SoftBank may cut its startup investments this fiscal year (FY 2023) by more than half, chief executive Masayoshi Son said on an earnings call Thursday, the latest high-profile investor to become vocally cautious about opportunities in the private markets amid a global slowdown.

The move follows a bleak year of performance by the Japanese conglomerate, which reported a record loss of $20.5 billion at its Vision Fund unit for the year ending March 31. The firm had posted a record quarterly profit a year ago.

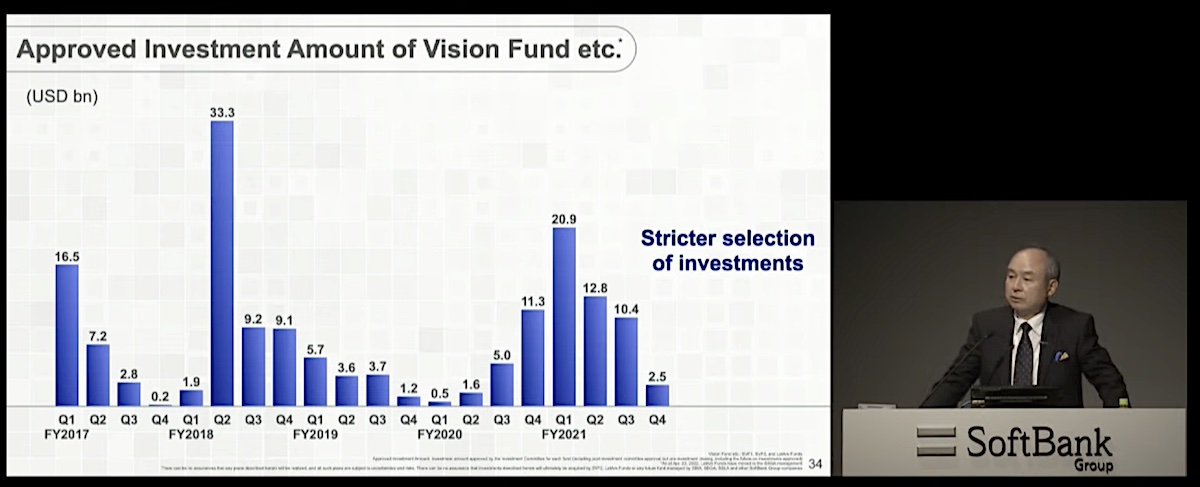

“It depends on our LTV levels and investment opportunities, and we strike balance, but I will say compared to last year, the amount of new investments will be half or could be as small as a quarter,” said Son, according to a company translator.

Image Credits: SoftBank

SoftBank, the world’s largest and one of the most influential investors, joins a list of investors including Tiger Global, Coatue and Dragoneer that have slowed down the pace of their investments — as well as the amount of capital they contribute — in startups this year.

The firm, which has expanded its aggressive bets in emerging markets like India in recent years, has been on the “safe driving” mode in recent months, a factor Son said has helped it improve its financial position. The firm deployed over $3 billion in India last year, for instance, and had planned to invest up to $5 billion in the country this year.

In the quarter that ended in March this year, the firm invested just $2.5 billion, significantly lower than the capital it deployed in several previous quarters. “When it rains, you open an umbrella,” he said on the earnings call.

Contributing to the record loss are several companies, including Chinese ride-hailing giant Didi, South Korean e-commerce Coupang and Chinese online property firm KE.