In order to understand the current inflation debate, investors should take a close look at corporate earnings reports, CNBC's Jim Cramer said Tuesday.

"We've got a serious supply chain snag that's pushing up prices all over the place," Cramer said. "But if the free market can correct itself ... then I think productivity increases will be able to trump price increases, which will allow the Federal Reserve to keep holding interest rates low and allow stocks to go higher."

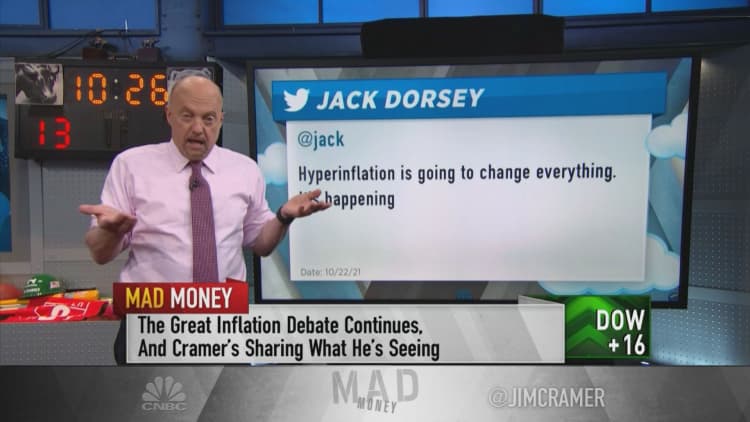

Some market participants expect higher prices to continue in a state of hyperinflation, while other contrarians like Ark Invest's Cathie Wood believe prices will fall.

"I want to wrestle with the inflation versus deflation debate by looking at what's happening with individual companies and their stocks," the "Mad Money" host said.

Cramer pointed to 3M's quarterly results. The manufacturing conglomerate on Tuesday beat Wall Street earnings expectations soundly, but 3M shares closed the session little changed. The company said high raw material costs are pressuring profit.

"Today, some huge companies reported and they made me feel less confident in Cathie Wood's vision of a deflationary future, because so many of them told us that rising raw costs are putting pressure on their ability to make money," Cramer said.

Meanwhile, United Parcel Service earnings "told a story of deflation," according to the host. UPS beat on top and bottom lines and the stock rallied about 7%.

"United Parcel's gains came down to higher productivity, which helps keep costs lower," Cramer said.

The "Mad Money" host said there's still more to learn from companies before market participants can understand the inflationary environment.

"Going forward, we need more stories like UPS and fewer stories sounding like 3M. By the end of this brutal week, I bet you we'll know the score," Cramer said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com