Oil may be near its peak if historical patterns hold true, CNBC's Jim Cramer said Tuesday.

The commodity climbed to new multi-year highs Tuesday amid supply shortages and strong demand. Brent crude futures settled above $86 and U.S. benchmark West Texas Intermediate crude futures settled above $84, each the highest since 2014.

"There's a widespread sense that inflation will continue endlessly, that the oil move is unstoppable," Cramer said. "However, some of the smartest people I know are already seeing signs that crude could be nearing a top. They think this oil rally could be on its last legs."

The "Mad Money" host turned to chart analyst Larry Williams for clues about oil's potential top.

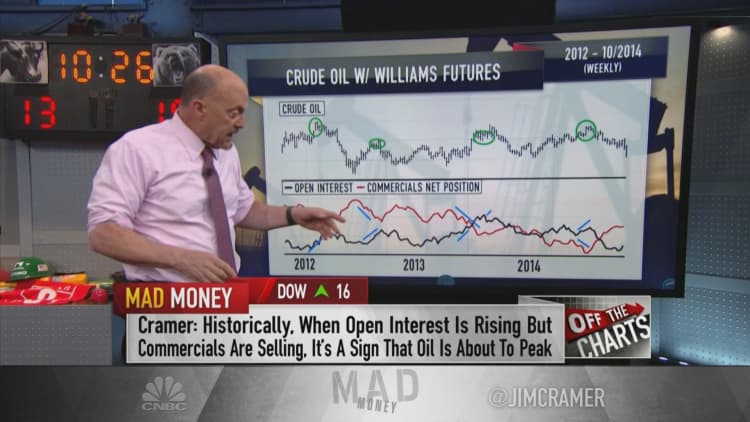

Williams tracked open interest in the oil futures, the total number of outstanding futures contracts. Then, Williams looked at the net long or short position of commercial hedgers, or companies that take futures positions in commodities in order to lock in the prices at which they buy raw materials or sell products.

When open interest rises but commercial hedgers are lighting their load, that signals oil is close to a peak, according to Williams. It means more contracts are being opened, but new buyers are probably speculators rather than players involved in the industry.

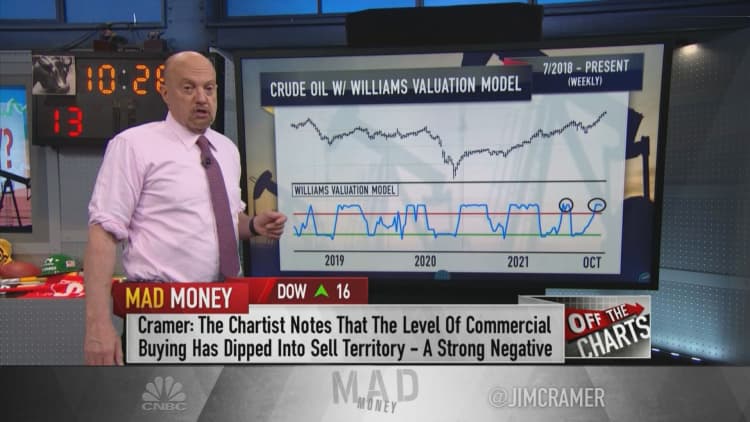

That pattern happened throughout 2012 and 2014 when oil prices peaked — and appears on track in 2021.

"When it comes to the price of crude, the commercial hedgers are unloading their positions while speculation keeps ramping up, and according to Williams' various proprietary indicators, oil's gotten overbought, and pretty much every pattern he can come up with suggests that we're getting close to a peak," Cramer said.

Still, Williams noted oil is continuing to trend higher and doesn't expect prices to peak immediately.

"The charts, as interpreted by Larry Williams, suggest that oil could have a lot of things going against it in the very near future," Cramer said. "If it's not quite ready to peak in the next couple of days, we'll see. But going forward, he thinks you need to be a lot more cautious about what has become the easiest trade in the book."

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com