- News

- Business News

- India Business News

- BharatPe strips Ashneer Grover of co-founder tag, holds back his Rs 300 crore equity

Trending

This story is from March 2, 2022

BharatPe strips Ashneer Grover of co-founder tag, holds back his Rs 300 crore equity

The Tiger Global-backed BharatPe accused the “Grover family and their relatives” of engaging in “extensive misappropriation of company funds, including, but not limited to, creating fake vendors through which they siphoned money away from the company’s expense account”.

NEW DELHI: Startup poster boy Ashneer Grover, who was removed as an “employee, a founder, or a director” by BharatPe — a fintech he had co-founded — was stripped of 1. 4% equity shares worth Rs 300 crore as he and his family members were accused of committing a financial fraud. The move came just a day after he tendered his resignation.

The Tiger Global-backed BharatPe accused the “Grover family and their relatives” of engaging in “extensive misappropriation of company funds, including, but not limited to, creating fake vendors through which they siphoned money away from the company’s expense account”.It added that the account was grossly abused in order to “enrich themselves and fund their lavish lifestyles”.

“In order to uphold the highest governance standards, and in light of complaints received, the board of BharatPe directed a thorough review of the company’s internal controls. This extensive review is being led by well-respected and independent external adviser,” the company said.

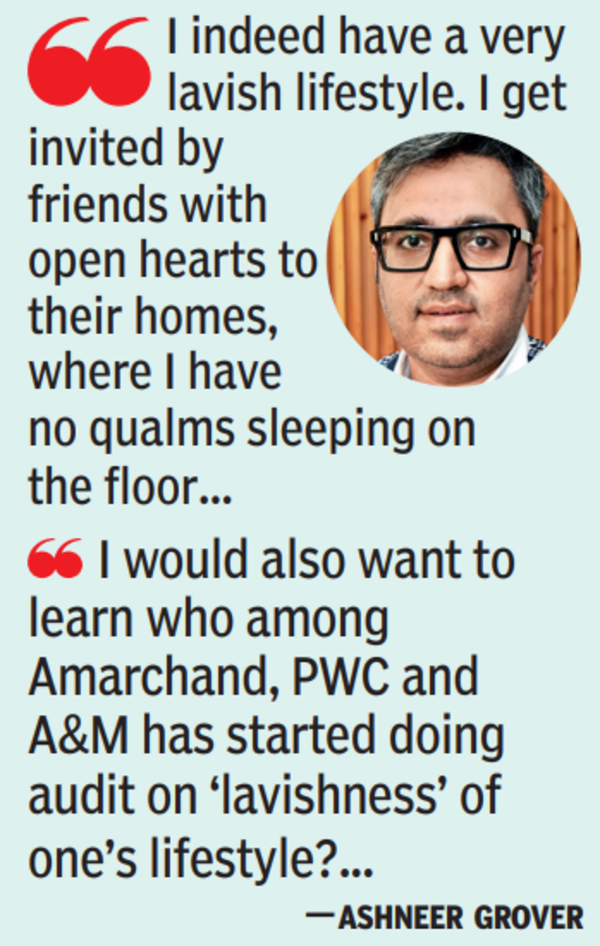

Grover said, “I am appalled at the personal nature of the company’s statement, but not surprised. It comes from a position of personal hatred and low thinking. I think the board needs to be reminded of $1mn of secondary shares investors bought from me in series-C, $2. 5mn in series-D and $8. 5mn in series-E. I would also want to learn who among Amarchand, PWC and A&M has started doing audit on ‘lavishness’ of one’s lifestyle?”

The Tiger Global-backed BharatPe accused the “Grover family and their relatives” of engaging in “extensive misappropriation of company funds, including, but not limited to, creating fake vendors through which they siphoned money away from the company’s expense account”.It added that the account was grossly abused in order to “enrich themselves and fund their lavish lifestyles”.

“In order to uphold the highest governance standards, and in light of complaints received, the board of BharatPe directed a thorough review of the company’s internal controls. This extensive review is being led by well-respected and independent external adviser,” the company said.

As a result, Grover — who holds about 8. 5% in the company (BharatPe was last valued at $2. 9 billion) is set to lose 1. 4% of his equity as a result of his shares being clawed back, sources told TOI. “The 1. 4% equity was to be vested with Grover, but pending his resignation without consent and other revelations, the process will not happen,” they added.

Grover said, “I am appalled at the personal nature of the company’s statement, but not surprised. It comes from a position of personal hatred and low thinking. I think the board needs to be reminded of $1mn of secondary shares investors bought from me in series-C, $2. 5mn in series-D and $8. 5mn in series-E. I would also want to learn who among Amarchand, PWC and A&M has started doing audit on ‘lavishness’ of one’s lifestyle?”

End of Article

FOLLOW US ON SOCIAL MEDIA