Soaring used car prices suggest inflation headwinds to intensify

Used vehicle prices jumped 8.3% in first half of October

Economists claim US inflation will carry over into 2022

Cato Institute chair of understanding of economics Ryan Bourne joins 'Kennedy' to discuss concerns surrounding the U.S. economy amid supply chain crisis

Surging used vehicle prices suggest inflation will strengthen in early 2022.

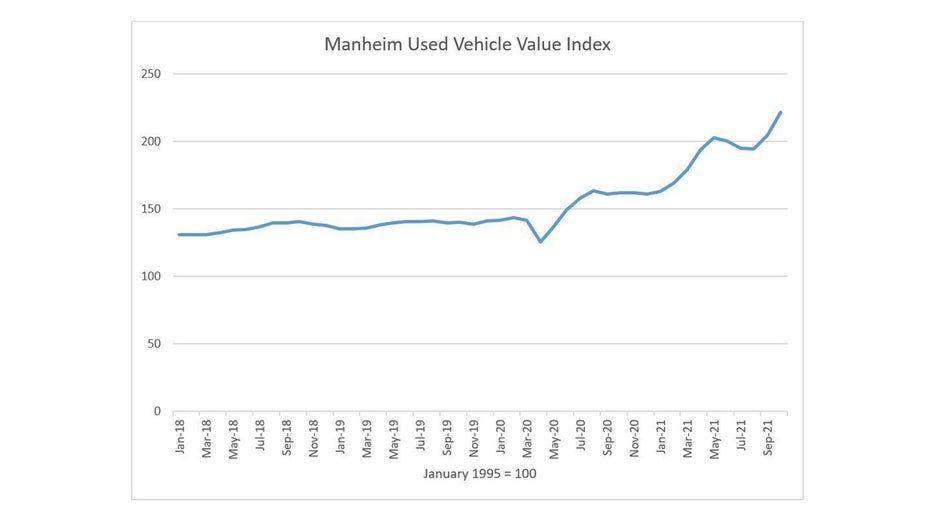

Wholesale used car and truck prices jumped 8.3% in the first 15 days of October compared to the month of September, according to the Manheim Used Vehicle Value Index.

The Manheim Used Vehicle Value Index

"There has been a lag of 2-3 months between the two so as we enter 2022 used cars will still likely be a big upward influence on the CPI number," said Deutsche Bank strategist Jim Reid.

BIG MONEY MANAGERS HOARD CASH, DUMP BONDS AS INFLATION FEARS MOUNT

Used car prices have soared 37% over the past 12 months as a global chip shortage caused automakers to rein in production, boosting demand for pre-owned vehicles.

Prices have also seen a boost due to pent-up demand coming out of the pandemic with many consumers having more cash to spend due to government stimulus measures.

Used vehicle prices make up about 4% of the core consumer price index basket but have added almost one percentage point increase, according to Reid.

Core CPI, which excludes food and energy, rose 4% year over year in October. However, that included a 24.4% annual increase in used car prices – more than 12 percentage points below the rise in the Manheim Used Vehicle Value Index.

Federal Reserve Chairman Jerome Powell has said the recent bout of inflation is "transitory" and that price increases will recede as supply chain bottlenecks ease.

The Fed, at its upcoming November meeting, is expected to lay out its plans for tapering its $120 billion per month in asset purchases. However, rate hikes are unlikely to begin for several months.

While the Fed expects inflation to moderate, Reid says there are signs that pricing pressures could grow even stronger next year.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"Primary rents and owners’ equivalent rent make up around a third of the basket (40% for core), and while they are not going to grow at the same breakneck speed [as vehicle prices], the forward looking models suggest that they could be a big story in 2022 and the baton could be passed from cars to housing for CPI strength," he wrote.