Spotify has confirmed price rises in 12 markets including the UK.

The streaming giant announced the move in its Q1 financial results.

The static price points of streaming subscriptions came under discussion during the DCMS Committee streaming investigation. It’s also been an issue for Spotify’s profitability and average revenue per user (ARPU), which has decline as the DSP has launched in more developing markets.

Spotify confirmed that it has raised prices for various subscription products in markets including the United States (Family Plan), United Kingdom (Student, Family, and Duo Plans), and Brazil (Full Portfolio). The UK price increase will be £2 for Family (£16.99), and £1 for Duo (£13.99) and Student (£5.99) plans.

In a note to investors, Spotify said price increases have not had a negative impact on sign-ups or churn.

“To date, we have raised prices across a variety of our Premium offerings in over 30 markets and early results have shown no material impacts to gross intake or cancellation rates,” said Spotify.

Within Premium, average revenue per user of €4.12 in Q1 was down 7% year-on-year (-1% in constant currency compared to -3% in Q4). Product mix (low-priced tiers) accounted for the majority of the ARPU decline.

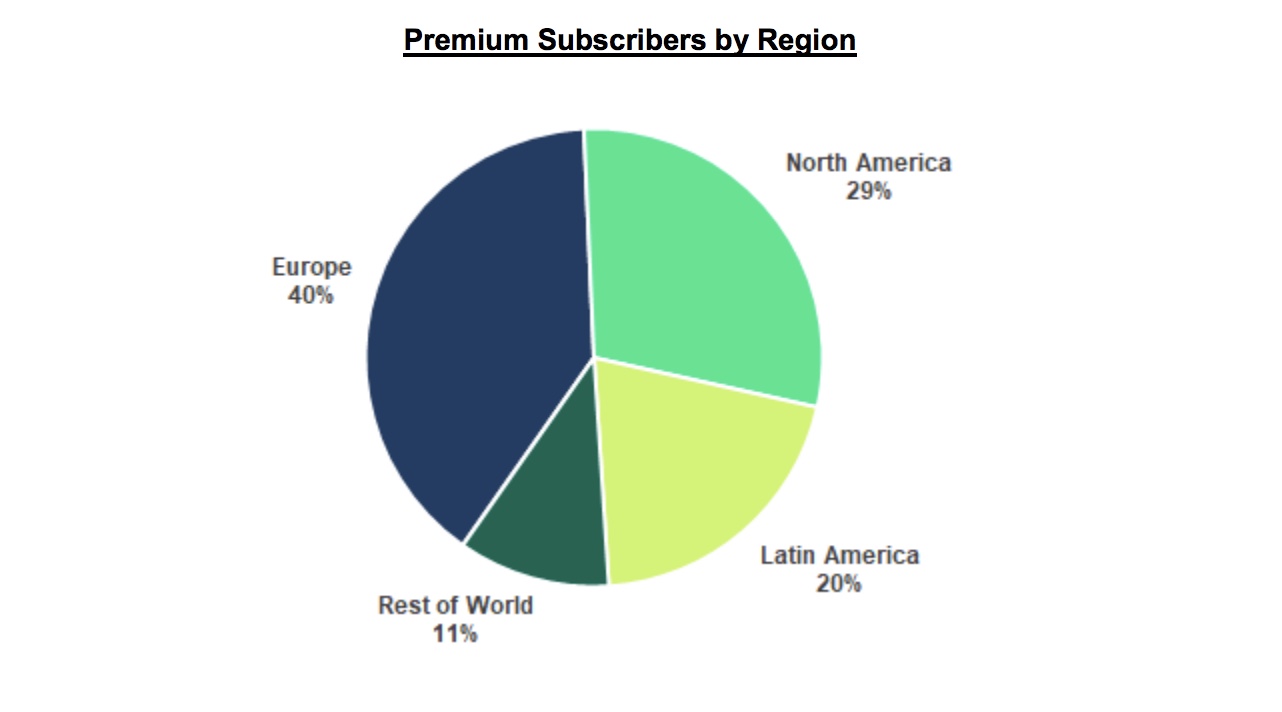

During Q1, Spotify’s premium subscribers grew 21% year-on-year to 158 million – a result at the top end of the guidance. In the first quarter, Spotify added nearly four million subscribers, which drove double-digit growth year-on-year across all regions. Churn rate was flat on the previous quarter and down year-on-year thanks to adoption of higher-retention offerings such as Family Plan.

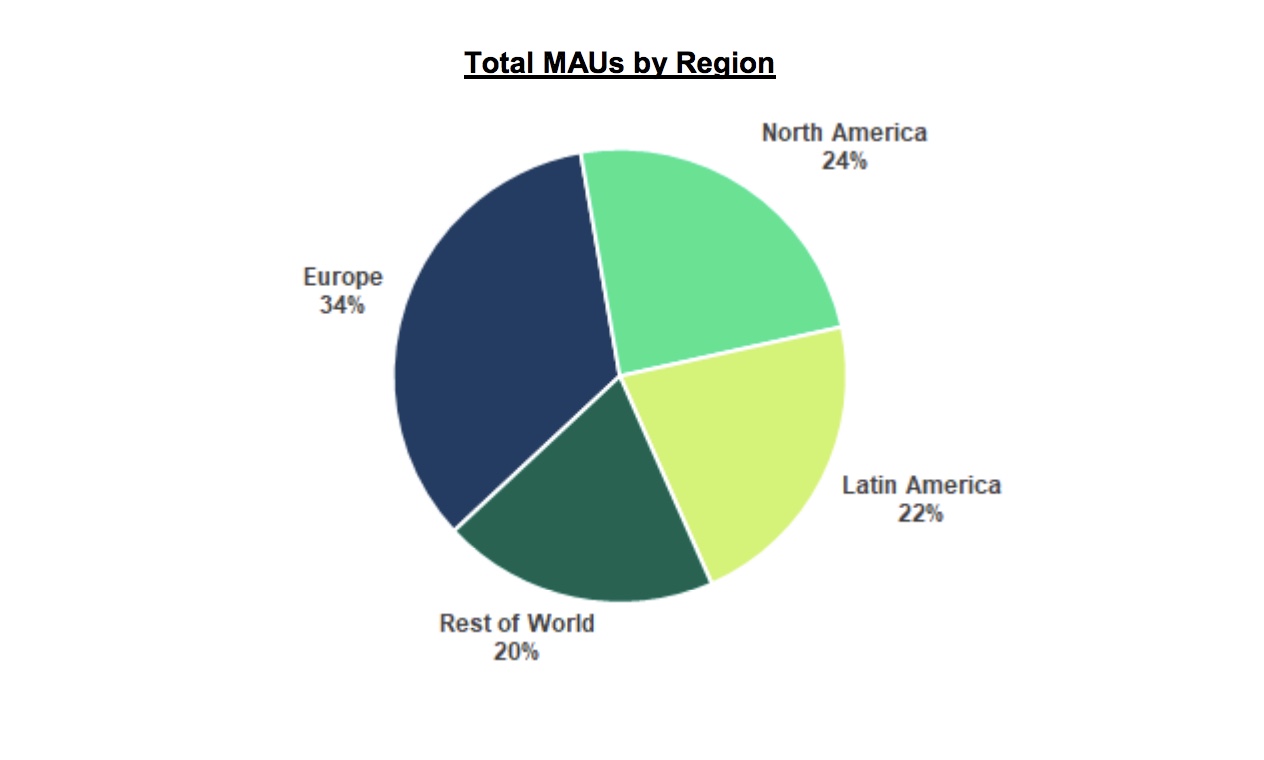

Total monthly active users (MAUs) grew 24% year-on-year to 356 million in the quarter. While that was in the guidance range, it was slightly below internal expectations. In Q1, Spotify added 11 million MAUs. The streaming giant said there were “meaningful” contributions from the US, Mexico, Russia and India. However, growth was lower than expected in Latin America and Europe.

Spotify CEO and founder Daniel Ek said: “I’m pleased with the continuing momentum we are seeing across many aspects of our business this quarter, including our subscriber growth. 2020 was a very strong year for Spotify and we believe Spotify is well positioned to continue to extend our leadership globally as we move forward.”

Global consumption hours continued to grow in Q1 on a year-on-year basis. Per user consumption grew in North America and Europe, while developing regions showed signs of improvement but remained below pre-Covid levels.

We believe Spotify is well positioned to continue to extend our leadership globally as we move forward

Daniel Ek

Total revenue of €2.147 billion grew 16% year-on-year in Q1 (22% on a constant currency basis). Reported revenue was toward the top end of the guidance range due to subscriber outperformance, less impact from currency fluctuations and advertising strength. Premium revenue grew 14% year-on-year to €1.931 billion (19% in constant currency terms). Ad-Supported revenue grew 46% year-on-year to €216 million (57% in constant currency terms).

Spotify made an operating profit of €14m in the quarter. Gross Margin finished at 25.5% in Q1, which was flat and at the top end of guidance.

At the end of Q1, Spotify had 2.6m podcasts on the platform (up from more than 2.2m podcasts by the end of Q4). The percentage of MAUs that engaged with podcast content was consistent with the Q4 level.

Key Q1 releases included Olivia Rodrigo’s Drivers License, which set the Spotify record for most streams in a day for a non-holiday song with over 15 million global streams on January 11.

For Q2, Spotify’s guidance is for 366-373m MAUs and 162-166m premium subscribers. For the end of the year, the streaming giant is forecasting 402-422m MAUs and 172-184m subscribers.