Ether could soon be the world’s first deflationary crypto, not Bitcoin

Ethereum’s native crypto Ether (ETH) is likely a better store of value than Bitcoin due to its new deflationary blocks, according to a report from a group of Australia-based academics.

A collaboration between brainiacs from the University of Technology Sydney, Macquarie University, the University of Western Australia, and the University of Sydney, suggest that Ethereum’s advantage is all down to the recent EIP-1559 upgrade.

ETH was historically minted at a fixed rate — around 2 ETH per block — which amounted to a yearly inflation rate of around 4%.

EIP-1559 changed that. It significantly slowed the ETH supply and forced some transaction fees to be burned, rather than distributed to miners.

This, combined with effectively unlimited supply, could lead to Ether becoming permanently deflationary.

“Unlike Central banks, cryptocurrencies can easily adjust their inflation rate with simple changes to code,” said the researchers.

“Bitcoin, with a finite eventual supply of tokens, is increasingly gaining acceptance as an alternative long-term digital store of value with similar anti-inflationary characteristics to gold.”

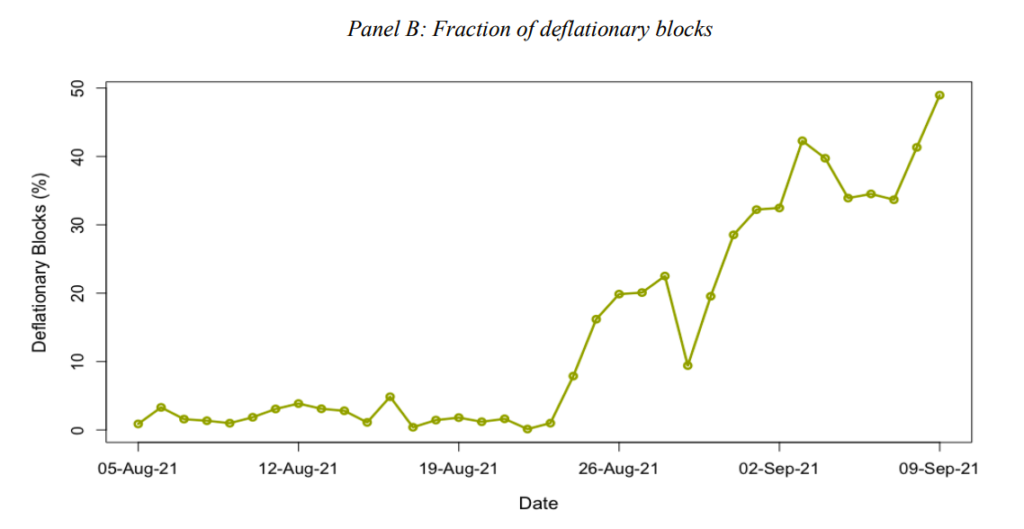

They explained that up to half of Ethereum’s blocks are destroying more ETH than is created.

This puts the claim that Bitcoin offers the best inflation hedge across the crypto markets under threat, they said.

Ether deflation discourages miners from gouging users

EIP-1559 has two sets of fees: a ‘base fee’ that users pay for the right to be in the next block, and an optional ‘priority fee,’ which encourages miners to include their transaction in the next block.

By automatically burning the base fee as miners receive the priority fee, the network discourages miners from purposefully causing congestion on the network to keep fees as high as possible.

The report claims shrinking ETH’s supply over time helps it chip away Bitcoin’s advantage as an inflationary hedge (by way of its fixed supply and slowing issuances).

Read more: [Ethereum is making the same mistakes as the Bitcoin hard fork attempts]

“The anti-inflationary properties of gold have for decades offered investors a stable long-term store of value,” said the researchers. “The limited issuance and hard supply cap of Bitcoin is increasingly seen as an attractive alternative digital option with similar attributes …”

Bitcoin’s properties are considered anti-inflationary until it reaches its supply cap sometime in the early-to-mid 22nd century. BTC itself is not totally deflationary in its current form.

Bloomberg recently reported analyst findings that showed Bitcoin offered 99.996% deflation (“in other words, what cost one [BTC] 10 years ago would now cost 0.004 [sats],” wrote Bloomberg).

Wall Street mainstay JP Morgan this week shared a note with its clients that claimed Bitcoin was the new inflation hedge, choosing the top crypto over gold (although some analysts have suggested BTC trades more like a risk asset than an inflation hedge).

Read more: [Ethereum 2.0 can be disrupted with small crypto stake, researchers find]

“However, we show that following the recent change in its transactions protocol, [Ether] displays a significantly lower net issuance rate of tokens than Bitcoin, achieved by destroying the fees associated with each transaction,” said the academics.

And considering the number of Ether blocks that are now deflationary (about half), ETH is potentially on its way to becoming the world’s first deflationary currency, they said.

“We argue that this provides better inflationary hedging properties than Bitcoin, and Ether may therefore offer a superior long-term value storage than Bitcoin.”

Looking for bite-sized news? We’re on Twitter.