- India

- International

After Panama, it’s Pandora: facing regulatory heat, elite Indians find new ways to ringfence wealth in secret havens

Pandora Papers | Top businessmen to corporate defaulters, CBI, ED-accused to celebrities: an investigation by The Indian Express finds how complex offshore trusts are used to park assets and evade detection

Vinod Adani, who is a Cyprus national residing in Dubai, is the sole shareholder of this offshore firm with 50,000 shares, and a director since May 2018.

Vinod Adani, who is a Cyprus national residing in Dubai, is the sole shareholder of this offshore firm with 50,000 shares, and a director since May 2018.Seven leaks later, after regulators worldwide have begun cracking down on global money flows, the elite are finding ingenious new ways to ring-fence their assets from scrutiny at home reshaping the secrecy industry in international finance.

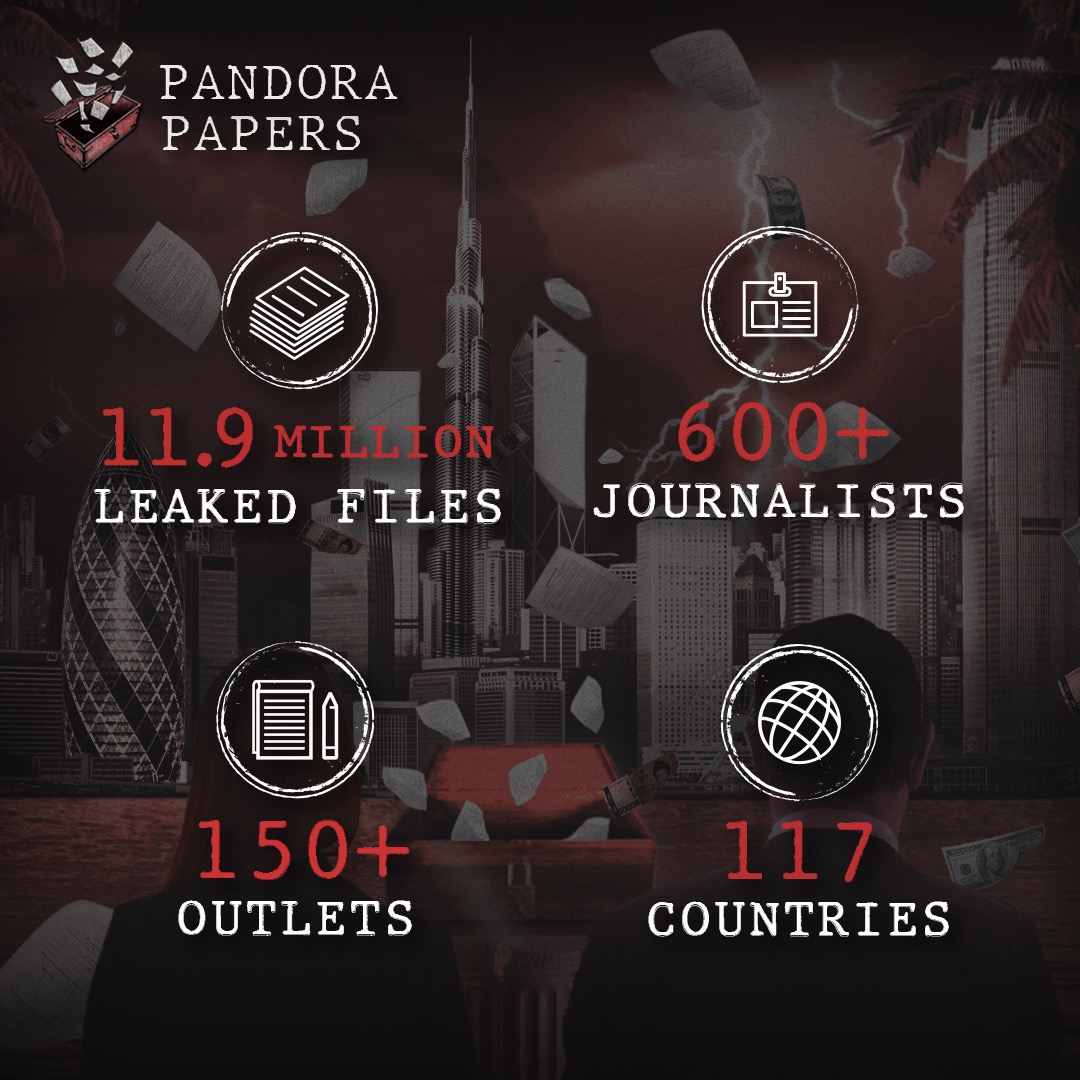

This has been revealed in Pandora Papers, the latest leak of offshore financial records, the most voluminous ever: as many as 12 million documents from 14 companies in offshore tax havens with details of ownership of 29,000 offshore companies and Trusts.

Obtained by the International Consortium of Investigative Journalists (ICIJ) two years ago, a one-year investigation of data linked to India by The Indian Express reveals how individuals and businesses , many already under the scanner, are pushing the envelope to evade detection, using loopholes in the law at home and the lax jurisdiction of tax havens.

So, Anil Ambani, who declares bankruptcy in one UK court, has 18 asset holding offshore companies; fugitive Nirav Modi’s sister sets up a trust just one month before he fled India; the husband of Kiran Mazumder Shaw, promoter of Biocon, sets up a trust with keys to a person who banned by Sebi for insider trading, reveals an investigation by The Indian Express.

Of the 300-plus Indian names, the offshore holdings of as many as 60 prominent individuals and companies were corroborated and investigated. These will be revealed in the coming days.

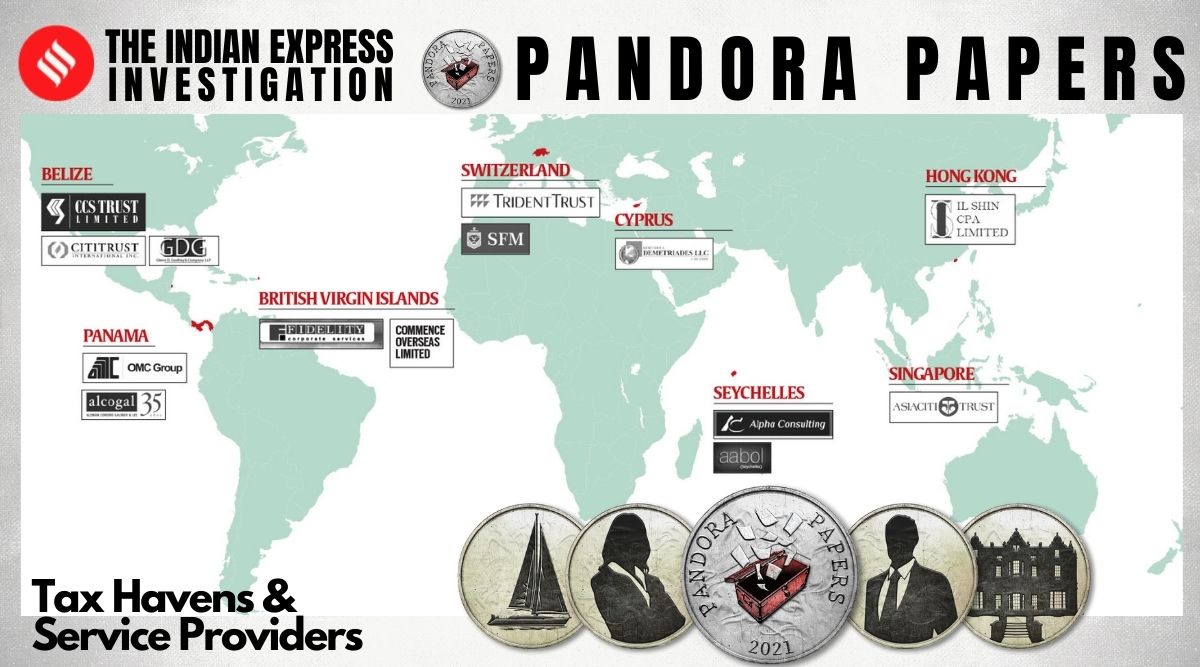

Pandora Papers: Tax havens and service providers

Pandora Papers: Tax havens and service providers

Five distinct patterns emerge in the investigation of Pandora Papers:

1. Several offshore entity owners, even in India, have found means to adapt to the post-Panama Papers scenario, when the offshore world was shaken, when several countries tightened regulations and in India, the taxman detected Rs 20,000 crore-plus undeclared foreign and domestic assets till early 2021.

Sports icon Sachin Tendulkar, for instance, asked for the liquidation of his entity in the British Virgin Islands just three months after the Panama Papers expose. There are other prominent Indians and NRIs too, who have, following the 2016 data leak, opted for a rejig or reorganisation of their offshore assets. Evidently, Indian businessmen have been setting up a plethora of offshore Trusts to project a degree of separation from their wealth and insulate their assets from creditors.

2. Individuals accused in economic offences and under investigation, have created an offshore network in tax havens like Samoa, Belize or the Cook Islands, besides larger tax havens like the British Virgin Islands or Panama. Indeed, many of the individuals and entities named in the Pandora Papers are no strangers to investigating agencies in India. Some are in jail and several subjects of this investigation are presently on bail. There is a fairly long list of Indian offenders who are currently under the scanner of agencies like the Central Bureau of Investigation, the Enforcement Directorate, and the Serious Fraud Investigation Office.

3. Those in debt to the tune of thousands of crores of rupees to Indian banks, have, as the Pandora Papers show, diverted a sizable section of their assets into a maze of offshore companies. In one case, major Indian economic offenders, currently in jail, have bought a Bombardier Challenger aircraft through their offshore entity. Many promoters, as the investigation reveals, parked their assets in offshore trusts, effectively protecting themselves from personal guarantees to loans being defaulted by their businesses.

🗞️ Read the best investigative journalism in India. Subscribe to The Indian Express e-Paper here.

4. Then there are PEPs or Politically Exposed Persons. Among the Indian PEPs are former Members of Parliament; those who have held public office in India; others who either deal in sensitive trades or trade in sensitive countries or even those who have been previously booked by Indian investigating agencies. All these PEPs were moved to the “high risk” watch list by the offshore service provider.

5. Leaked records reveal that many of the power players who could help bring an end to the offshore system instead benefit from it— stashing assets in covert companies and trusts. The confidential data of the 14 offshore service providers, for instance, shows offshore entities set up by a former Revenue Service officer, a former tax commissioner, a former senior Army officer, a former top law officer and so on.

While offshore trusts are recognised by law in India, what has led to a rush of Indian industrialists and business families to set up Trusts is the fear of a return of the estate duty, which till its abolition in 1985, was as high as 85 per cent.

“Inequality has risen, and the gap between the rich and poor has risen. It was Arun Jaitley as Finance Minister who hiked the surcharge on the super-rich (those earning over Rs 1 crore a year) to 12% while doing away with the 1% wealth tax in the Budget for 2015-16,” a senior Income-Tax Department official said.

Although India has signed information exchange agreements with various countries, they exist only on paper. “It is near impossible to pierce the corporate veil… and our rule of law does not allow us to undertake random I-T surveys and searches,” the official, who was involved in following up the Panama Papers investigations, told The Indian Express.

“Also, most big business houses over the years have ensured they have an NRI family member or an overseas citizen managing the offshore affairs. This ensures such entities do not have to disclose assets in the Foreign Assets Schedule while filing returns,” the official said.

Pandora Papers: Over 600 journalists from 150 news organisations worked together in what is the largest-ever investigation.

Pandora Papers: Over 600 journalists from 150 news organisations worked together in what is the largest-ever investigation.

Overseas, the Pandora Papers expose dealings of the King of Jordan, the Presidents of Ukraine, Kenya and Ecuador, the Prime Minister of the Czech Republic, and former British Prime Minister Tony Blair. The files detail financial activities of Russian President Vladimir Putin’s “unofficial minister of propaganda” and more than 130 billionaires from India, Russia, the United States, Mexico, and other nations.

In popular imagination, the offshore system is often seen as a far-flung scattering of palm-shaded islands. The Pandora Papers show that the offshore money machine operates in every corner of the world, including financial capitals of the richest and most powerful economies including the United States of America.

The system is also sustained by elite institutions that serve the rich and powerful — global banks, law firms, and accounting practices headquartered in the US and Europe.

A document in the Pandora Papers shows, for example, that banks around the world set up at least 3,926 offshore companies for their customers with the help of Alemán, Cordero, Galindo & Lee, a Panamanian law firm led by a former Panamanian ambassador to the US The law firm — also known as Alcogal — has affiliated offices in a dozen countries, including New Zealand, Uruguay and the United Arab Emirates. It shows Alcogal set up at least 312 companies in the British Virgin Islands at the request of American financial services giant Morgan Stanley.

Besides Alcogal, the largest number of secret records in the Pandora Papers are from the Trident Trust Company of BVI and the Asiaciti Trust of Singapore. Other major offshore providers include Aabol (All About Offshore Seychelles Limited), OMC (Overseas Management Company Inc), and Fidelity Corporate Services Limited. The leaked records of the 14 offshore providers span an over two-decade long period from 1996-2020 while the period of incorporation of the companies and Trusts is even longer, ranging from 1971 to 2018.

Apr 18: Latest News

- 01

- 02

- 03

- 04

- 05