Alphabet (GOOGL) Q4 Earnings and Revenues Beat Estimates

Alphabet Inc.’s GOOGL non-GAAP earnings of $22.30 per share for fourth-quarter 2020 surpassed the Zacks Consensus Estimate of $15.91. Earnings increased 36% sequentially and 45.3% year over year.

Net revenues — excluding total traffic acquisition cost or TAC (TAC is the portion of revenues shared with Google’s partners, and amounts paid to distribution partners and others who direct traffic to the Google website) — came in at $46.43 billion.

The figure was up 22.2% sequentially and 23.6% year over year. Also, net revenues outpaced the Zacks Consensus Estimate by 5.31% driven by strength in the company’s search, cloud and YouTube businesses.

Following strong fourth-quarter results, Alphabet’s share price increased 7.6% in after-hours trading.

Notably, primary drivers of the Google business haven’t changed. Yet, pricing remains under pressure, both on account of nagging FX concerns, and persistent strength in mobile and TrueView.

Nonetheless, Google continues to enjoy strength in the cloud business. The company’s Google Cloud recorded 46.6% year-over-year revenue growth for the quarter. It is to be noted that the firm will continue to invest in this space.

Markedly, advertising sales surged across all regions and industries during the quarter.

YouTube remains a strong contributor to the company’s growth. More than a thousand creators are currently engaged in the platform, bringing in a thousand subscribers every day. However, time and again it faces continuous pressure from advertisers to tighten controls on the fast-growing YouTube video service in a bid to avoid adult or offensive content.

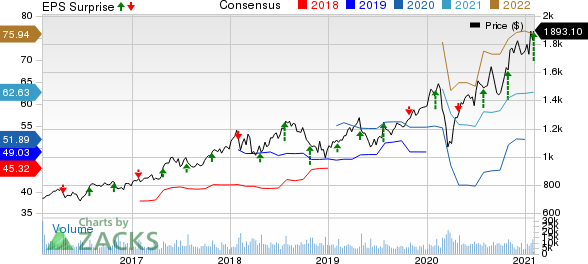

Alphabet Inc. Price, Consensus and EPS Surprise

Alphabet Inc. price-consensus-eps-surprise-chart | Alphabet Inc. Quote

Numbers in Detail

Revenues

Gross total revenues of $56.9 billion increased 23.2% sequentially and 23% year over year (up 23% in constant currency).

The increase was driven by higher advertiser spend in Search and YouTube, as well as persistent strength in Google Cloud and Play.

Google Segment

The segment includes Google Services, Google Cloud and Other Bets.

Google Services Segment

Revenues from the Google services business increased 22.4% year over year to $52.8 billion, accounting for 92.9% of quarterly revenues.

Under the services business, search revenues from Google-owned sites increased 17.4% year over year.

YouTube advertising revenues grew 46% year over year to $6.9 billion, while Network advertising revenues increased 23% to $7.4 billion.

Google other revenues — which consist of YouTube non-advertising revenues — were $6.7 billion for the fourth quarter, up 26.8% year over year, driven by growth in YouTube non-advertising and Play revenues.

Total Google advertising revenues grew 21.8% year over year to $46.2 billion.

Google Cloud Segment

In addition, Google Cloud revenues grew 46.6% year over year to $3.8 billion, accounting for 6.7% of the quarterly revenues. Strong growth in Google Workspace revenues was driven by growth in both seats and average revenue per seat.

Other Bets Segment

Other Bets revenues were $196 million, up 14% year over year, accounting for 0.3% of total fourth-quarter revenues.

Total traffic acquisition cost or TAC was up 23.1% year over year to $10.5 billion.

Operating Results

Operating margin was 28%, up 800 basis points from the year-ago quarter.

Operating expenses (including research and development, sales and marketing, as well as general and administrative expenses) were $15.2 billion, down 3.9% from the year-ago quarter.

Balance Sheet

At fourth quarter-end, Alphabet had a solid balance sheet, with cash & cash equivalents, and marketable securities of $136.7 billion, up from $119.7 billion in the comparable prior-quarter period.

The company generated $22.7 billion cash from operations for the fourth quarter and spent $5.5 billion on capex, netting a free cash flow of $17.2 billion.

Zacks Rank and Other Stocks to Consider

Currently, Alphabet carries a Zacks Rank #2 (Buy). Other top-ranked stocks in the broader technology sector include Semtech Corporation SMTC, JD.com, Inc. JD and Microchip Technology Incorporated MCHP, each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth for Semtech, JD.com, and Microchip Technology is currently projected at 12.5%, 51.2% and 14.9%, respectively.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microchip Technology Incorporated (MCHP) : Free Stock Analysis Report

Semtech Corporation (SMTC) : Free Stock Analysis Report

JD.com, Inc. (JD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research