Why Only Two Companies Are Left With the AAA Rating

AAA bonds are considered the safest debt by the three primary bond rating agencies: Fitch, Moody's, and Standard & Poors. With thousands of institutions issuing bonds, it would be safe to assume that at least a dozen were rated AAA. Thus, it would be shocking to realize that there are only two companies that are rated AAA. Namely Johnson and Johnson and Microsoft. To better understand why only two companies are rated AAA, we must adequately comprehend the prerequisites of getting such a rating.

What does it take to earn a AAA rating?

Several underlying factors dictate what ratings are assigned by credit agencies, which are used to calculate the probability of default. An institution's financial health, balance sheet, future growth, and cash position, amongst others, are assessed to determine this probability. In addition to an institution's ability to service its debt from its net revenue, the following factors are examined:

Earnings growth

Profit margins

Future outlook

Regulatory environment

Tax burden

Industry trends

Following an evaluation, the rating agency assigns a credit rating to the security. The most secure debts get a AAA rating, which denotes the lowest expectation of default risk. They are assigned only in cases of exceptionally strong capacity for payment of financial commitments. This capacity is highly unlikely to be adversely affected by foreseeable events.

Over the years, most institutions have found that receiving AAA credit rating is not something worth aspiring as it would require a more conservative approach that would inhibit growth and thus revenue. Moreover, today's markets often render credit assessments before the rating agencies; therefore, a downgrade has a less noticeable effect.

The decline in AAA-Rated Institutions

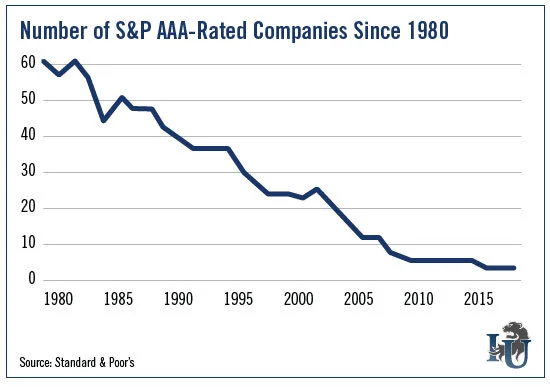

Number of AAA-Rated Companies Since 1980

The diagram above shows the steady decline of AAA-Rated companies from sixty in 1980 to two in 2020. Berkshire Hathaway and General Electric lost their AAA ratings in 2009. Exxon lost its AAA rating in 2015, and ADP lost its in 2015. Clearly, none of these businesses has been adversely impacted since losing its AAA status, emphasizing that in today's market, credit ratings have lost its importance. Furthermore, following their downgrade, they have gone on to enjoy lower borrowing costs.

Will Microsoft Lose Its AAA Rating?

Microsoft has beat out rivals Apple and Alphabet. All three major credit rating agencies have reaffirmed Microsoft's credit rating. Primarily citing that Microsoft is well-positioned to take advantage of cloud computing services, leveraging legacy strengths in its Office software applications to provide Microsoft with robust growth to mitigate the secularly weaker and cyclical PC-related business. Microsoft currently has a manageable debt to cash ratio of 0.73. Its outlook is presently stable reassuring lenders and investors that it will be able to weather the economic downturn onset by COVID-19.

Will Johnson & Johnson Lose Its AAA Rating?

Unlike Microsoft, Johnson & Johnson, despite retaining its AAA rating, has a negative outlook. Johnson & Johnson's negative outlook is mostly due to concerns over litigation risks of opioid and talc lawsuits. Moody's Senior Vice President Michael Levesque said the company's "Aaa rating continues to reflect an excellent business profile and outstanding financial flexibility including annual free cash flow after dividends in excess of $9 billion and cash on hand above $15 billion." It is expected that the growth of the company's pharmaceutical business will slow because of competition, and that litigation risks will constrain cash flow for years to come.

Conclusion

In the present economic downturn, the question is, how long will the remaining two AAA-rated firms keep their ratings when under pressure, and if they lose them, will anybody care?

click here to view our analysis on Goldman Sachs before earnings release.