Why Does Web3 Matter? (Part 3 of 7)

0xIntro

We don’t need to repeat why crypto and web3 are going to be at the forefront of the next generation’s companies. We believe in it, and text our frens “gm” and “wagmi” every morning. We’ll cut the bullsh*t and get straight to the point.

It’s hard for the average person to understand what this noise is all about, so we took the initiative to write up a series of posts that dive into what’s actually inside the rabbit hole.

If you don’t know us already, Ripple Ventures is an early-stage venture fund looking to back extraordinary founders building market-shifting software tools. We’re focused on anything enterprise, creator, and developer-focused in web2 and web3.

This is the third of a seven-part series covering:

- What is Web 1, 2, 3?

- The Benefits and Drawbacks of Web 2

- Why Does Web 3 Matter?

- What’s the Metaverse?

- State of the Crypto Market & Ecosystem

- Web 3 Leading Indicators

- Web 3 Dictionary Resource

Up Next…

Next week, we’ll be launching our next post covering What’s the Metaverse??

Follow our Medium account and subscribe to our Substack to see it first!

Get in touch!

If you’re a founder building in this space and want to connect, please reach out to us using this link!

Value Proposition of Web 3

Here, we’ll dive into the three core value propositions of Web3 which are interoperability, low barriers to entry, and decentralization.

Interoperability

If you wanted to switch from Spotify to Apple Music or vice versa, it would be a pain because you would have to remake all of your playlists, listening history, liked songs, and more. Data within applications is centralized and siloed, built with the purpose of locking users in. The lack of interoperability between the Web 2 music streaming services makes it annoying and difficult for a consumer to switch.

We’re excited about Web 3 applications because they are much more interoperable, meaning that as a user you can switch between different applications with ease. This is driven by the decentralized nature of storing, exchanging, and programming property rights for things like currencies, assets, and identity.

However, if you wanted to switch from Uniswap (a decentralized Web 3 exchange — DEX), then you could do so easily since Web 3 services are interoperable. You could switch to Amber, Sushiswap, Bottle Pay, or any other Web 3 DEX and have all of your information transferred over with ease. This is because everything is tied to your wallet address. Think of it as an email but with an associated public transaction trail and all of your assets plugged in. Gone are the days of going through a KYC/AML process and a lengthy fintech app onboarding flow. All you need to do is simply plug in your wallet address and you’re good to go!

Low Barriers to Entry

Developers have a much lower barrier to entry when creating a Web 3 application because data is being shared at the protocol level.

“Protocols are basic sets of rules that allow data to be shared between computers. For cryptocurrencies, they establish the structure of the blockchain — the distributed database that allows digital money to be securely exchanged on the internet” — Coinbase (Source)

Some of the most common protocols used today are in financial and trading use cases. Think of things like asset derivatives, yields, and lending. You’ve probably heard of something called DeFi (decentralized finance) before, and most of the protocols in this space enable that to happen.

Since protocols are open and transparent, any new developer will have access to the same information. This is in stark contrast to Web 2 where the large tech companies have siloed data with much higher barriers to entry. Since all data is being aggregated and kept in silos at the application layer for Web 2, barriers to entry are higher for new product creation in the long run.

Further, developers are also able to self-finance projects by leveraging future speculation of the success or failure of the project. Developers can supercharge the innovation cycle by creating a project token, bypassing the need for traditional venture capital or debt financing. We’ve even seen DAOs (decentralized autonomous organizations) raise capital to finance projects and innovations in this space. The pace of development in this industry is performing at an unprecedented pace due to some originally Web 2-focused tools expanding into Web 3 like Vercel (frontend development).

Decentralization

Since Web 3 uses blockchain, data and computing power is not centralized like it is in Web 2. This means that there is no central point of failure and that there could be anywhere from 10 to 10 million individual computers validating transactions, storing data, or providing computing power to back the applications happening on Web 3.

Further, there is no central decision making party for Web 3 applications (most of the time), which means changes to the rules of an application are voted upon with governance tokens allowing for community based decision making — rather than a centralized authority changing the rules. We explore why this is so important in our previous blog post here.

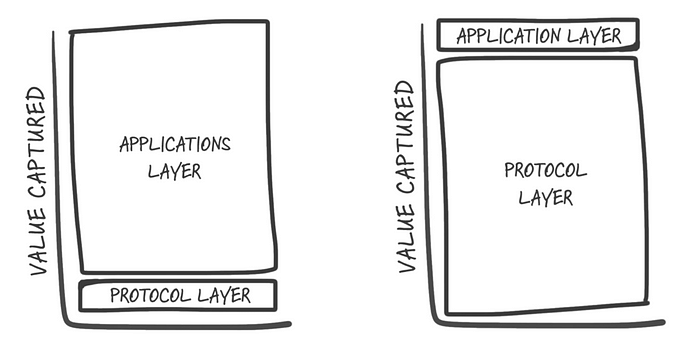

The left diagram showcases Web 2 — a small protocol layer with a fat application layer where large companies aggregate and store data in silos to stifle competition. The right diagram shows how Web 3 will create lower barriers to entry for developers. The protocol layer is much larger and the application layer is smaller — this means that the data is aggregated in an open and transparent way for all developers at the protocol layer.

Will Web 3 phase out popular Web 2 applications?

Traditionally, it has been very hard for decentralized networks to gain momentum because it would be difficult to incentivize thousands of strangers to maintain and build out a shared ecosystem. This is because Web 3 companies have been typically operating without a central authority to control decisions, capture data, and earn profits. There have been some comparisons on Web 3 development and DAOs to democratic governments moving slower than others. We’re still in the early days to add in a lot of infrastructure and governance tooling, but this is definitely a risk to mass adoption in the short term.

However, token economics and protocols have changed that and have been the main driver in allowing decentralized networks to coordinate, pool together resources, build, and maintain a shared ecosystem. Token economics and protocols enable decentralized networks to work because, despite no centralized authority, it creates an economic incentive for users and developers to grow an ecosystem.

Thanks for reading!

If you have any suggestions on edits or more content we should cover, please reach out to us at matt@rippleventures.com and dom@rippleventures.com