State of the Crypto Market & Ecosystem (Part 5 of 7)

--

0xIntro

We don’t need to repeat why crypto and web3 are going to be at the forefront of the next generation’s companies. We believe in it, and text our frens “gm” and “wagmi” every morning. We’ll cut the bullsh*t and get straight to the point.

It’s hard for the average person to understand what this noise is all about, so we took the initiative to write up a series of posts that dive into what’s actually inside the rabbit hole.

If you don’t know us already, Ripple Ventures is an early-stage venture fund looking to back extraordinary founders building market-shifting software tools. We’re focused on anything enterprise, creator, and developer-focused in web2 and web3.

This is the fifth of a seven-part series covering:

- What is Web 1, 2, 3?

- The Benefits and Drawbacks of Web 2

- Why Does Web 3 Matter?

- What’s the Metaverse?

- State of the Crypto Market & Ecosystem

- Web 3 Leading Indicators

- Web 3 Dictionary Resource

Up Next…

Next week, we’ll be launching our next post covering A Simplified View into the Web3 Ecosystem.

Follow our Medium account and subscribe to our Substack to see it first!

Get in touch!

If you’re a founder building in this space and want to connect, please reach out to us using this link!

State of the Crypto Market & Ecosystem

The growth of the crypto market can be tracked by a few different indicators:

- Overall market capitalization

- Decentralized finance and exchange activity

- Total transactions and wallets

Market Drivers and Capitalization

Market capitalization is a great high-level view into market sentiment around the space and whether the asset class is becoming more valuable over time. The majority of projects in this space also use digital currencies to utilize their applications.

While there isn’t a one-to-one relationship between the appreciation of value in cryptocurrency market capitalization of layer 1 tokens (Ethereum/Solana) and the real utilization of Web 3 protocols (Uniswap, Curve), we think that it’s a great leading indicator of its momentum across both sides.

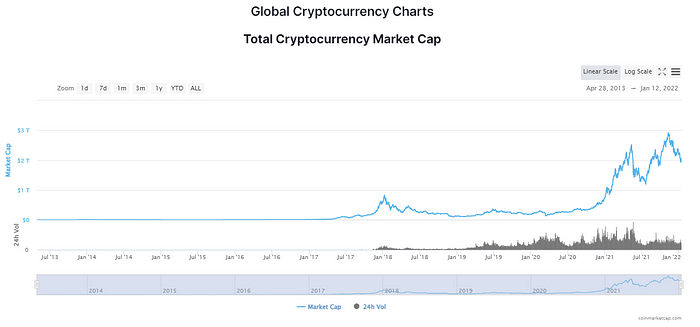

After hitting all-time highs with a market cap of $2.9 trillion on November 9, the market has slowly begun to retreat back to $2.1 trillion where it currently sits as of January 12, 2022. There was a short bull cycle due to the explosive NFT and DAO activity, and overall optimism within the space.

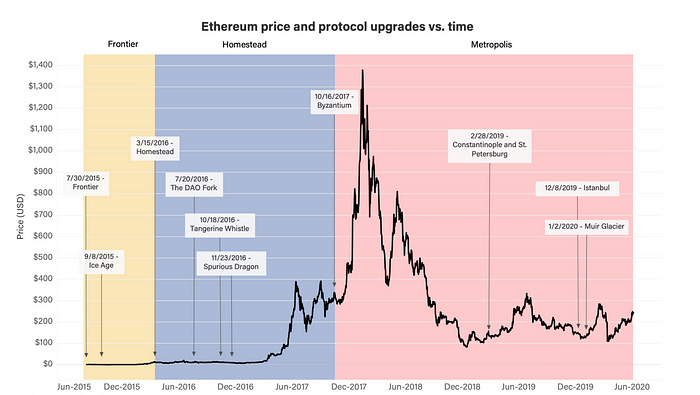

Back in 2017, there was a bull run in the market driven by the ICO (initial coin offering) rush. There were a lot of malicious players during this time, doing token offerings off of white papers with no real products behind them, only to “pull the rug” from under any investors that caused their token prices to appreciate. Many investors lost a lot of capital from this event, and this caused a large panic sell in the market due to a lack of confidence in the ecosystem. The market eventually crashed in 2018 and stayed that way for a few years until the market started picking up momentum in 2021.

In 2021, there was a lot of interest regained in this space with investments from institutional firms like hedge funds and venture funds. A lot of new technology was being built on top of the core blockchain infrastructure with new innovations around decentralized finance (defi) projects, non-fungible tokens (NFTs), and decentralized autonomous organizations (DAOs). All of these new projects and protocols in the space, alongside social distribution to end-users caused a regained confidence and awareness of the ecosystem.

Near the end of 2021, when we hit all-time highs in the market, there was a pullback which can be attributed to regulatory crackdowns (especially in China), liquidation cycles, as well as some headwinds in the market around trust and governance.

Decentralized Finance and Exchange Activity

The user base and activity across decentralized finance and exchanges can also show what adoption looks like in this space. As of today, there are roughly 4 million defi users in the world, which is still very little compared to the global population. There’s a lot more room to grow and we’re still early in the cycle, where the majority of people still haven’t gotten past just buying tokens on a centralized exchange like Coinbase and are just holding it in a wallet like Metamask.

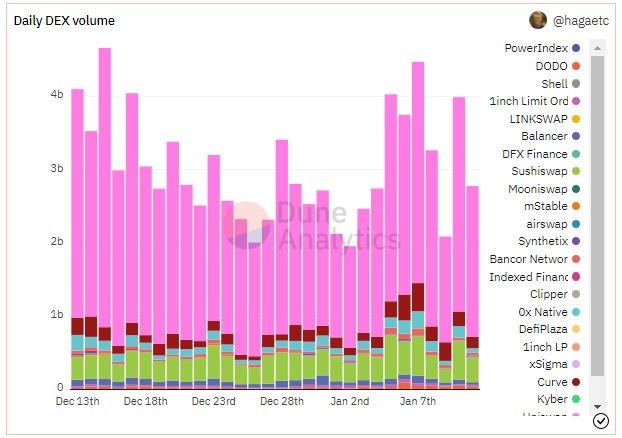

What’s really promising is the volume of activity across the decentralized exchanges in the market, which have been consistently over $2 billion over the past month even though the market has been declining in market capitalization. Users in this space are highly active and finding different ways to make money even in this slight downturn in the market and engaging heavily in these protocols. This is a great sign for the market as it’s not just purely financial, builders and users are continuously innovating no matter what the price of assets are.

Transactions and Wallets

A few other metrics that can be used to gauge overall market sentiment and growth (in addition to total market capitalization) are daily transactions and the number of individual wallets.

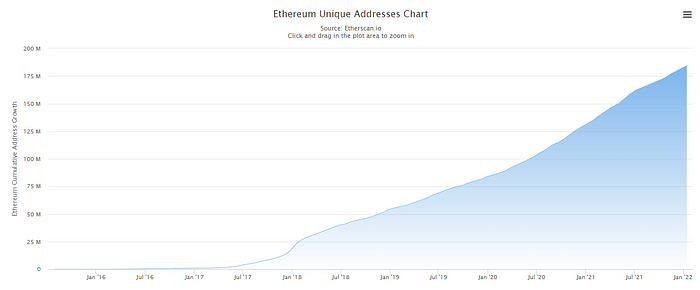

Both metrics show us the total number of Web 3 participants and how engaged these participants are within the ecosystem. Both of these metrics are near all-time highs or close to all-time highs.

- Daily Transactions: There are roughly 1.2 million transactions happening daily on the Ethereum network, down from the 1.7 million transactions per day high back in early November. Even though the market capitalization has decreased, there has been a sustained level of transactions still happening.

- Number of Individual Wallets: There are 184 million individual wallets on the Ethereum network, an all-time high.

We are long-term investors and believers in the crypto and Web 3 ecosystem and know that the heightened adoption of these new technologies will continue over the next decade.

Thanks for reading!

If you have any suggestions on edits or more content we should cover, please reach out to us at matt@rippleventures.com and dom@rippleventures.com