Huang Qing, the Shanghai-based creative director of athleisure label Voice of Insiders, meticulously accounts for each design choice. His high-tech garments are cut from material woven with seaweed fiber and colorfast nylon spun with marine collagen. Then, after an item is shipped, that’s likely the last time he’ll see it — even if it is returned. “It’s too frustrating to bring it back [to China], too much back-and-forth,” he told Rest of World.

Huang, a niche designer, faces the same dilemma as thousands of Chinese clothing suppliers who sell on marketplaces like Amazon or via an ultra-fast-fashion giant like Shein. Four Chinese manufacturers told Rest of World that they are left scrambling to dispose of the garments however they can, often allowing online shoppers in the U.S. to keep clothes they’re trying to return as a cost-saving measure — and to avoid a logistical nightmare.

Some said they meet in WeChat groups to share tips on where to move items. Others said they directly returned and unsold items in bulk to markets in Africa through a trader or request they be destroyed. For Huang, unless the product is a bestseller, he considers most returned items dead stock. Added pandemic-related supply chain issues — soaring freight rates, worker shortages, and lengthened shipping times — have ensured that other options aren’t worth the time and expense they require.

As online buying ballooned during the pandemic, so did returns. In the U.S. alone, returns during 2021 of fast-fashion clothing jumped by 22% from the year before, according to the retail analytics firm Edited, which tracks over 4 billion distinct items for sales across 140,000 retailers. Shipping costs often exceed the value of the ultra-low-priced garments, with the cost of some routes up more than seven times early pandemic levels in 2021. Tax exemptions and bulk shipping, which ease the journey for garments moving into the U.S., disappear when the time comes to receiving returns.

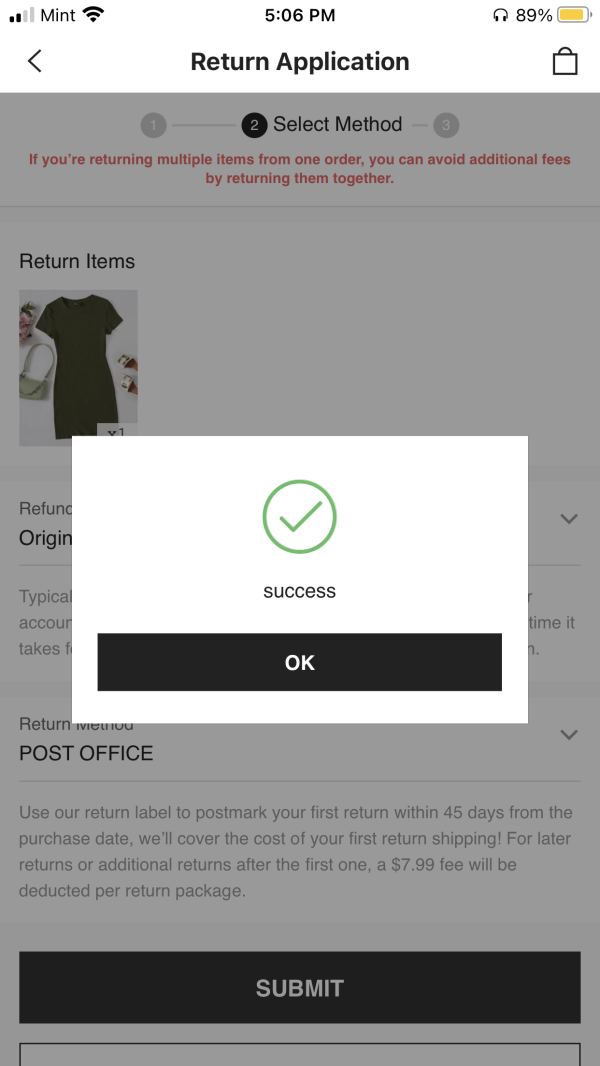

For shoppers, returns via a giant e-commerce retailer app like Shein’s, making a return is a simple process. In the Shein app, there are a dozen options to choose from in order to explain the reason for a return — “don’t like it,” “ordered wrong,” “arrived damaged” — and a further handful of options to describe exactly which ways an item doesn’t fit. Once the return is approved, the company issues shoppers a printable shipping label. That’s the end of the headache for shoppers, analysts say.

“The fashion industry, for a long time, has been able to hide from the right hand what the left hand is doing,” said Elizabeth Shobert, vice president of marketing and digital strategy at e-commerce analytics firm StyleSage, referring to the asynchronous processes of sales and returns. “The pileup in the supply chain in the last six months or so has really brought this to light.”

To examine supply chain limitations, Rest of World spoke with manufacturers in China, including a supplier for Shein and the head of the largest organization of Amazon manufacturers in the industrial province of Fujian, visited a clothing market in Nigeria, and tracked Shein returns from the U.S. Through the course of reporting this story, a reporter purchased and returned four items from Shein, while using Apple AirTags to track the returned garments’ journey.

The first garment, a trendily cropped, scoop-neck black cardigan ($14.86), was refunded within five hours of initiating the return in Shein’s app by the customer service arm in Hong Kong, which told the reporter to keep the clothing. The second, an army-green minidress ($9.36), made it to the returns stage: instructions in the Shein app directed it be mailed to an address outside of Newark, New Jersey. Rest of World used the AirTags to track the progress of the third and fourth items, the third a muted coffee-brown knit with raglan sleeves ($19.99), and the fourth a ribbed cotton dress ($9), through the returns process.

Refunds for the three items were issued as soon as the items were scanned into a New Jersey warehouse, which shares an address with a Chinese furniture company called Loye. (A Shein spokesperson said in an email that the company did not own the New Jersey warehouse or have any relationship with the furniture company but does operate a warehouse in Los Angeles.)

Over the month of January, the two items with AirTags attached sat for approximately two weeks at the New Jersey warehouse before making their way by vehicle through the U.S. Postal Service to suburbs of California and Florida respectively. Both appeared to be at residential addresses — the last received signal before the AirTag pings disappeared. The spokesperson for Shein did not directly answer written questions around whether returns in the U.S. were resold to new customers in the country.

According to Shobert, returns cost retailers about two-thirds of an item’s original selling price. That means the $20 sweater purchased by Rest of World could cost a company $13 to take back.

“They have basically built their profit model — that if they have to throw away all that’s unsold, it’s calculated into their model,” explained Juliana Prather, chief marketing officer at Edited.

American consumer spending through the holiday season at Shein alone increased nearly fivefold since 2019. By mid-2021, the Chinese fashion app had almost surpassed Zara and H&M combined to account for the largest share of the American fast-fashion market. “So on one hand, that creates incredible power but [also] incredible focus on getting [products] out there,” Prather said.

The spokesperson for Shein did not answer a question about whether unsold stock was calculated in the company’s profit model, saying in a written response that they do not disclose “proprietary business data.” They also declined to share what percentage of the company’s orders are returned. Without specifying the amount of stock, the spokesperson told Rest of World, “Many returned items that cannot be restocked are donated to local charities” or sold to a wholesaler.

Left with bales of clothing, manufacturing companies headquartered in China coordinate bulk shipments of garments from the U.S. and China to destinations in Latin America, Africa, and Southeast Asia, a Rest of World analysis found via company listings on Alibaba, the Chinese e-commerce platform. Two Guangzhou-based suppliers told Rest of World that they resell a combination of unsold inventory and defective items. When Rest of World pressed the two Chinese traders for details on the international shipments they coordinate, both cut off communication, and one took down its Alibaba page altogether.

"They have basically built their profit model that if they have to throw away all that’s unsold, it’s calculated into their model."

In Lagos, Nigeria, a seller at the busy Katangowa flea market showed Rest of World denim garments from China hanging in his stall, and others he identified as returned clothes from the U.S.

“These are mostly European secondhand clothes and Chinese factory rejects,” said Ernest Okeke, who runs a clothing stall in the market. “Some are returned from Europe and America.”

Colorful bales of clothing arrive by the hundreds weekly at Apapa Wharf at the Port of Lagos in Nigeria, home to the country’s two biggest seaports. WhatsApp group chats, populated by these traders and local Nigerian sellers of all kinds, sell items ranging from children’s clothes to branded running shoes.

Once garments are returned to a factory, China-based traders step in and buy them to shift on to the Nigerian market, he said. “The factories even sell these clothes to traders on credit because they want to dispose of them quickly,” he said. When some clothes stay too long in the stall, Okeke and other traders team up with the dozens of tailors in the market to refashion them into a new design or recut them into baby clothes, for example.

Okeke himself normally spends a few weeks each year shuttling from Lagos to Guangzhou, China, acquiring and shipping denim pants and shirts back to his home country. During the pandemic, the Chinese government limited travel by Nigerian traders to China, leaving him to rely on shipping.

There were more than 1,600 listings for Shein suppliers on Alibaba at the end of January, and ten of the first 30 listings also advertise as sellers of used, secondhand, or bulk wholesale clothing. Some of the pages offer to ship Shein goods in bulk, while others include photos of piled, Shein-branded plastic bags. Shein told Rest of World that the company’s suppliers are not authorized to sell Shein products for any purposes aside from fulfilling Shein orders. “Shein only orders what it can sell,” the spokesperson wrote in an email. “We prohibit suppliers from selling oversupply, to prevent the production of counterfeit material, of which all overstock is.”

Many Chinese sellers have set up private WeChat groups. In these group chats, they ask if retailers want to buy unsold items in bulk, or if anyone has a contact for warehouses, at times in places as far as Italy or Mexico. Ada, a manufacturer in Zhejiang who produces homewares, handbags, and pet clothing for sale outside of China on Amazon, joined these groups in early 2021. She asked to be identified by her English first name, out of concern over Amazon’s scrutiny of Chinese third-party sellers.

Retailers who sell on Amazon can choose to have the e-commerce behemoth manage their logistics with their in-house team. “There’s a setting where you can choose to have all of your returned inventory destroyed,” said Ada. She chooses this option most frequently. Another alternative is to have the Amazon warehouse evaluate the item’s resale potential, but she would have to pay Amazon for storage space for those items until they resold.

In an effort to avoid destroying returned items or sending them to landfills, some U.S. retailers turn to companies that specialize in reverse supply chain management by returning goods from shoppers to sellers.

For a fee, these companies offer to optimize the money-losing headache of returns. Adam Vitarello, co-founder of Optoro, which manages returns for companies such as Target and American Eagle, says his company’s U.S.-based clients restock 90% of their returns, and most of the rest, which Optoro tracks through its platform’s reuse rate, is diverted to secondary channels like eBay, leaving about 4% headed to the landfill.

But they rely also on the same overloaded infrastructure that the rest of the e-commerce global supply chain runs through once a sale is made. One of Optoro’s logistics partners is UPS, which hired nearly 100,000 new workers during the holiday season to keep up with high online shopping volumes. Rest of World’s AirTagged returns appeared to travel via the U.S. Postal Service, which has experienced unprecedented delays during the pandemic, due to high volumes, worker shortages, and increased labor costs. Shein confirmed that the U.S. Postal Service is among its own logistics partners.

As the pandemic drags on, the strain on shipping and labor capacity is only heightening: Huang said he expects his shipping costs to increase by upward of 20% in 2022. He said that he knows there are other clothing makers who destroy their unsold and returned inventory but also said, “No matter what, we will try our best to use the value of these clothes until the end.” Even if he can recoup just a small amount, it’s better than sending them to the landfill, he added.

Huang had explored a business relationship to recycle his returns with FirstMile, an American e-commerce shipping and fulfillment organization, but the fees were too high — nearly $200,000 a year. Despite having a comfortable profit margin, he still doesn’t know if he has enough goods to justify the costs. “Even though I thought this [idea] was beautiful,” said Huang, “we decided not to go through with it.”