- India

- International

Explained: The tax row involving UK minister Rishi Sunak’s wife Akshata Murthy

Akshata Murthy, wife of UK’s Indian-origin finance minister Rishi Sunak, has reportedly avoided up to £20 million in UK tax. Akshata, however, has said she is exempt from paying taxes on overseas income in the UK due to her status as a non-domiciled citizen.

British Chancellor of the Exchequer Rishi Sunak and his wife Akshata Murthy. (Reuters)

British Chancellor of the Exchequer Rishi Sunak and his wife Akshata Murthy. (Reuters)Until recently, the UK’s Indian-origin finance minister Rishi Sunak was widely considered a top contender to replace prime minister Boris Johnson. But for the last few months, his popularity has been waning. The first wave of criticism came when he unveiled a controversial mini-budget in Parliament, sharply hiking taxes despite a spiralling cost-of-living crisis fuelled by the pandemic. Now 10 Downing Street seems even further out of reach for Sunak, after it was revealed that his wife, Akshata Murthy, has potentially avoided up to £20 million (around Rs 197 crore) in UK tax.

The daughter of Infosys co-founder Narayana Murthy, Akshata owns about 0.93 per cent of the Bengaluru-based IT company, valued at almost $1 billion at current prices, according to Bloomberg. She receives about £11.5 million (Rs 11.56 crore) in annual dividends from her stake in the company, The Guardian reported.

It’s interesting to note that with a total estimated fortune of about £690 million (over Rs 6,834 crore), Akshata is richer than the Queen. But this certainly doesn’t help Sunak’s political ambitions, with Opposition leaders accusing him of hypocrisy and his popularity ratings at an all-time low.

Why has Akshata not paid tax for her overseas income?

Akshata has said that she is exempt from paying taxes on overseas income in the UK due to her status as a non-domiciled citizen. “Akshata Murthy is a citizen of India, the country of her birth and parents’ home,” her spokesperson told The Guardian. “India does not allow its citizens to hold the citizenship of another country simultaneously. So, according to British law, Ms Murthy is treated as non-domiciled for UK tax purposes.”

So far, she has collected about £54.5 million in dividends from Infosys, according to a report by The Guardian. Due to her non-dom status, she was able to save about £20 million in UK taxes, the report estimated. Since 2016, the total tax applied to dividend payouts for higher rate UK-resident taxpayers has sharply risen from about 30.7 per cent to 39.35 per cent this week.

Murthy’s spokesperson insisted that she has been paying relevant taxes for her income generated in the UK. Labour MPs have since written to Sunak asking if his wife paid foreign tax in India or in tax havens like the Caymen Islands — a claim that Murthy’s spokesperson refused to comment on.

This is not the first time Murthy has been fielding such allegations. In 2020, a report by The Guardian revealed that some of her investments were being routed through Mauritius to avoid taxes in India.

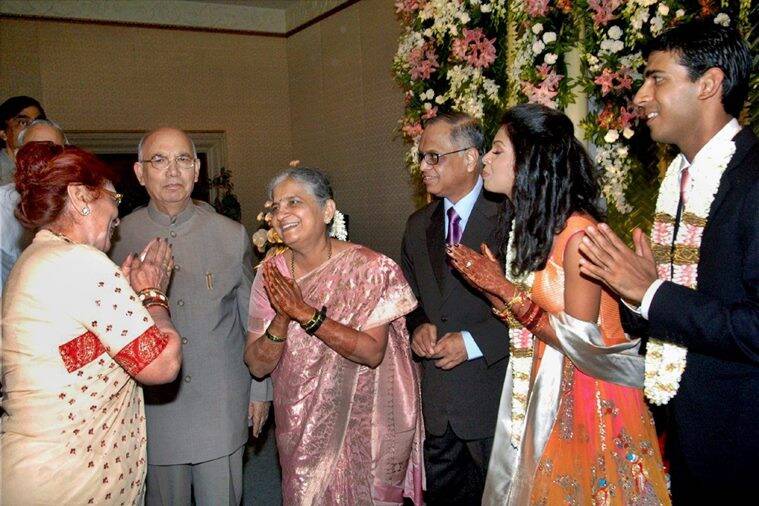

Then Karnataka Governor H R Bhardwaj with wife at the wedding reception of Infosys co-founder Narayana Murthy’s daughter Akshata and Rishi Sunak in Bengaluru.

Then Karnataka Governor H R Bhardwaj with wife at the wedding reception of Infosys co-founder Narayana Murthy’s daughter Akshata and Rishi Sunak in Bengaluru.

So, what is non-domicile status and who qualifies?

A controversial part of colonial-era tax law, non-domicile status applies to people who are tax residents of the UK, but have their permanent homes outside the country. Since they are registered as tax residents and non-domiciled with the HM Revenue and Customs (HMRC), they are not liable for taxes in either the UK or their homeland on their foreign income.

But non-domicile status is not automatically bestowed upon foreign-born residents or non-citizens. They are required to apply for tax exemptions on foreign income of over £2,000. Critics were quick to point out that Murthy’s tax status in the UK was not an obligation and that she had to have actively applied for non-dom status.

Being a non-dom isn’t cheap. Those who have resided in the UK for at least seven of the previous nine tax years have to pay £30,000 a year to the government, according to The Guardian. Under British law, a non-dom will automatically be deemed domiciled after residing in the country for 15 years.

Is her tax arrangement legal?

Yes, technically her tax arrangement is legal. According to government sources, Sunak declared his wife’s tax status to the Cabinet Office when he became a minister in 2018 and also after he took charge of the UK treasury just a year later, PTI reported.

Why is non-dom status controversial?

When non-dom status was first introduced in 1799 during the rule of King George III, it aimed to protect the wealth of a new class of colonial rich by exempting all of their foreign income from UK tax. If it hadn’t been for non-dom status, these wealthy British colonialists would have had to pay sky-high tax bills for much of their wealth acquired overseas in places like Jamaica and India, according to a report by The Times.

Today, the rule continues to benefit the country’s wealthy elite. According to a study by the London School of Economics and the University of Warwick, over two-fifths of UK tax residents who earned £5 million or more in 2018 claimed non-dom status at some point since 1997.

From film stars and athletes to top-earning bankers and industrialists — many of the UK’s highest-earning non-doms are household names. Among them are Russian oligarch and outgoing owner of the Chelsea football club Roman Abramovich, and steel tycoon Lakshmi Mittal.

But why is the issue being raised now?

The latest controversy comes at a time when Sunak’s popularity is at an all-time low. In recent weeks, he has faced tremendous backlash for his mini-budget which was widely criticised for not doing enough to deal with the cost of living crisis in the country, spurred by soaring energy and fuel prices and the coronavirus pandemic.

Sunak also faced questions about Infosys’ presence in Russia at a time when the UK was imposing stringent sanctions on Moscow amid the war in Ukraine. Soon after, several media reports suggested that Infosys was soon going to pull out of Russia.

Newsletter | Click to get the day’s best explainers in your inbox

More Explained

EXPRESS OPINION

May 02: Latest News

- 01

- 02

- 03

- 04

- 05