3 reasons Ethereum dropped much harder than Bitcoin in abrupt correction

3 reasons Ethereum dropped much harder than Bitcoin in abrupt correction 3 reasons Ethereum dropped much harder than Bitcoin in abrupt correction

Photo by Patrick Hendry on Unsplash

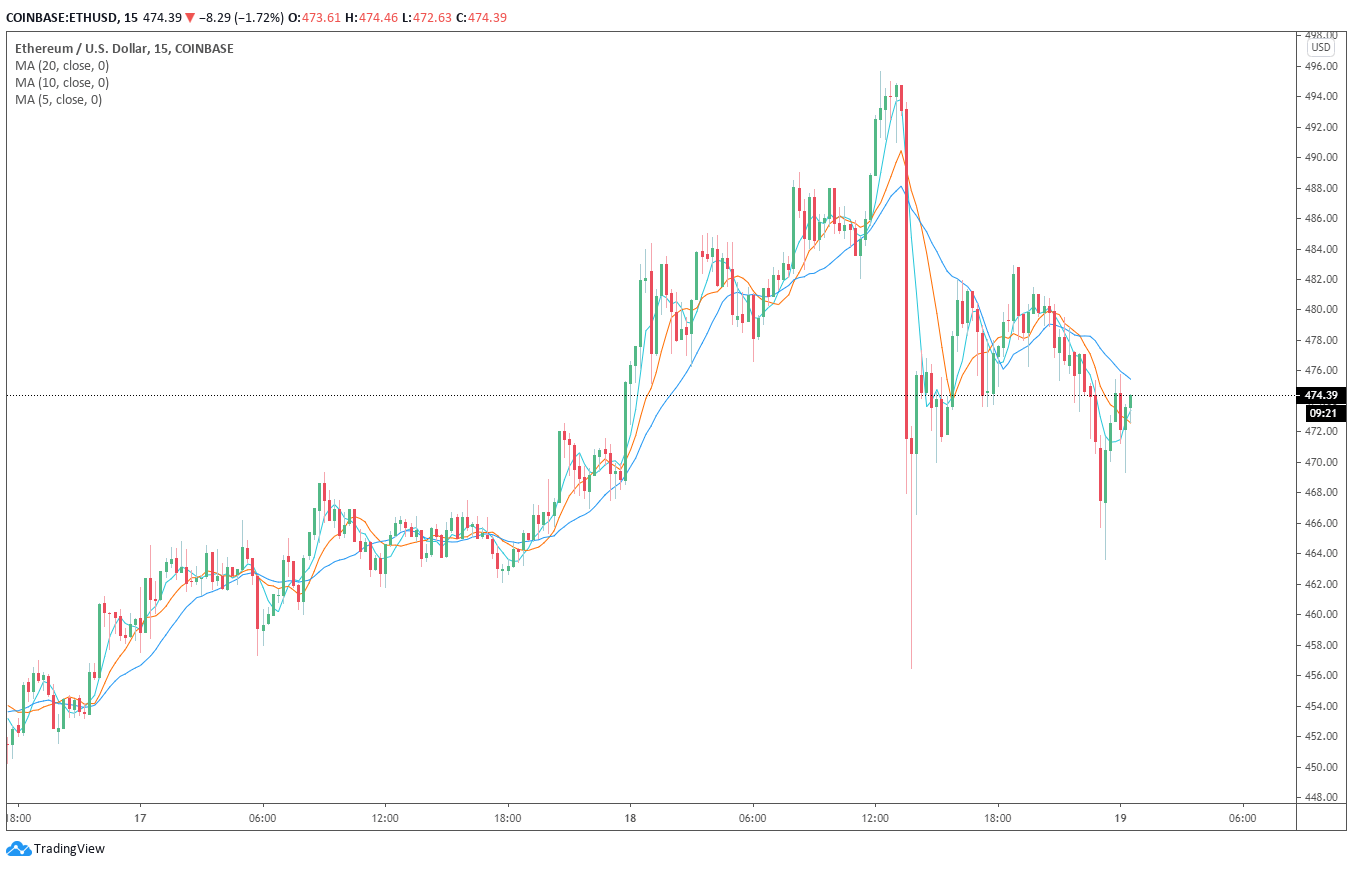

Within 30 minutes, on November 18, the price of Ethereum dropped 7.7% as Bitcoin also recorded an abrupt 6% drop. ETH saw a much sharper drop in the same period, sparking concerns regarding extreme volatility.

Three key reasons likely caused Ethereum to see a more volatile drop than Bitcoin. The factors are thinner order book, high futures open interest, and algorithms.

Thinner order book compared to Bitcoin

Throughout the past month, Bitcoin has vacuumed most of the volume from the cryptocurrency market.

For instance, as of November 18, the daily volume of Bitcoin on Binance is hovering at $3 billion. In contrast, the volume of Ethereum is at $831 million, which is substantially lower than Bitcoin.

The massive gap in the volume between the two assets could lead to a more volatile price movement for Ethereum.

The sudden price drop of Ethereum from around $493 to $455 occurred right after Bitcoin abruptly fell from $18,476 to $17,214.

This shows that the initial drop of Bitcoin led ETH to drop, but due to its comparably lower volume, Ethereum saw a larger drop than BTC.

Futures open interest for Ethereum is high

There has been significant optimism surrounding Ethereum since early November, primarily due to ETH 2.0.

Consequently, the anticipation of ETH 2.0 led the trading activity around ETH to increase, as the market began to speculate around the mainnet launch.

The increase in trading activity eventually led the open interest of Ethereum futures to spike. The term open interest refers to the total sum of long and short contracts in the market.

When the open interest is high, it typically indicates that there are more traders betting for or against the price of Ethereum.

A high open interest makes a volatility spike for an asset more likely. It increases the probability of short or long squeezes, which could cause cascading liquidations.

ETH 2.0 is a crucial network upgrade for Ethereum that massively expands its transaction capacity. Following ETH 2.0, the Ethereum blockchain will be able to process a higher number of transactions per second.

ETH2 deposit contract released:https://t.co/bDrtf9vRpJ

— vitalik.eth (@VitalikButerin) November 4, 2020

On November 4, Ethereum co-creator Vitalik Buterin released the eth2 deposit contract address. This confirmed the imminence of an ETH 2.0 mainnet release, which has been highly anticipated for years.

For the ETH 2.0 mainnet to launch, over 400,000 ETH would have to be deposited into the eth2 address. So far, according to analysts at Glassnode, 100,000 ETH has been staked in the eth2 deposit contract. They wrote:

“The #Ethereum 2.0 deposit contract has crossed 100,000 $ETH in staked value. Almost 20% of the phase 0 staking goal have been reached.”

The improving progress around ETH 2.0 likely led the futures open interest to continuously surge. As such, ETH has been seeing volatile movements in the past several weeks.

Algorithms are acting up

The most likely reason both BTC and ETH saw extreme price movements within a matter of minutes is algorithms.

When BTC first sold off, market and volume trends suggested algorithms and bots started to sell en masse.

Ethereum Market Data

At the time of press 1:45 pm UTC on Nov. 19, 2020, Ethereum is ranked #2 by market cap and the price is down 0.73% over the past 24 hours. Ethereum has a market capitalization of $53.95 billion with a 24-hour trading volume of $14.69 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 1:45 pm UTC on Nov. 19, 2020, the total crypto market is valued at at $502.03 billion with a 24-hour volume of $151.31 billion. Bitcoin dominance is currently at 66.27%. Learn more about the crypto market ›