Thirty-nine years ago, the Revenue Act of 1978 was signed, adding section 401(k) to the Internal Revenue Code and creating the first US defined contribution plans. While the code itself simply described a provision under which employees would not be taxed on the portion of income they chose to receive as deferred compensation, it ushered in a new era in retirement saving by paving the way for the modern 401(k) plan.

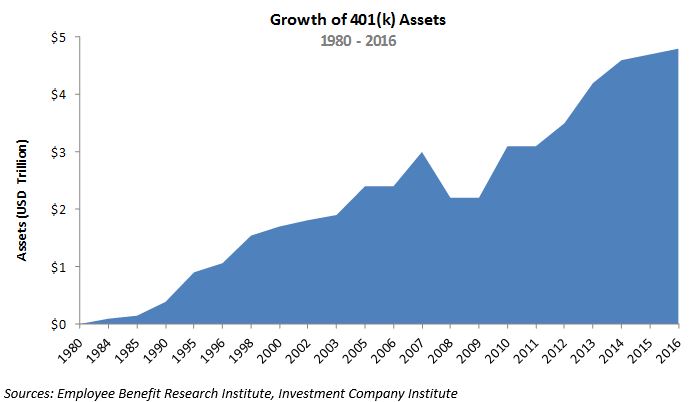

Although initially assailed as a savings plan for the rich, Richard Stanger—the principal author of the legislation—commented, “We were confident that assets would flow into the system in a reasonable way, not just from the highly compensated, but from the entire workforce.”[1] By 1990 the number of plans offering a 401(k) feature grew to over 97 thousand with 20 million active participants and $385 billion in assets.[2] However, as the equity bull market in the 1990s swelled, so did fund options. It was not uncommon for a plan lineup to consist of 30-50 funds, many of which were redundant. This excess eventually gave way to regulatory oversight, increased fund lineup scrutiny, and the implementation of choice architecture in plan design.

Yet, despite the added surveillance, plan lineup growth continued. In an effort to mitigate the challenges of self-directed investing, managers created target-date funds (TDFs). The prevalence of TDFs would increase dramatically with the passage of the Pension Protection Act of 2006. Now, equipped with an approved set of default investment options, plan sponsors could implement auto-enrollment and auto-escalation of savings rates in an effort to help improve participants’ retirement outcomes.[3] These advances transformed the 401(k) market into the one we recognize today.

Far from perfect and far from failure, America’s ERISA[4] voluntary employer-sponsored retirement system passed its 40th anniversary in 2014 with an estimated 55 million active participants and $4.6 trillion dollars saved.[5] According to Stanger, “The Defined Contribution system is a really good example of something done well; the government enabled it and let the private market innovate. This same framework will address future shortcomings and ensure continued success.”[6] As we look to the future I hope that same creativity, innovation, and focus on outcomes will proliferate the next generation of retirement investment strategies. Since the goal of a retirement account, for many plan participants, is to provide a steady stream of income that will sustain their standard of living in retirement, next generation retirement investment strategies should likewise be aligned with this goal. That alignment entails managing risks that are relevant to retirement income by allocating assets over time in a way that balances the tradeoff between asset growth and income risk management, and providing meaningful communication to participants that enables them to monitor performance in income units rather than just an account balance. This framework is well reflected in the S&P Shift to Retirement Income and Decumulation (STRIDE) Index Series which I believe can serve as the appropriate benchmark for next generation retirement strategies.

The S&P STRIDE INDEX is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”), and has been licensed for use by Dimensional Fund Advisors LP (“Dimensional”). Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Dimensional. Dimensional’s Products, as defined by Dimensional from time to time, are not sponsored, endorsed, sold, or promoted by SPDJI, S&P, Dow Jones, or their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such products nor do they have any liability for any errors, omissions, or interruptions of the S&P STRIDE Index.

Dimensional Fund Advisors LP receives compensation from S&P Dow Jones Indices in connection with licensing rights to S&P STRIDE Indices.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

[1] Jim Miller, “In 401(k) We Trust”, DC Dimensions, page 2 (Summer 2014)

[2] “History of 401(k) Plans: An Update”, Employee Benefits Research Institute (February 2005)

[3] Shlomo Benartzi and Richard Thaler, “Behavioral Economics and the Retirement Savings Crisis”, Science, Vol. 339, Issue 6124, pp. 1152-1153 (March 2013)

[4] Employee Retirement Income Security Act of 1974

[5] Jack VanDerhei, Sarah Holden, Luis Alonso, and Steven Bass, “401(k) Plan Asset Allocation, Account Balances, and Loan Activity in 2014”, Employee Benefits Research Institute (August 2016)

[6] Jim Miller, “In 401(k) We Trust”, DC Dimensions, page 7 (Summer 2014)

The posts on this blog are opinions, not advice. Please read our Disclaimers.