The market for crypto-focused investing is growing rapidly. News that Paradigm put together a $2.5 billion fund the other day is a reminder of the scale of funds now available to startups looking to build on the blockchain. Andreessen Horowitz has a mega-fund in the market as well, while Coinbase Ventures is setting a blistering pace for a corporate venture firm.

The result of the run-up in capital availability has led to, as in many other venture markets, larger and more rapid-fire rounds — and more unicorns.

While the now-dated unicorn valuation threshold of $1 billion is losing some of its salience in a market where there are hundreds of unicorns globally, inside a single niche the metric can still prove useful. The crypto market is one such place.

The Block, a crypto-focused publication and research operation, has a new data collection out this morning that highlights just how rapidly the unicorn cohort is expanding in the crypto space. The data set also details where unicorns are being formed, in both focus terms — exchanges, NFT platforms, etc. — and geographically.

Key takeaways today are that the United States, despite certain domestic complaints that it is hostile to the crypto economy, is by far the dominant single market for crypto unicorn creation, and that the business-model mix of crypto unicorns is broader than I anticipated. Let’s dig in!

Money

It’s the perfect moment to discuss crypto unicorns, and not because Paradigm just secured billions to invest. Furthermore, rumor is out that OpenSea, an NFT platform, is considering raising capital at a $10 billion valuation. The company was last valued at $1.5 billion earlier this year. That’s the sort of valuation appreciation that some crypto startups are enjoying today.

The result? There are now 64 total crypto unicorns. And, per The Block Research, that figure has grown by 39 so far in 2021. Simply: More than half of the global crypto unicorns reached the $1 billion threshold this year alone.

There are a few reasons why. Crypto trading has proven to be nearly comedically lucrative, leading to a number of exchanges raising what we might describe as hella bank. But more than that, crypto assets themselves have proven to be profitable trades to host. NFT marketplaces are minting cash, adding more unicorns to the tally.

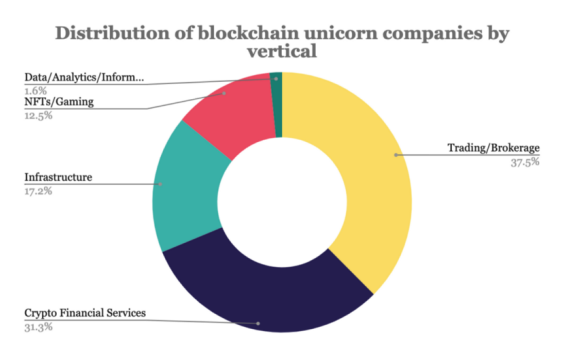

Here’s The Block’s breakdown of today’s crypto unicorn model makeup:

Image Credits: The Block Research

I would have anticipated that crypto infra projects (Consensys, Alchemy, Blockstream, etc.) would have had a higher portion of the unicorn tally. But crypto financial services (Circle, Coinlist, Ripple, etc.) managed nearly double that share. That’s notable.

The NFT and gaming portion of the list is also a bigger chunk than we expected. But thinking about the names we’ve covered in that subvertical like Dapper and OpenSea and SoRare should have given us an indication of how active it has proven.

Geography

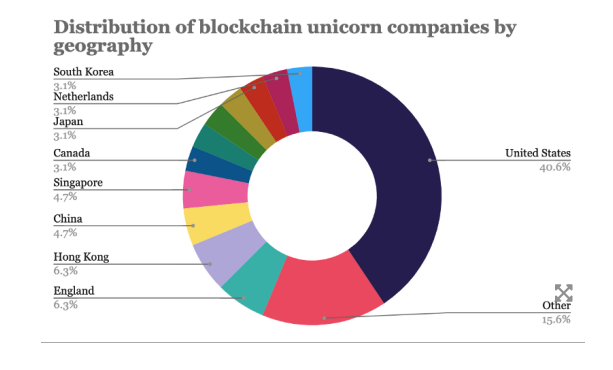

The geographic breakdown of crypto unicorns is the most interesting nugget from The Block’s larger report.

Observe:

Image Credits: The Block Research

Reading that chart, our takeaway is that no single market — or even region — can compete with the United States’ market share. If we aggregate unicorn share from South Korea, Hong Kong, Singapore, Japan and China, it comes out to just under 22% of the whole, or roughly half of what the United States has managed on its own in terms of being the breeding ground for crypto unicorns.

So much for the U.S. having an environment antithetical to innovation or losing the crypto race to China.

There are some caveats to take into account. Coinbase Ventures, The Block notes, has the most crypto unicorns in its portfolio of any single venture investor. Indeed, the leading investors in crypto unicorns appear to share a U.S. domicile. Given that the most active funds in crypto appear to be American, it’s not that huge a shock that companies based in the same geography are doing as well as they are.

All told, the crypto economy is more mature than we expected. And that means more dollars are flowing through its leading companies than we anticipated. A little something to chew on this weekend.