Dear Bankless Nation,

One of the key documents to evaluate the health of a company is the quarterly earnings report. These reports include cash flows, profit and loss statements, and key growth indicators.

Ethereum isn’t a company… it can’t release its own quarterly report.

So we’re doing it instead.

This is Ethereum’s quarterly report.

The data that follows shows the massive year-over-year growth that Ethereum the protocol and Ethereum the ecosystem had between Q4’20 and Q4’21.

All available on chain for anyone to audit.

This is the economic data of an emerging digital nation. An economy that made stunning leaps of growth in the last 12 months.

The state of Ethereum is strong.

Ben digs into the Q4 numbers.

- RSA

P.S. This piece pairs nicely with Ryan Allis’s recent Ethereum DCF Valuation 👀

Ethereum, the world’s largest smart contract platform, reported financial results for the fourth quarter and fiscal year ended December 31, 2021.

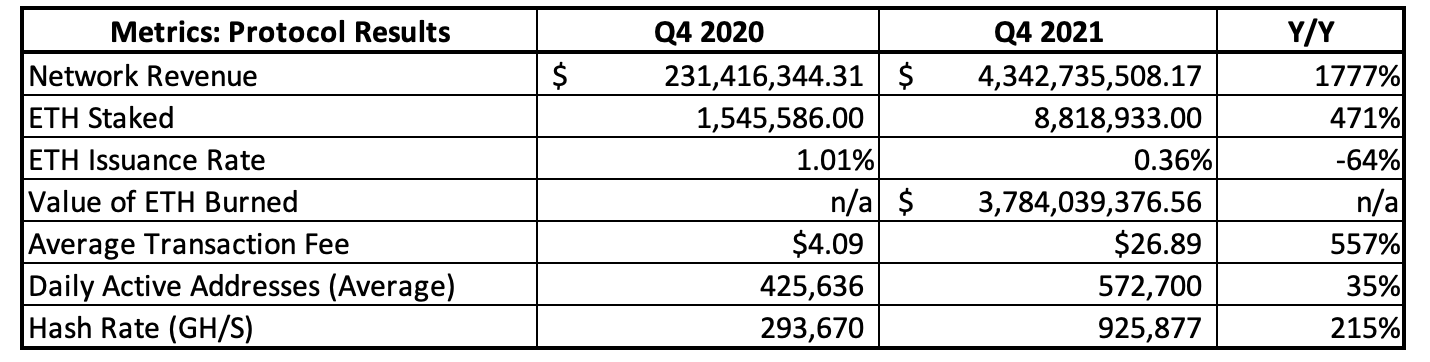

Protocol Summary

Numbers compare performance in Q4 2020 to Q4 2021

- Network Revenue rose 1,777% from $231.41 million to $4.34 billion. Network revenue refers to fees paid in ETH by users to transact on the network. Of this, $3.78 billion (87%) worth of ETH was “burned” and removed from the circulating supply through EIP-1559.

- Average Daily Active Addresses grew 35% from 425,636 to 572,700. This measures the average number of individual wallet addresses that interacted with the network each day over the course of the quarter.

- ETH Inflation Rate fell 64% from 1.13% to 0.46%. This tracks the increase in the supply of ETH, less burnt fees, as a result of the block reward issued to miners as compensation for confirming transactions.

- ETH Staked increased 471% from 1,545,486 to 8,818,933. This measures the amount of ETH Staked on the “Beacon Chain,” which eventually be merged with the current Ethereum network when it switches from Proof-Of-Work (PoW) to Proof-Of-Stake (PoS). About 7.40% of the total ETH supply is staked.

- Average Transaction Fee rose 557% from $4.09 to $26.89. This represents the average price paid per transaction by a user on the network.

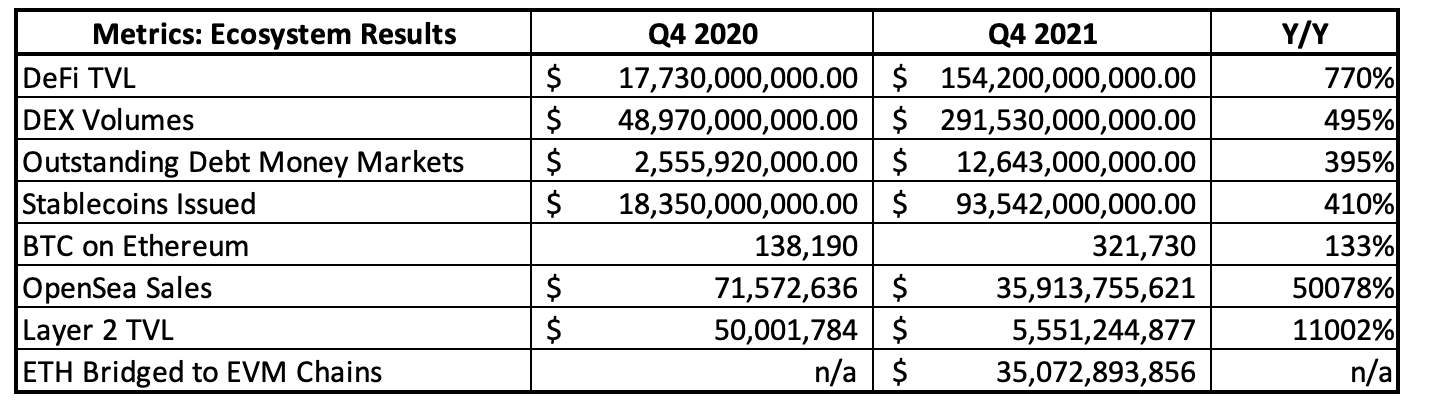

Ecosystem Summary

Numbers compare performance in Q4 2020 to Q4 2021

- DeFi TVL grew 770% from $17.73 billion to $154.20 billion. This measures the value of assets deposited into Ethereum based DeFi applications.

- DEX Volumes rose 495% from $48.97 billion to $291.53 billion. This tracks trading volumes on Ethereum’s largest decentralized exchanges such as Uniswap, SushiSwap, and Curve.

- BTC on Ethereum grew 133% from 138,190 to 321,730. This represents Bitcoin that has been tokenized in various forms, such as wBTC, renBTC, and tBTC, with roughly 1.69% of the BTC supply now living on Ethereum.

- OpenSea Sales increased 50,078% from $71.57 million in $35.91 billion. This tracks the sales volume of the network's largest NFT marketplace.

- Layer 2 TVL increased 11,002% from $50.01 million to $5.55 billion. This measures the amount of value bridged from Etheruem into L2 scaling solutions such as Optimistic and ZK Rollups.

Ecosystem Highlights

Metaverse Mayhem

Q4 was defined in part by an explosion in awareness and speculation surrounding the metaverse.

Catalyzed by Facebook’s announcement of their rebranding to “Meta” in October 2021, Q4 saw a parabolic rise in the prices of metaverse-related assets. This includes tokens used to govern and transact within virtual worlds, such as Decentraland (MANA) and The Sandbox (SAND), which saw their tokens appreciate 337% and 635% respectively in Q4. In addition, both projects experienced record-breaking land sales within their worlds, including purchases of $2.43 million for the former and $4.3 million for the latter.

The MVI, a basket of metaverse tokens created by Index Coop ended the quarter up 88% from October 1st to December 31st, 2021, while peaking at 197% in late November.

Partially overshadowed by the frenzy surrounding crypto-native projects, traditional companies, such as Microsoft, also announced their intention to foray into the metaverse. This sets the stage for an eventual showdown between the centrally planned and controlled metaverses of Web2, and the open, user-owned ones within Web3.

Rise of DeFi 2.0

Another primary theme of Q4 was the rise of “DeFi 2.0.”

A term used to broadly describe the next generation of protocols and primitives, many of these projects place an emphasis on increased capital efficiency, liquidity, and treasury management, and pursuing aggressive growth strategies by deploying onto multiple chains and layer 2s. Along with their increasingly innovative designs, many of these protocols are entirely grassroots, not raising any money from traditional venture capitalists within the space. These projects have pushed the envelope of token design to reduce emissions and drive demand for their native asset.

There are several notable examples of DeFi 2.0 stealing the spotlight in Q4. This includes the rise of Frog Nation, whose ecosystem of protocols has amassed more than $7 billion in TVL, Olympus DAO, whose treasury holds more than $203 million in risk-free value and saw the launch of numerous forks during an “OHM Fork SZN,” as well as the merger of Fei Protocol and Rari Capital into TribeDAO.

Future Outlook

FY 2022 is shaping up to be a pivotal year for Ethereum.

At the protocol layer, Ethereum is expected to undergo the most significant network upgrade in its history in the form of the “merge,” which is expected to go through in Q2/Q3. This will consist of Ethereum replacing its Proof-Of-Work (PoW) consensus mechanism with Proof-Of-Stake (PoS), which will enable the network to drastically reduce its energy consumption, as well as the issuance of ETH needed to secure the network. In addition, the merge will also pave the way for sharding, which will enable Ethereum to more easily scale and fulfill its ambition of becoming a modular blockchain.

Despite the merge, Ethereum will face some major headwinds this year. This comes primarily in the form of scaling, as gas fees have priced out all but the wealthiest of users, and stiff competition from other ecosystems such Solana, Terra, Cosmos, Avalanche, and Fantom. Ethereum is in desperate need of a solution of its own if it hopes to maintain and grow its market share into the future. Thankfully, help may be arriving in the form of L2s such as Optimism, Arbitrum, zkSync, and StarkNet.

With token launches and incentive programs likely on the horizon for each of these scaling solutions, there is a strong possibility Ethereum will be able to capitalize on that momentum and utilize this newfound capacity to fuel growth.

Results Table

About Ethereum

Ethereum is an open-source, decentralized blockchain network. Ethereum is a technology that's home to digital money, global payments, and applications. The community has built a booming digital economy, bold new ways for creators to earn online, and so much more. It's open to everyone, wherever you are in the world – all you need is the internet (Taken from the Ethereum.org website.)

About This Release

This release is not a release of Ethereum or the Ethereum foundation.

Action steps

- 🔎 Investigate the data yourself with Token Terminal, Etherscan, & The Block

- 📚 Read The State of Ethereum | Q3 2021

- 📖 Check out the original First Quarter 2021 Results

Ben Giove

Ben Giove