The Shuttering of Digital Storefronts

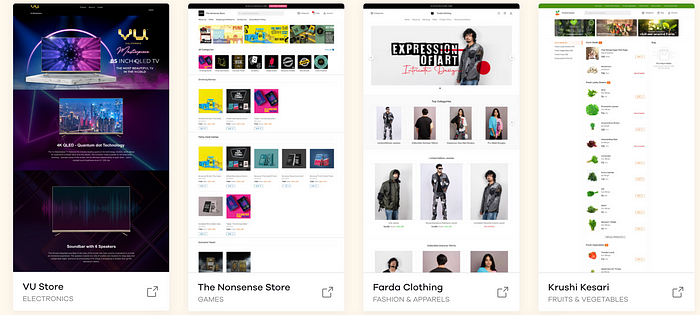

The big 3 players in the Indian “kiranatech” ecosystem: Khatabook, OkCredit and Dukaan have all shut down or pivoted away from their e-commerce enablement plays in the last 6–8 months. The Ken recently ran a piece dissecting this. While Khatabook and OkCredit have stopped offering their products (MyStore and OkShop, respectively), Dukaan is now focusing on small, direct-to-consumer brands, enterprises, and content creators not kirana stores.

This news is quite personal for me. In 2015, at Grofers, we were somewhat early in trying to build products for the kirana. We did almost exactly the same thing for them — built them a “digital storefront” to take and deliver orders from the neighbourhood. I headed that business for Grofers until we pivoted in late 2016 to become an end-to-end retailer. In short, we failed to get the kirana to become a storefront and thought it best to just become one.

For all these years, and especially after “kiranatech” or “dukaantech” has been getting the kind of attention and funding that it has, I have always wondered why we failed:

- were we were too early (pre-Jio / pre-smartphone ubiquitousness)?

- is the kirana store just not capable of being “digitised” as a storefront?

- or, was it some sort of personal failure in getting this off the ground?

It seems now that I can finally absolve myself of some of that guilt and that the things we learned along the way in 2015 still apply to the “kiranatech” ecosystem today. Here are some of the things I learnt in that journey:

Demand Side

- Lots of Competition: Just having a kirana storefront is not enough to generate orders even from the kirana catchment area. Consumers ordering online had tons of options (even in 2015) and customers planning to pay the kirana a visit did so anyway. So a digital storefront becomes just another online ordering channel with no specific loyalty.

- Higher Pricing: Kiranas could never compete with our own dark stores or the offerings of the other online players like BigBasket. Kiranas usually sold products at MRP, while Grofers dark stores offered discounts. This is because brands pass on higher margins to e-commerce players given lower supply chain costs. This higher pricing also impacted demand from the online storefront of the kirana.

- Poor Assortment: Selection at a kirana store was also more limited. When a consumer went offline, they demonstrated flexibility to accommodate substitutes which they didn’t demonstrate online, resulting in drop-offs due to assortment quality.

Supply Side

- Poor Inventory Quality: Kirana stores were unable to manage and update the status of the inventory available on their digital stores. Given the assortment range (1500–2000 SKUs), it wasn’t possible to manually update inventory status at the end/beginning of each day. We did try and integrate POS machine data at a few stores but even that data was not reliable. It was always 50–50 whether a product was really on the shelf or not. Since this was the case, we had a fill-rate of 60%-70% (i.e., in only 60–70% of the orders were we able to deliver the entire order). In the rest of the orders, there was always some product missing and that meant the customer was unlikely to come back.

- Low Delivery Capacity: Kirana stores would not hire to scale up delivery capacity. Given the margin profile of a kirana store, they would only ever use excess manpower capacity for delivery, they would never hire just to scale delivery. Let’s dig into the numbers here: Kirana stores usually make a margin of 10% (after accounting for all costs). For online orders, they would need to give us a small commission (around 2%). The basket size of a typical online order was about 500 INR. That’s 40 INR of margin. A typical delivery boy would cost somewhere between 15,000–20,000 a month. To breakeven, the delivery boy would need to deliver 375–500 orders a month, which is 12.5–17 orders a day. Because of low and unpredictable demand, maintaining this steady utilisation target of 12.5–17 orders/day was impossible. So this meant that even the larger kirana stores would set their maximum delivery capacity at ~30–40 orders a day (as much as 2 store hands, doing part time could manage). This was not meaningful enough for them (as extra source of revenue) or for us, at Grofers. In contrast, a Grofers dark store in the area would be doing 10–15x of the order volume.

The Future of Digital Storefronts

Kirana store owners fundamentally care only about the cashflows from the business. They appreciate products that help improve margins or demand (importantly, while keeping costs the same), with immediate effect. They have very little appetite to pay for services and software, where they might have to wait to see the benefits accrue.

My view is that as more customers move to shop online (especially given the convenience of quick commerce players), it is likely that kirana stores starting giving way to dark stores (especially in Tier-1 cities). Validating this thesis, a senior operator who works in the FMCG industry mentioned that in Delhi NCR their contribution from the kirana business had reduced from 80% to about 68%-70%. That is a pretty big shift and in my view signals the start of the move away from the kirana. In this scenario, building out digital storefronts for the kirana is likely not going to have a big pay off.

I would love to hear from operators today on their experience building this out in the last 5years. If any of the learnings have changed over these years and whether they agree with where the kirana stores are headed.