Online beauty and grooming products marketplace Purplle has raised Rs 257.43 crore or close to $38 million in its extended Series D round from Sequoia Capital and others.

The Mumbai-based company had recently raised around $106.7 million in this round from the likes of Kedaara Capital and Premji Invest.

Purplle has approved the allotment of 5608 Series D1 preference shares at an issue price of Rs 459,041 per share to raise Rs 257.43 crore or $38 million, regulatory filings show. Sequoia has led the round, investing Rs 238 crore or $32 million via a special purpose vehicle Faces Investments Holdings. Blume and Sangeeta Pendruka have invested the remaining amount.

According to Fintrackr’s estimates, Purplle has raised the fresh funds at a valuation of around $728 million. The company was valued at $600 million during the last tranche in November, last year.

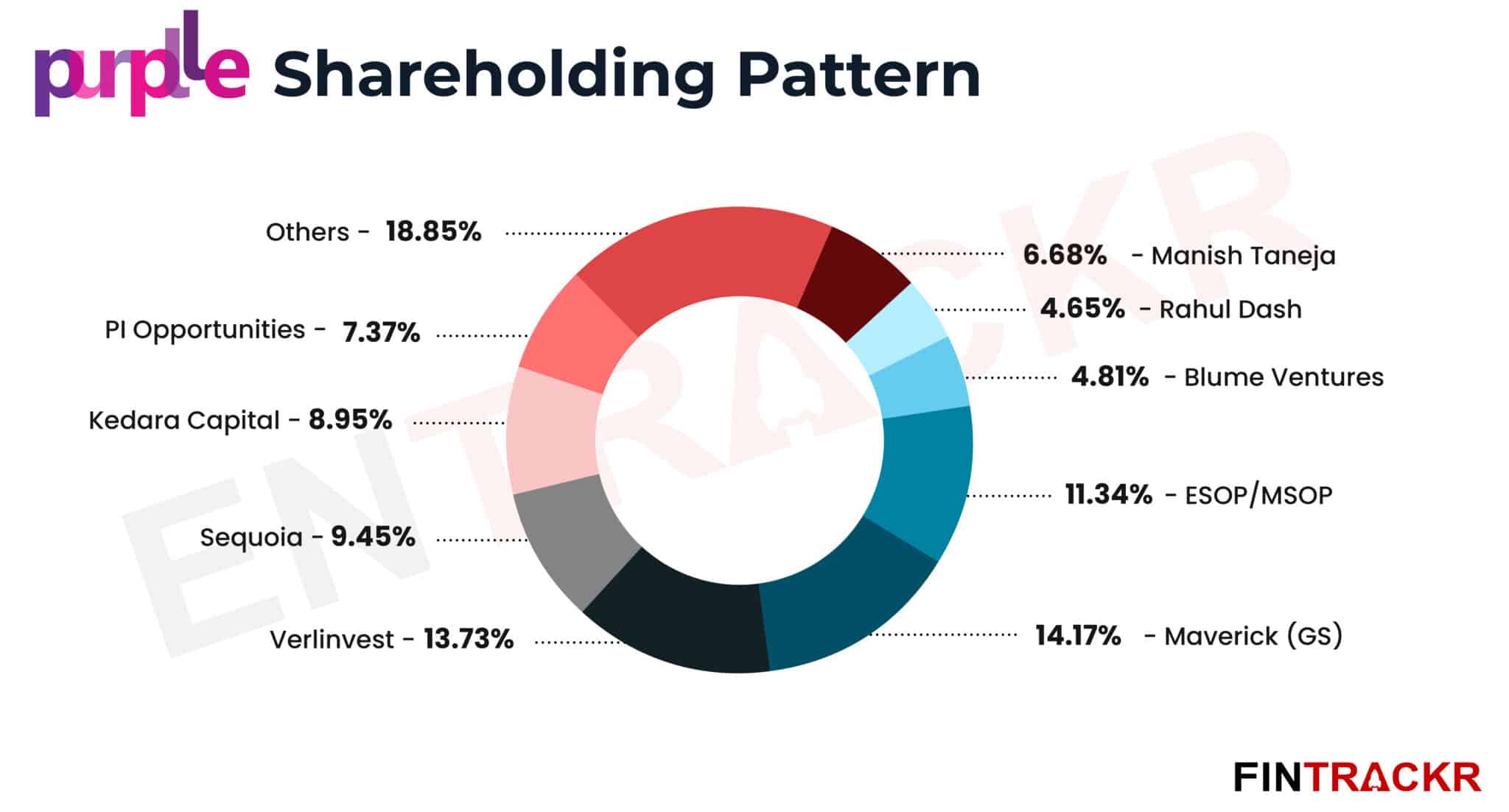

Following the allotment of fresh shares, Maverick has emerged as the largest stakeholder in Purplle with 14.17% holding in the company. Verlinvest, Sequoia and Kedaara Capital have 13.73%, 9.45% and 8.95% stake respectively. Founders Manish Taneja and Rahul Dash collectively owned a little over 11% of the company.

Purplle is the second-highest valued startup in this category after Nykaa. The company’s direct competitor had a spectacular stock market debut last year. It also competes with other horizontal majors such as Amazon and Flipkart. The company sells beauty, personal care products and gadgets for grooming.

Besides aggregating products of different brands, it sells its private labels on the platform.

Last year, the Manish Taneja-led company also made two investments in the beauty space. It had acquired a minority stake in D2C beauty brand Juicy Chemistry followed by the complete acquisition of another D2C cosmetics brand Faces Canada.

As part of the regulatory filings, Purplle has also disclosed its financial position for the fiscal year ended in March 2021. The company’s annual losses grew 2.08X to Rs 51.3 crore as compared to Rs 24.7 crore in FY20.