The Supply Transparency Report brings visibility to the actions of the key categories of a cryptoasset’s holders that are deemed to restrict supply from the market, as defined in the CMBI Float Adjustment Methodology. The current universe of cryptoassets that are covered in this report is reflective of those that Coin Metrics administers Free Float Supply values for, which includes: 0x, Aave, Balancer, Basic Attention Token, Bitcoin, Bitcoin Cash, Bitcoin Gold, Bitcoin SV, Cardano, Compound, Chainlink, Crypto.com Coin, Curve, DASH, Decred, Digibyte, Dogecoin, Ethereum, FTX Token, Huobi Token, Litecoin, MakerDAO, NEO, Stellar, Uniswap, XRP, Yearn and Zcash.

Note, for all of the monthly and quarterly U.S. Dollar values herein, an approximate aggregate quarterly value has been calculated by taking the net supply added or removed each day and multiplying it by that specific date’s Coin Metrics End of Day (00:00 UTC) Reference Rate.

The additional net value added to crypto markets from assets included in this report during Q4 2021 was $5.7B, up from the $2.8B that was added in Q3. The most significant reasons for this increase were:

- $1.2B of FTX Coin that was added to more free float supply, mostly flowing from Foundation controlled addresses.

- $910M of XRP that was added to circulating supply, mainly flowing from Foundation-controlled addresses.

- $970M of ether that was added to circulating supply, mainly due to higher prices over the quarter as ether hit a new all-time high price.

The largest contributors to the increase in free float value in Q4 2021 were FTX ($1.2B), ether ($970M), XRP ($910M), and bitcoin (BTC) ($600M).

The largest contractors of free float value in Q4 2021 were Uniswap (-$265M), Maker (-$90M) and Huobi Token (-$55M).

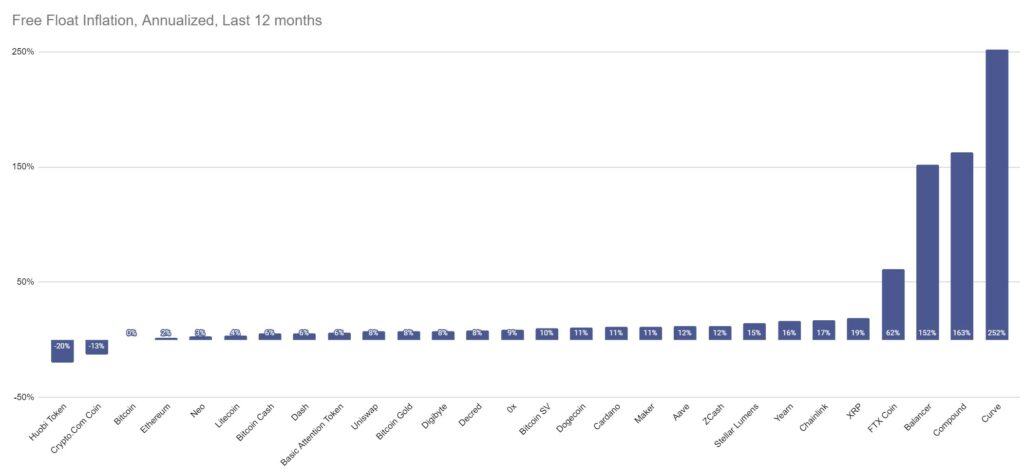

The cryptoassets with the highest free float annual inflation rate (denominated in native units) over the last year were Curve(252%), Compound (163%), Balancer (152%) and FTX Coin (62%). Over the same period, Huobi Token (-20%), Crypto.com Coin (-13%), Bitcoin (0%), Ethereum (2%) had the lowest annual inflation rate.

Note 1: Compound launched in March 2020, Balancer in July 2020 and Curve in August 2020, all with low initial floats and a liquidity mining program that contributed to their high early inflation.

Note 2: In October, Huobi Global burned 2.11M Huobi Tokens (HT)

Note 3: In February and April 2021, Crypto.com conducted two one off burns of 59.6B and 5B CRO respectively from Foundation controlled addresses.

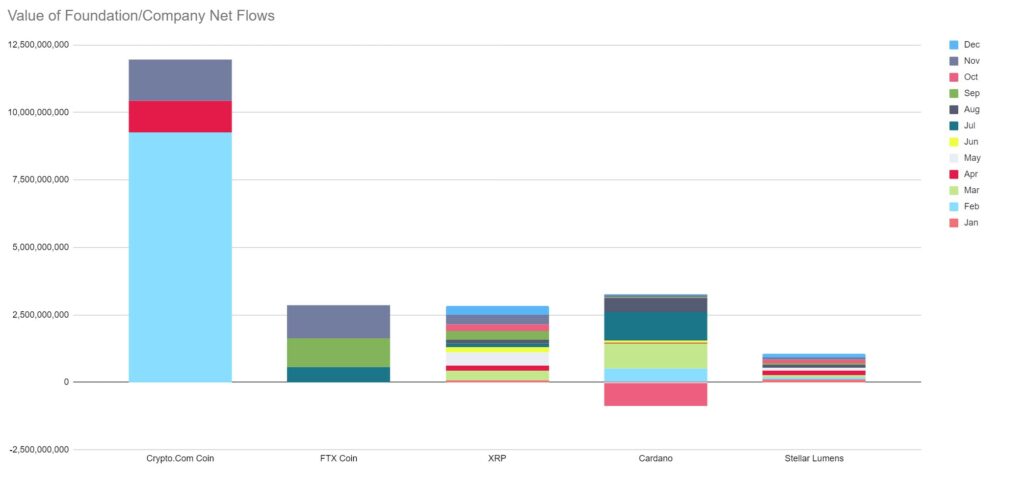

The net value of cryptoassets that moved outside of identified Foundation/Company controlled addresses was $3.7B, during Q4 2021, down from $4.7B in the previous quarter. The two largest sources of this quarter’s Foundation token movements can be attributed to:

- Crypto.com Coin Foundation who completed a token burn of $1.5B in November

- The FTX Foundation who transacted $1.2B from Foundation controlled addresses to more liquid ones, mostly in one transaction

Note: Company/Foundation asset sales can be conducted for many reasons, including but not limited to operating expenses, team member/advisor vesting, strategic long term partnership/BD, scheduled and unscheduled token burns, strategic investments and treasury management. Companies/Foundations may also behave differently, either choosing to issue large volumes infrequently or issue on an as needed basis. Further, movement of assets from Foundation/Company controlled addresses does not necessarily mean assets have been sold (e.g. distribution to team members, burns, strategic placements, community incentive programs, etc).

Note: In February 2021, the Crypto.com Foundation burned $13.3B worth of CRO

Note: In April 2021, the Crypto.com Foundation burned $1.2B worth of CRO

Note: In November 2021, the Crypto.com Foundation burned $1.6B worth of CRO

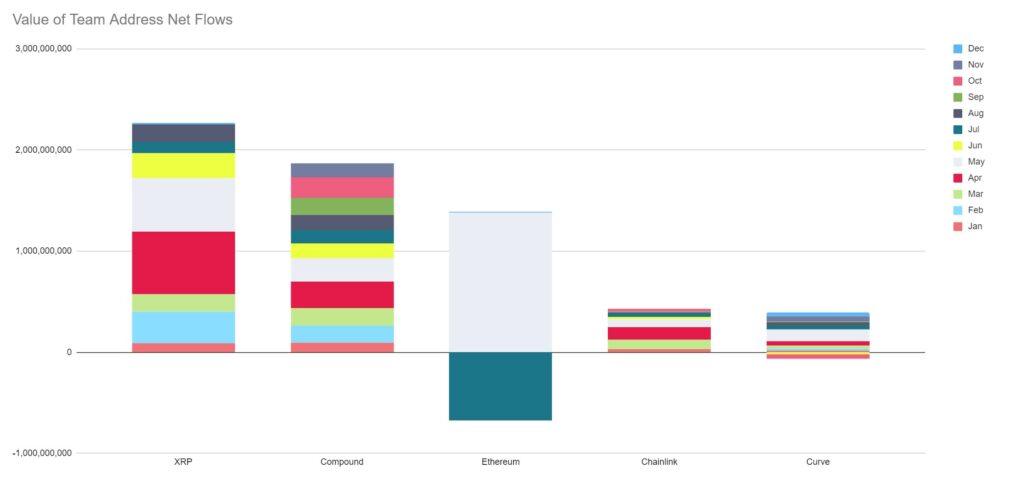

The net value of cryptoassets that moved outside of identified Company Team addresses rose in Q4 2021, from $650M to $785M. The team members that contributed most to changes in the free float supply of their assets during Q4 2021 were:

- Crypto.com Coin – where 3B CRO entered more liquid addresses, representing $600M.

- On October 26th, 2.8B CRO was aggregated from team addresses to a single address

- Chainlink – where an additional 12M LINK entered more liquid markets, representing a value of $340M.

Note: Movement out of Team controlled addresses does not necessarily mean assets have been sold, but rather can be an indication of activity (e.g. movement to passive yield generating tools such as Compound).

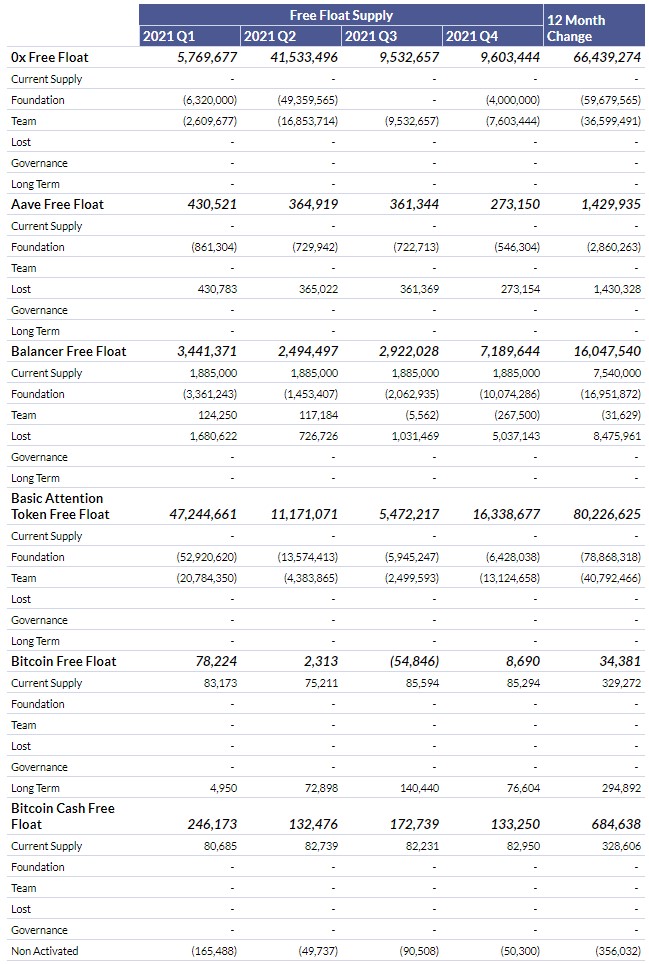

CHANGES TO FREE FLOAT SUMMARY

0x (ZRX)

During Q4 2021, the total ZRX moved from Team owned addresses was 7.6M, a decrease of 2M from the previous quarter. It is worthwhile noting that in Q2, 21M ZRX were deposited into the ZRX vault and thus might have just been the foundation utilizing their treasury assets to make them productive. As tokens in the vault earn interest, perform governance functions and are indistinguishable from one another, they are considered to be active and thus more liquid than passively held assets. 4M ZRX also moved from the Foundation owned addresses. 11.6M ZRX entered free float in Q4 in total.

Aave (AAVE)

Having only launched in Q4 of 2020, there is limited free float history for Aave. At the end of Q4 2021, Aave Foundation owned addresses still managed just over 5M AAVE. Of this amount, ~500K are still in the Migration contract, unclaimed by holders of Aave’s previous token, LEND. Through Q4, there was a free float increase of 273K AAVE.

Balancer (BAL)

Balancer released 1,885,000 BAL tokens into circulation through their liquidity mining program, mimicking the same numbers from the previous 4 quarters. The number of BAL released from the Balancer Foundation into more liquid markets increased in Q4 to ~5M BAL. With a transfer of 268K BAL tokens from team owned addresses to more liquid markets, the net change to free float through the Q4 2021 was 7.2M.

Basic Attention Token (BAT)

Throughout Q4 2021, the free float supply of Basic Attention Token increased 16.3M, increasing from 5.5M new BAT that entered circulation in Q3. The majority of the increase came from team addresses with 13M BAT flowing out of identified team addresses. In addition, 3.2M BAT flowed from Foundation-controlled addresses.

Bitcoin (BTC)

The new BTC issued from mining activities in Q4 2021 was 85.3K. Long-term holders (>5yrs without a send transaction) increased again in Q4 by 77K, after Bitcoin experienced its largest quarterly gain in long term holders in Q3, adding 140K Bitcoin and removing them from the free float supply. In total, net free float supply increased by 8.7K BTC for the quarter.

Bitcoin Cash (BCH)

Bitcoin Cash’s free float increased ~133K BCH during Q4, representing a slight decrease from the previous quarter. Whilst the emissions from mining in Q4 were in line with the previous quarters, only 50K BCH entered free float supply from coins activated for the first time since Bitcoin Cash forked from Bitcoin, down from ~90K in Q2.

Bitcoin Gold (BTG)

Bitcoin Gold’s free float increased 135K BTG throughout Q4 of 2021, slightly lower than the previous quarterly increase of ~180k BTG. The BTG added to the free float from mining activities (82K) matched the issuance in previous quarters given the steady issuance schedule. An additional 53K BTG was added to the free float of Bitcoin Gold from coins that were activated for the first time since the BTG fork.

Bitcoin SV (BSV)

Bitcoin SV’s free float supply increased ~269K BSV during Q4 2021, up slightly from Q3 (128K BSV). Whilst the new issuance of Bitcoin SV from mining related activities was in line with previous quarters, 186K BSV were activated for the first time since the BSV fork, the highest quarterly increase in activated supply since Q4 of 2020 when 419K was activated.

Cardano (ADA)

Cardano’s free float increased 195M ADA in Q4 2021, a significant decrease from Q3 where 1.3B ADA were added to free float supply. A total of 320M ADA went back to Foundation addresses while 2M ADA left team controlled addresses. Finally, 513M was added to the free float from proof of stake emissions.

Chainlink (LINK)

Chainlink’s free float supply decreased from Q3’s value of 19.5M to 12M LINK in Q4. The entirety of the increase in free float supply can be attributed to transactions from team identified addresses.

Compound (COMP)

During Q4, 439K COMP was added to free float supply, less than the 666K COMP added to free float supply in Q3. The decrease comes after Q3’s September hiccup which released unexpected funds from foundation wallets into more liquid markets. Of the total amount in Q4, 100K came from team controlled addresses while 337K left Foundation-controlled addresses to more liquid ones. COMP is distributed to users of the protocol with roughly 2,312 COMP being distributed each day, sent from the Comptroller address.

Crypto.com Coin (CRO)

During Q4 2021, Crypto.com Coin free float supply increased by 1.98B. A total of 7.4B CRO was sent from Foundation-identified addresses while Team Controlled addresses sent a further 3B CRO. However, much of this CRO was burnt (sent to inaccessible ETH address) netting out to only a 1.98B increase in free float supply.

Curve (CRV)

The free float supply of Curve increased 64M in Q4, down from 126M in Q3. Curve is a relatively new protocol that launched in August of 2020 and has a predefined rate of token issuance that is set to continue at a similar pace for the next few quarters. The majority of the increase in free float supply was from increased issuance of tokens from foundation controlled addresses to liquid markets and the release of team controlled CRV.

DASH (DASH)

DASH’s issuance from mining related activities in Q4 was 148K DASH, in line with previous quarters which were after the ~6.0% inflation rate adjustment that occurred during Q3 of 2020. During the quarter, there were 11K DASH that were identified as being inactive for over 5 years and as belonging to long term strategic investors or lost supply. The net result of the two aforementioned factors was an increase in DASH’s free float supply of 137K for the quarter.

Decred (DCR)

277K DCR was added to the Free Float Supply during Q4 2021, slightly lower than Q3’s increase (300K). The majority of the increase resulted from the 308K DCR that were added to the total on chain supply from mining activities during the quarter, with 35K DCR being removed from supply due to aging (>5yrs old) and foundation accumulation.

Digibyte (DGB)

The Free Float Supply of Digibyte increased 277M in Q4, a slight decrease over the 299M DGB added in Q3. Inflation from Digibyte mining related inflation continues to decrease every quarter, with 257M added this quarter, down from 266M in Q3, 272M in Q2, and 279M in Q1. There were also 5M DGB that were removed from free float during the quarter as they aged over 5 years without activity. As per the Free Float Methodology, these coins are classified as likely belonging to strategic long term holders or as being lost, thus not contributing to liquid markets (and free float).

Dogecoin (DOGE)

Dogecoin’s free float supply increased by 1.29B tokens added to the free float supply, of which 1.26B are from mining related activities. An additional decrease in free float supply was from a net reduction in the number of DOGE held by long term holders (>5 years without a send transaction).

Ethereum (ETH)

After decreasing for the first quarter ever in Q3 with a net reduction of 754K, Ethereum’s free float increased in Q4 by 253K ETH. Q4 was the first full quarter with EIP-1559, a major upgrade to Ethereum’s fee mechanism which introduced a base fee that is burned (removed from circulating supply). This dampened the additional new supply that entered through mining rewards as ~912K ETH was burned in Q4. Additionally, the amount of ETH held by the ETH 2.0 staking contract, which users contribute ETH to to join the set of validators of the Proof of Stake Beacon Chain, surpassed 8.8M ETH in Q4. Currently, this ETH is unrecoverable once it is sent to this contract. It is expected that withdrawals will be introduced after Ethereum undergoes its anticipated transition to PoS in 2022 from its current Proof of Work consensus mechanism.

FTX Token (FTT)

During Q4, the free float supply of FTX Token increased 18.4M FTT, a decrease from the 35M FTT that entered free float supply in Q3. A total of 20M FTT left Foundation-controlled addresses to more liquid ones.

Huobi Token (HT)

Huobi Token continues to be one of the most consistent deflationary assets in the crypto market, recording a reduction in free float supply every quarter of 2020 and 2021 so far. During Q4 the HT free float supply was reduced by 6.4M. This consisted mainly of Huobi continuing to conduct on-chain burns of HT, one to the tune of 2.11M.

Litecoin (LTC)

Litecoin’s free float supply increased 613K LTC in Q4, higher than the 584K LTC added during Q3, but generally in line with previous quarterly increases. Whilst the new supply from mining related activity remained relatively consistent, adding 666K LTC in Q4, a net increase to LTC in addresses that have remained dormant for over 5 years (53K) removed some liquidity from markets. The net result was an increase in free float supply of 613K LTC during Q4 2021.

MakerDAO (MKR)

The free float supply of MakerDAO decreased in Q4 2021, with 30K MKR removed from the free float. The primary reason for this decrease was due to a net increase of 25K MKR to the MakerDAO Governance contract.

NEO (NEO)

The NEO free float supply decreased by 191K in Q4 of 2021, 45K from Team owned NEO addresses that were moved to more liquid addresses during the quarter.

Stellar Lumens (XLM)

The Stellar Lumen free float supply increased 882M XLM during Q4 2021, an increase from Q3. This was mostly composed of Foundation owned addresses moving XLM to more liquid addresses during the quarter.

Uniswap (UNI)

The free float supply of Uniswap decreased by 9.5 M UNI during Q4 2021, after increasing the previous three quarters of 2021. The decrease in free float supply can be attributed to 10M UNI flowing back to team-identified addresses.

XRP (XRP)

The XRP free float supply increased 900M in Q4 after increasing 1.0B during Q3 2021. The largest contributor of extra liquidity to the market during the quarter was from Ripple Foundation controlled addresses, which experienced net outflows of 883M XRP. Ripple Team controlled addresses also experienced a 20M XRP net outflow.

Yearn (YFI)

During Q4 of 2021, Yearn’s free float supply decreased by 27 YFI. The majority of this came from the increase of YFI held in Foundation controlled addresses. A total of 144 YFI flowed back to Foundation addresses in the quarter. However, 117 YFI left team-identified addresses, netting out to 27 YFI decrease in free float supply in Q4.

Zcash (ZEC)

Zcash free float supply increased 319K ZEC during Q4 2021, very similar to the previous quarter’s increase. This low level again is the result of the recent ZCash block halving event in November of 2020. About 10K ZEC was removed from free float supply due to long-term holders (greater than 5 years without a transaction) the first time this has happened for Zcash, which launched in October 2016. There were no other known changes to the free float supply of Zcash. Note it is unknown if the foundation/team controls assets if they utilize shielded transactions.

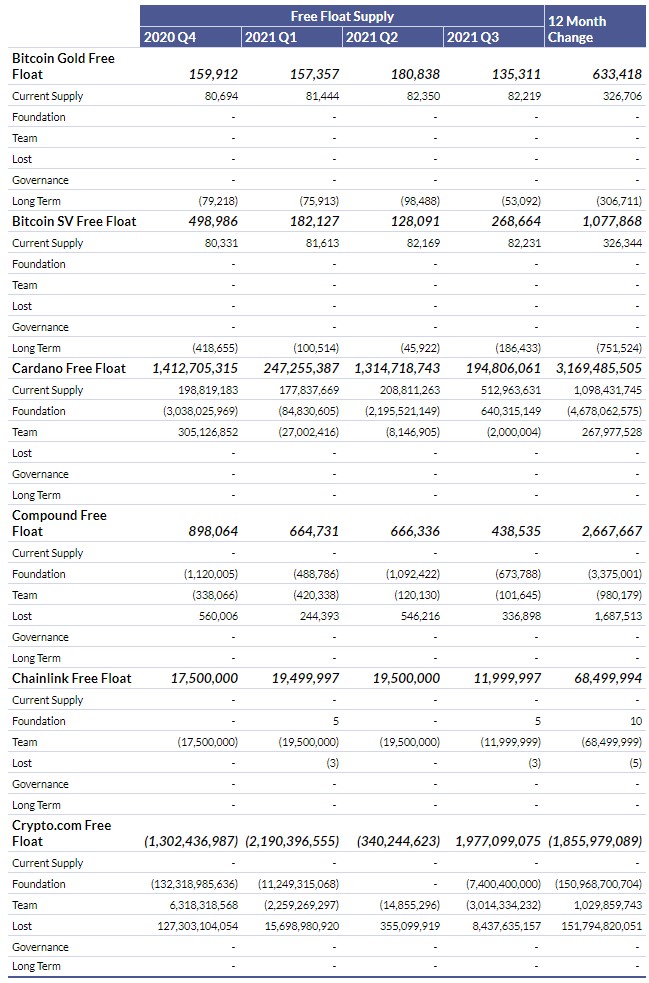

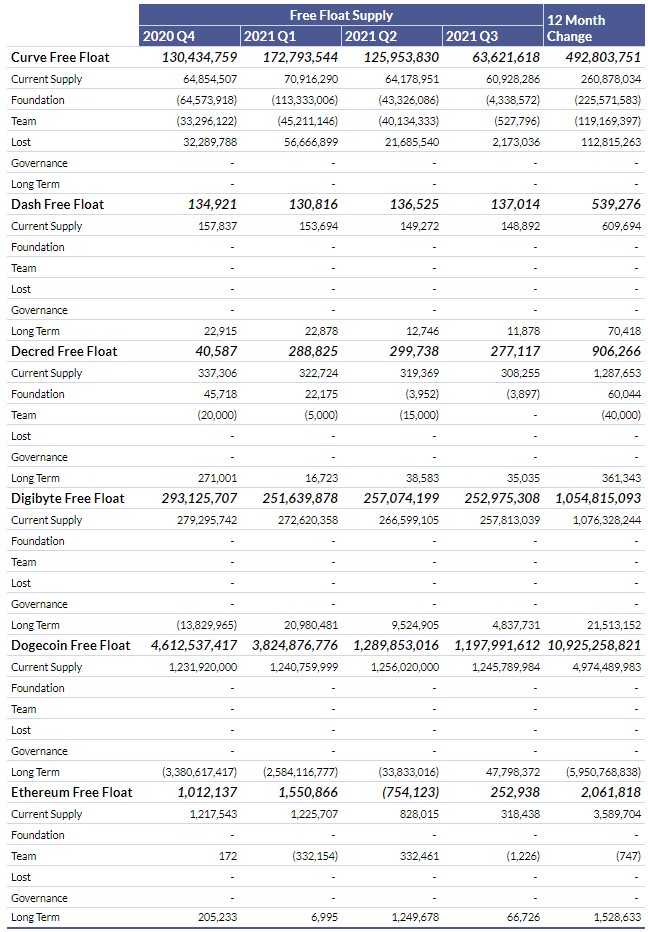

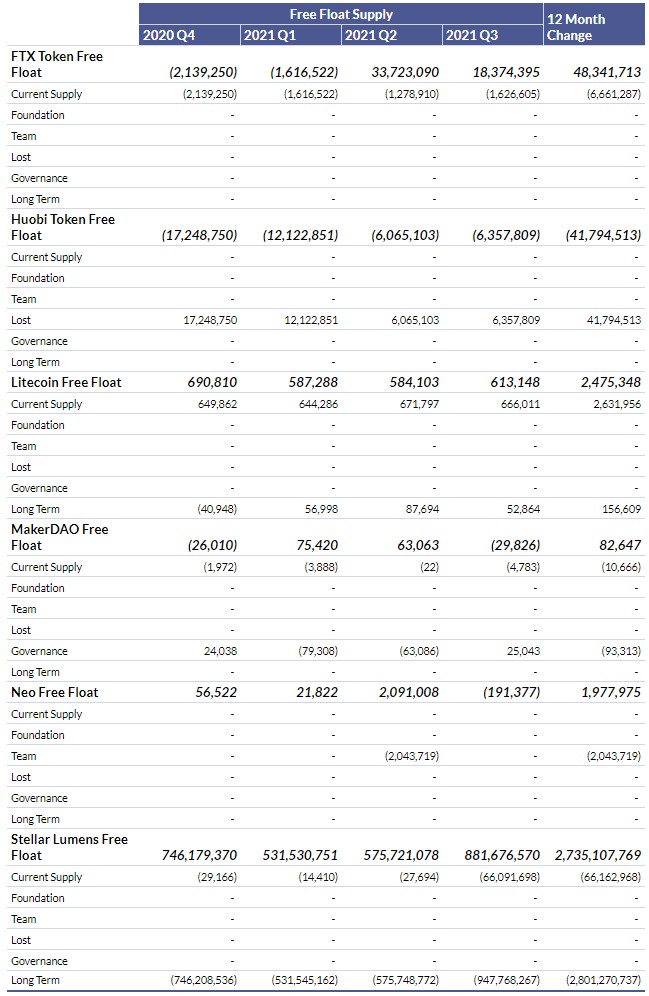

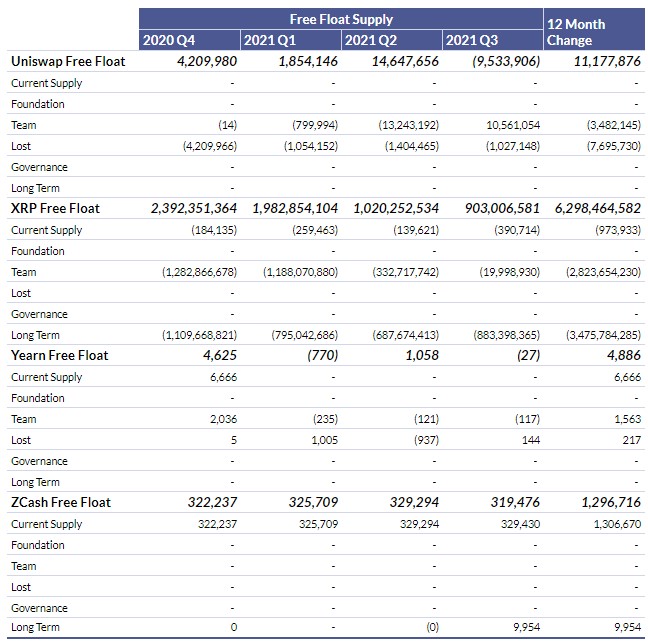

DETAILED FREE FLOAT CHANGE BREAKDOWN

ABOUT COIN METRICS

Coin Metrics is a leading provider of transparent and actionable cryptoasset market and network data. Coin Metrics delivers mature data across multiple formats to various industry stakeholders, including financial enterprises, funds, media and research outlets, and data/application providers. Coin Metrics’ data empowers its clients and the public to better understand, value, use, and ultimately steward public crypto networks. Further Coin Metrics research can be found here.

ABOUT CMBI

Coin Metrics launched CMBI to bring independent and transparent index solutions to the cryptoasset investment community. In the nascent and often complex cryptoasset market, CMBI Indexes strive to be dynamic and adjust to the rapidly changing market conditions to design and maintain investable products. CMBI Indexes provide markets and customers with industry-leading solutions that aid in performance benchmarking and asset allocation.