy to chat about what else is out there.

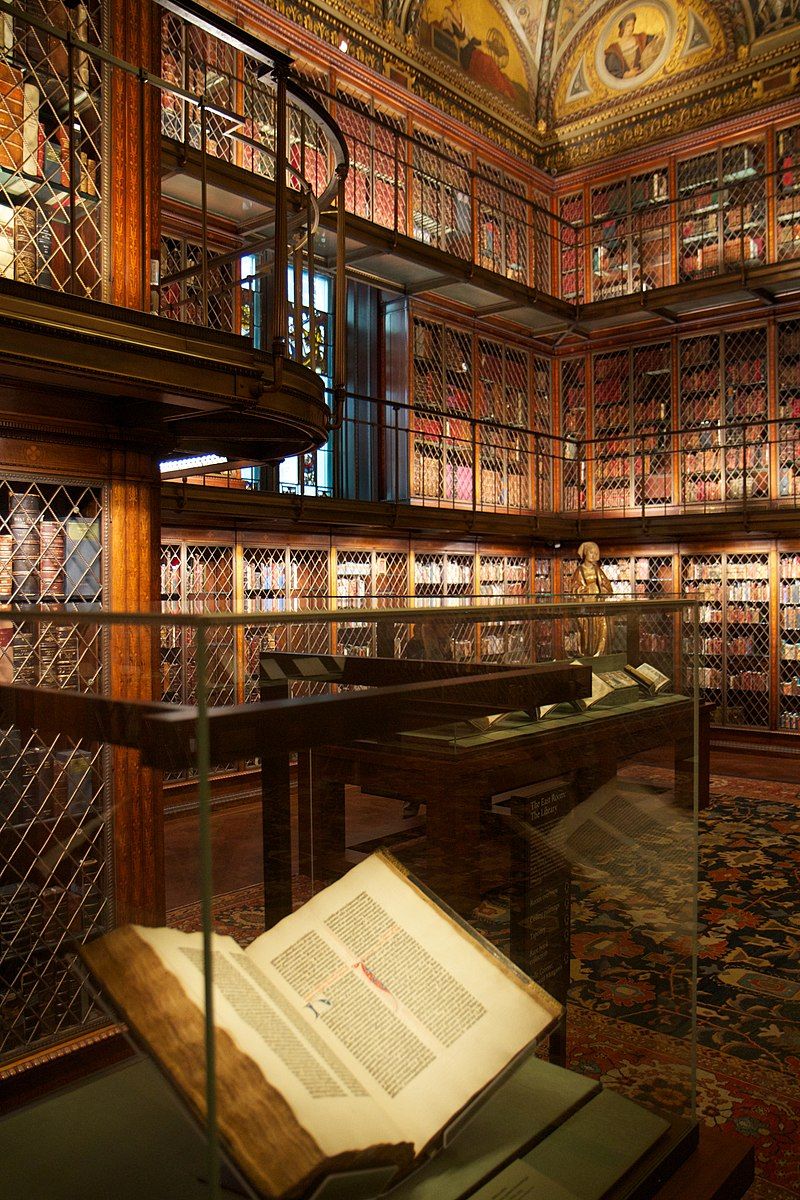

In fact, the growth of Zoom and Libgen has partly turned physical books into NFTs. Physical books are nicer to read, but the digital ones are cheaper and easier to search for and instantly access, so on the margin the purpose of a physical book is increasingly decorative. And Zoom has created a venue for showing off book collections. Of course, physical books do have plenty of perks on their own; less distracting than an Internet-connected device, and less likely to get accidentally or deliberately deleted. But over time, the part of the physical book rising in value fastest is the spine. ↩

The market for Andy Warhol's works ($, FT) has given some indication that this dynamic can be sustained for a while. When there are multiple prints, it means there's liquid markets and good price setting for the value of that print. This means if you're not an art expert you're able to know that you're not getting ripped off so much. (The market is heavily reliant on the confidence of buyers, so wealthy but uninformed buyers need assurances from the market.) And when art becomes less exclusive, provenance becomes more important. This means who owned it before, what galleries has it been shown in, and most importantly who owns the other copies. "The high value art market is about creating peer relationships between a global class of wealthy people." ↩

The classic example of this is that British utilities used to prepare for power spikes during breaks in or at the end of popular shows, since a measurable fraction of the country would get up to make tea, using surprisingly power-hungry electric kettles. ↩

Byrne Hobart

Byrne Hobart