Jesse Walden

Product vs. Protocol: Finding a Balance in Web3

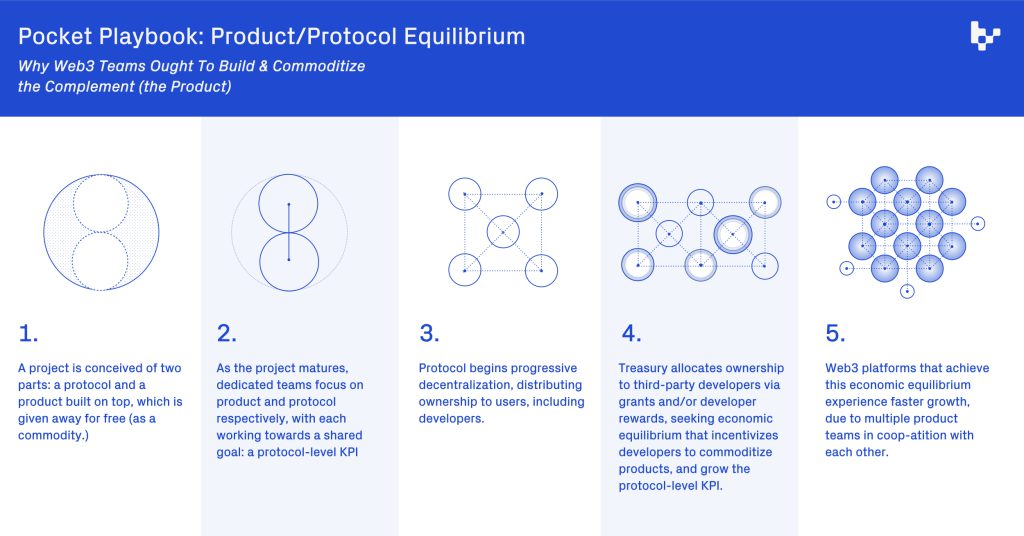

Why Web3 projects should commoditize the complement (the product)

Nearly twenty years ago, Joel Spolsky coined a phrase that informed the decision-making of countless startups and tech giants: “commoditize the complement.”

In general, a company’s strategic interest is going to be to get the price of their complements as low as possible. The lowest theoretically sustainable price would be the “commodity price” — the price that arises when you have a bunch of competitors offering indistinguishable goods. So: Smart companies try to commoditize their products’ complements. If you can do this, demand for your product will increase and you will be able to charge more and make more.

Companies selling cars, cereal, and printers benefit when prices decrease for gasoline, milk, and ink, because the total price of a product includes the product plus anything else you need to maximize its potential–the complement. When the cost of complements decreases, the core product becomes overall more affordable. As affordability improves, so do sales — and with increased sales, pricing power leverage over the complements increases — a virtuous cycle. The biggest fans of virtually free ink would be Canon and HP, which would see their products become effectively cheaper to use without having to lower prices.

Web3 teams have an opportunity to learn from and improve on the strategy of commoditizing the complement. In this essay, we’ll discuss why building and commoditizing a product on top of a user-owned protocol offers maximum leverage to execute this strategy, with potential for stronger economic equilibriums that drive growth, and value, beyond that of earlier implementations executed by legacy tech companies.

Let’s start with some historical examples.

Licensing, Co-opting, and Walled Gardens

In hardware, perhaps the most famous example of “commoditizing the complement” was Microsoft’s strategy of fostering competition among PC hardware manufacturers by licensing Windows, its popular operating system, to anybody who could pay. Doing so weakened the market position of hardware manufacturers by encouraging cut-throat competition within the PC industry. By reducing the total cost of buying a desktop computer, Microsoft eliminated IBM as a hegemonic threat, increased the addressable market for PCs, and in turn increased demand for Windows, which compounded their pricing power.

In software, corporate embrace of open source projects has inhibited startups’ ability to develop profitable and threatening businesses at that layer, while also encouraging the use of proprietary services that further extend the tech giants’ advantage. Google licensing TensorFlow — its machine learning engine that cost millions of dollars to develop — killed would-be competitors building general machine-learning frameworks and increased the number of developers using and improving the TensorFlow software, driving demand for TensorFlow Enterprise on Google Cloud.

In the Web2 era, platforms like Twitter and Facebook ran powerful but temporary versions of the “commoditize the complement” strategy early in their growth phase. By giving away their products and APIs for free, the platforms were able to attract invaluable social graphs and user data, which in turn helped attract an ecosystem of third-party developers that built products to reach those users and extend the platform’s functionality. But there was a catch: After commoditizing the API as a way to drive growth, social networks shut off the valve and turned their platforms into proprietary walled gardens to capture more of the value therein. This put them in zero-sum conflict with third-party developers and often, their users, by eroding their choice.

Web3 protocols have an opportunity to do things differently, owing to the fact that they can distribute tokens to turn their users into owners, empowering them to govern the platform in alignment with their continued interests.

Bootstrapping Through Commoditizing in Web3

The first and largest “user” of a Web3 platform — defined as a software service running on an open blockchain (and often called a “protocol” in Web3 parlance) — is usually the product team that built the underlying platform. Web3 teams building these platforms are wise to build the first product on top and give it away for “free,” as a commodity, in order to bootstrap users, data, and network effects.

An example is Uniswap: Uniswap Labs, the company, built app.uniswap.org, the first and primary interface to the Uniswap Protocol, which is open and runs on the Ethereum blockchain. Compound Labs, also a company, did the same for the Compound money-market protocol. Making these early DeFi protocols accessible via an intuitive, user-friendly front-end was critical to bootstrapping liquidity in each respective marketplace platform—and once liquidity poured in, so too did network effects wherein the pricing of the product got better for each additional user. A growing user base, coupled with solid developer documentation, greased the wheels for third-party devs to integrate the underlying protocols to new products and services. For example, Metamask includes token swaps directly in their Ethereum wallet, where the liquidity is sourced directly from Uniswap. Critically, Metamask could do this without asking for permission, and without fear of the API getting yanked from underneath as was common in Web2, because the Uniswap protocol and all its data runs on a public blockchain, and is owned by users.

So to recap: Making the complement (the Uniswap trading app) accessible at zero cost is a way to maximize benefit to end-users, whose usage mobilizes the network effects of the underlying platform (Uniswap Protocol). These network effects bootstrapped by the commoditized product can help to attract third-party developers, who build more functionality, attracting more users and usage, compounding those network effects. Finally, a distribution of ownership of the underlying platform — in the form of tokens — can be distributed to those driving the value, typically users and developers.

Web3 companies, in other words, can commoditize the complement — but not as a means of draining profits and position from a potential competitor, as in Web2, but as a practical means of furthering sustainable innovation.

This practice of progressive decentralization aligns all parties’ incentives around growing value in the underlying platform or protocol — and puts teams that earn tokens for their contribution in a position to commoditize the complement, their own product, in order to capture value in the underlying platform.

Balancing the Needs of Protocol and Product

This Web3 model of commoditizing the complement — and the accompanying structural separation of protocol from product — creates the need for an economic equilibrium, in which protocols incentivize developers to commoditize their complementary products while reaching the widest possible user-base and aligning their success with the growth of the underlying platform.

With more teams jumping into Web3, it is worth highlighting best practices that enable this equilibrium. Two steps stand out as important:

First, as a Web3 platform matures, there may be a benefit to structuring the core project development work between two teams: those focused on the underlying platform or protocol, and those building the initial product for the end-user (each might have its own distinct brand to avoid confusion).The product team learns what end-users need, and can help inform the protocol design. And as the protocol team learns what product devs require, they can consider adding features that will attract more of them.

Second, both the product and protocol team should be aligned around a singular goal: a KPI focused on protocol growth. Measuring against a protocol-level metric helps ensure the product is truly complementary, driving the intended value to the underlying protocol. With dedicated product and protocol teams aligned around a shared metric — a protocol or platform level KPI—it should be possible to measure contributions to that KPI and meritocratically distribute value of the underlying platform to the developers and users who drove it.

The initial product team, which helps to bootstrap the network effects of the underlying protocol, should be rewarded for that outsized contribution to the ecosystem. But ultimately, protocol treasuries would be wise to optimize for multiple product teams building on top, as that’s likely a way to grow the platform bigger, faster. An economic equilibrium that can achieve that end has the potential to be a tide to raise all boats.

In this equilibrium, a product that seeks to extract too much value from the protocol layer will face stiff competition from others that are commoditizing their product to capture value elsewhere. This excessive value capture would replicate, rather than reform,the Web2 model—third-party innovation would be suffocated, developers would be inclined to fork, and users would look for cheaper, more innovative alternatives.

Some early examples of protocols working toward a proper equilibrium include grants programs from large DeFi protocols like Uniswap, Compound, AAVE, et al., which reward third-party developers for ecosystem-growing products and services in their native treasury token. Liquity Protocol rewards developers who build front-ends to their stablecoin protocol with LQTY rewards pro-rata to users who deposit funds to the protocol. These front-end operators can receive a portion of these rewards by tagging deposits facilitated by their interface and specifying a percentage of LQTY rewards to split with their users. UMA Protocol tried something similar with its Developer Mining program, which encourages distributed innovation using economic incentives to reward developers who directly contribute to sustainably increasing UMA’s Total Value Locked (TVL) KPI. If you’ve built or seen other good examples, I’d love to learn about them.

Commoditizing the complement is a concept with long roots in technology strategy. Web3’s ownership economy provides us with new tools to employ it, not as a means of stifling innovation and community, but encouraging them.

To close, here’s a summary pocket playbook:

Thanks to Jonathan Glick for being a great thought partner in crystallizing the piece, and to Li Jin, Spencer Noon, and many of the builders in Variant’s portfolio and community for conversations that helped shape the ideas.