Web 3 Leading Indicators (Part 6 of 7)

0xIntro

We don’t need to repeat why crypto and web3 are going to be at the forefront of the next generation’s companies. We believe in it, and text our frens “gm” and “wagmi” every morning. We’ll cut the bullsh*t and get straight to the point.

It’s hard for the average person to understand what this noise is all about, so we took the initiative to write up a series of posts that dive into what’s actually inside the rabbit hole.

If you don’t know us already, Ripple Ventures is an early-stage venture fund looking to back extraordinary founders building market-shifting software tools. We’re focused on anything enterprise, creator, and developer-focused in web2 and web3.

This is the sixth of a seven-part series covering:

- What is Web 1, 2, 3?

- The Benefits and Drawbacks of Web 2

- Why Does Web 3 Matter?

- What’s the Metaverse?

- State of the Crypto Market & Ecosystem

- Web 3 Leading Indicators

- Web 3 Dictionary Resource

Up Next…

Next week, we’ll be sharing the final edition of this series, a Web3 Dictionary Resource.

Follow our Medium account and subscribe to our Substack to see it first!

Get in touch!

If you’re a founder building in this space and want to connect, please reach out to us using this link!

Web 3 Leading Indicators

There are a few Web 3 leading indicators that we’re tracking:

- Developer Movement

- Apps and Infrastructure Development

- Breadth and Depth of User Adoption

Developer Movement

Developers play an important part in building out the Web 3 ecosystem. Currently, developers are attracted to Web 2 companies due to the compensation, status/exit opportunities, work/life balance, and the company’s ability to assist in immigration status.

Something that’s often said in markets is to pay attention to where the developers are moving. Developers want to work on interesting, complex, and large problems. Though compensation and benefits are important, this archetype of person will likely lean toward what interests them and what they’re seeing some of the other smartest people around them start doing.

However, Web 3 companies are beginning to entice more and more developers by using token economics to incentivize and attract workers, better aligning to the decentralized, open, and transparent values of most workers, providing the ability to work on “the next big thing” and groundbreaking technology, and allowing remote work (which removes the need for visa sponsorship). The number of developers within the Web 3 ecosystem is growing rapidly, with the Ethereum network attracting around 300 new developers a month.

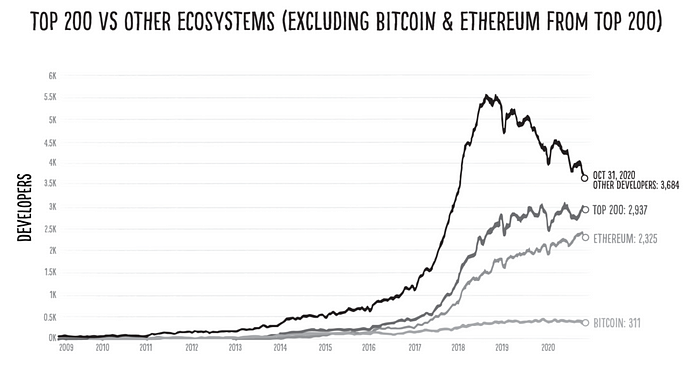

The number of developers for the top 200 blockchains has been increasing, while the bottom 7,800 blockchains have seen a decrease in developers. This indicates a consolidation in developer activity into the top 200 blockchains.

Apps and Infrastructure

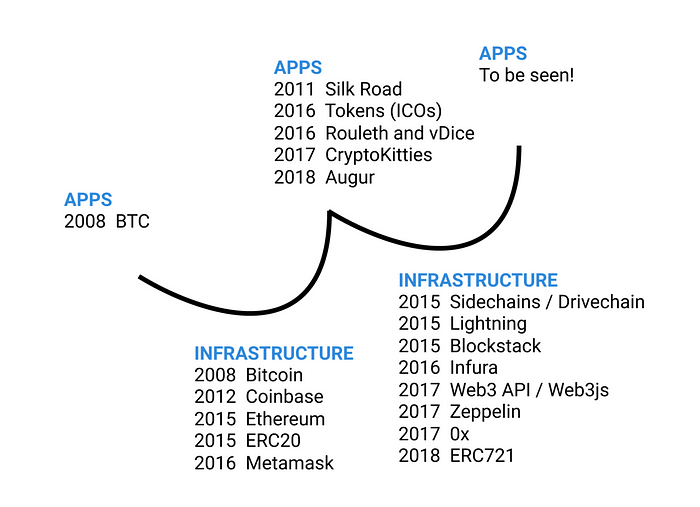

Another thing to track in the ecosystem is whether or not applications have hit problems of scale. There’s the debate of whether apps or infrastructure matter more, but our view is that they’re both important. Apps need to be developed to enable access to core technology to end users. Infrastructure needs to be created to scale and improve the underlying technology for apps.

When end users are hitting breaking points, seeing slow downs in performance, and higher costs to use the apps, then we’ve hit a scaling issue. This is a good thing to see in the market because there’s enough end usage that’s putting pressure on the apps. This pushes a need for innovation in the infrastructure of apps, which is where we’re seeing a ton of new Layer 2 solutions to help Layer 1 blockchains like Ethereum perform faster or cheaper. It’s where we’re seeing new Layer 1 solutions like Solana that apply new frameworks on processing transactions much faster and cheaper than Ethereum.

USV shares some great examples of the app and infrastructure cycle shifts above. The moral of the story is that as long as there’s a constant iteration and improvement in the ecosystem, there’s better growth and adoption of technology. If no one was using or participating in Web 3, there’d be no need to improve it. There are improvements and innovations being developed every day.

Breadth and Depth of User Adoption

As mentioned before, the total crypto market cap, individual user wallets, and total transaction activity can all measure the number of users and level of engagement of these users. Another framework to use to measure the level of users within the Web 3 ecosystem is breadth (the number of users), and depth (how active these users are).

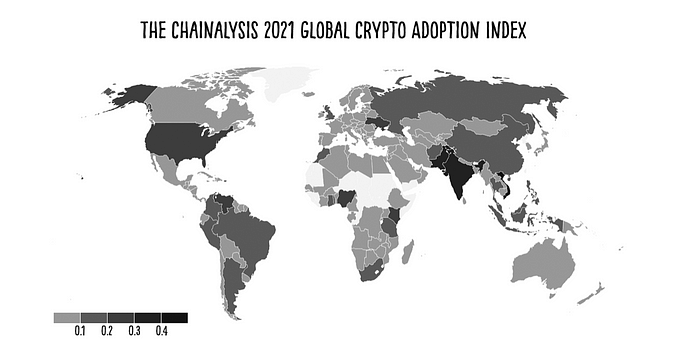

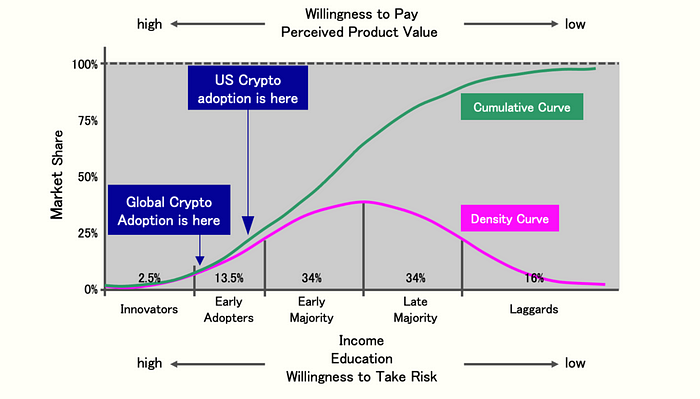

Breadth: Crypto.com estimates that there are 221m global crypto users as of July 2021. Dividing this number by the global population of 7.9b implies that global crypto adoption is 2.8%, or roughly similar to global internet adoption in 1998.

NORC estimates that 13% of 330m Americans are crypto users as of July 2021. This would imply that the US crypto adoption rate currently is similar to the internet adoption rate of 1996.

The US has one of the fastest levels of crypto adoption in the world, and it’s showing no signs of slowing down.

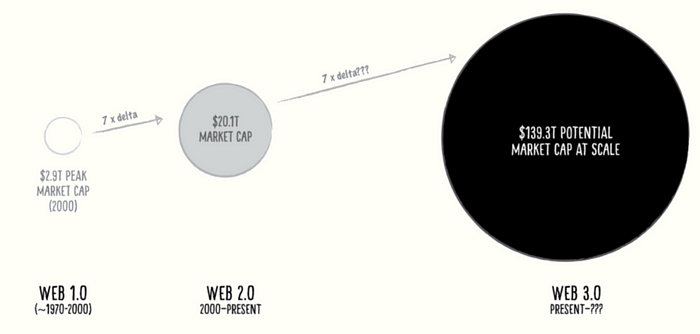

Depth: The depth of engagement can be measured by the wallet and transaction activity as we covered in the last post. M13 Capital estimates the market capitalization of Web 3 to have the potential of $130t+, roughly five times the size of the Web 2 ecosystem.

Thanks for reading!

If you have any suggestions on edits or more content we should cover, please reach out to us at matt@rippleventures.com and dom@rippleventures.com