BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

Ahead of an expected direct listing later this year, the S-1 filing of behavior tracking unicorn Amplitude Inc. was made public today, and it shows a company with increasing losses.

Amplitude had previously announced that it had confidentially filed its direct listing paperwork with the U.S. Securities and Exchange Commission in July.

For the year ended Dec. 31, Amplitude reported revenue of $102.5 million and a net loss of $23.7 million, or 98 cents per share. For the six months ended July 30, revenue came in at $72 million, up from $46 million in the first half of 2020, with a loss of $16.5 million, or 57 cents per share.

Through the six months to the end of July, total operating expenses rose to $65.9 million, from $49 million year-over-year. Sales and marketing drove the increased cost, increasing to $36.8 million, up from $25.4 million in the same half of 2020.

Amplitude warned in its filing that the losses will increase going forward. “We expect our costs and expenses to increase in future periods,” the company said. “In particular, we intend to continue to invest significant resources in the development of our Digital Optimization System… the development or acquisition of new products, features and functionality, and improvements to the scalability, availability, and security of our platform,” along with other expenses.

The figures are not positive coming into the direct listing, but likewise, the company has seen solid revenue growth and investors will be looking past rising short-term losses to where Amplitude might be in three to five years from now.

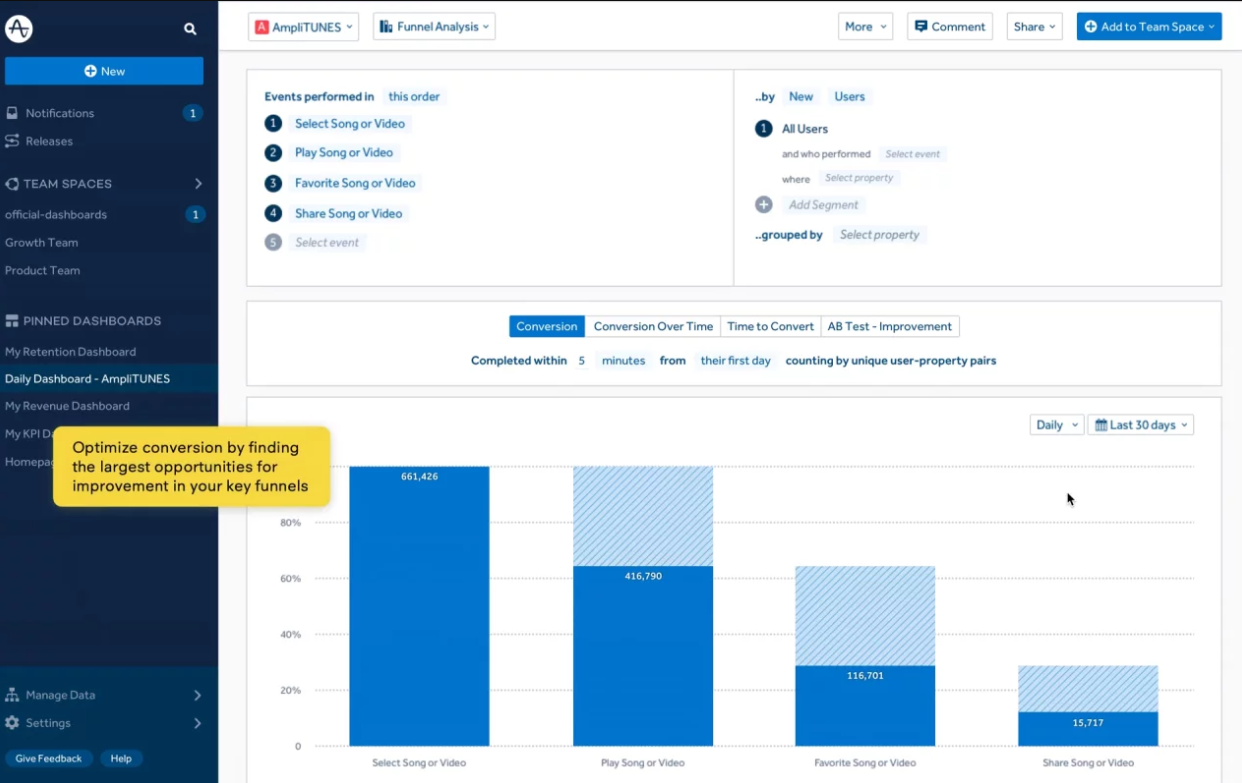

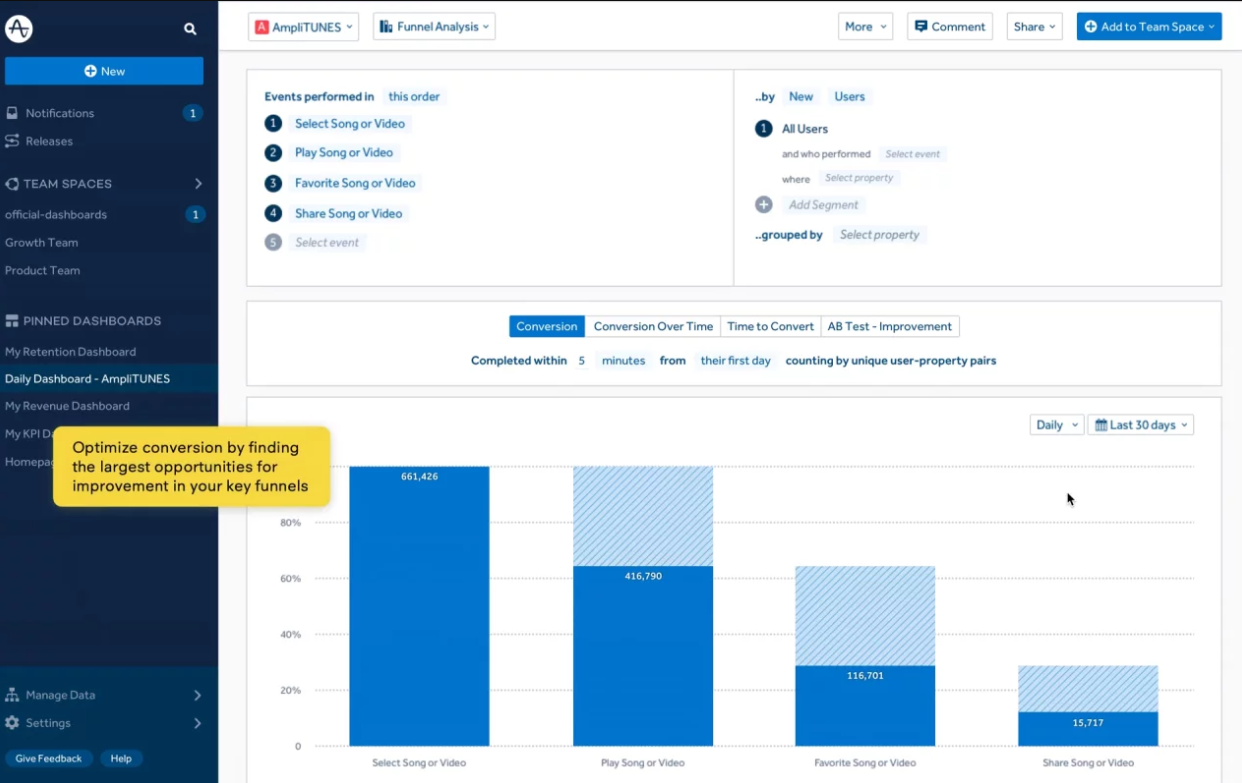

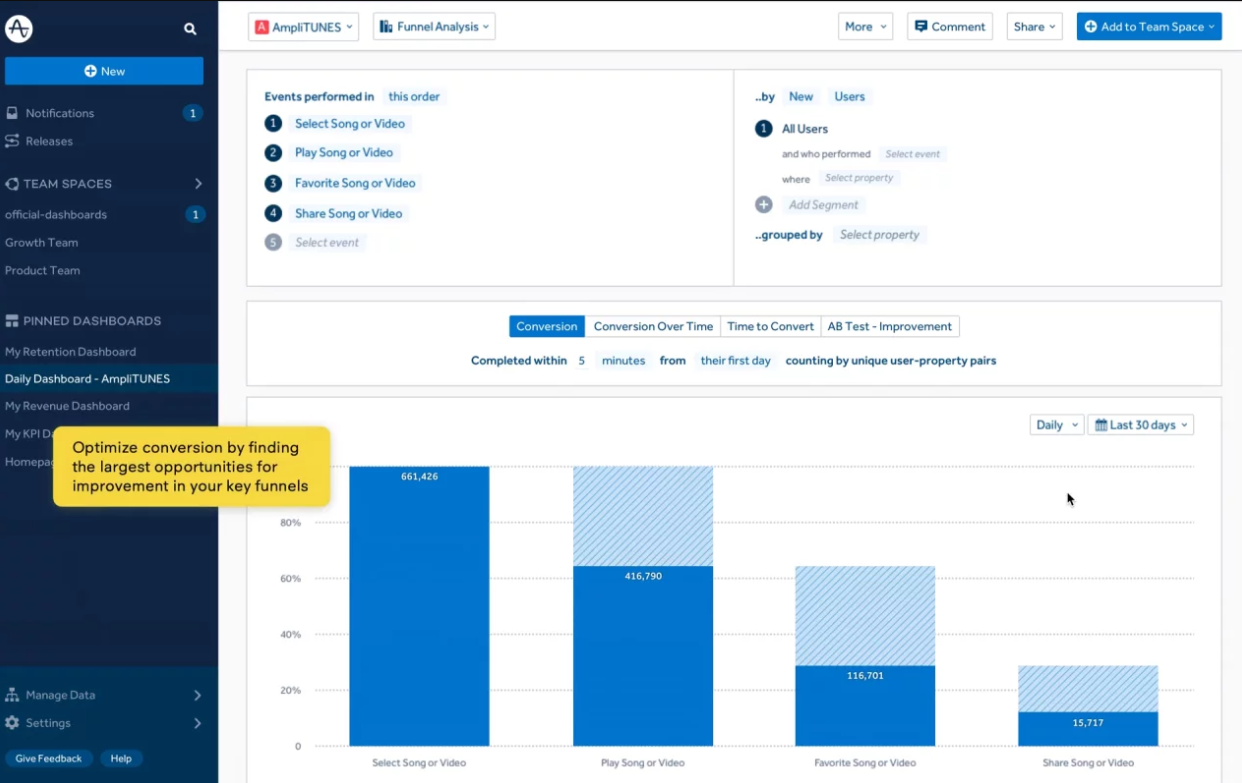

Founded in 2012, Amplitude provides product intelligence tools designed to help teams run and grow digital businesses. Amplitude records how users interact with a service via the web and native apps to create a detailed picture of activity.

Amplitude’s service brings together information collected from different platforms into a centralized dashboard that automatically organizes everything without the need for manual cleansing. Visual controls enable users to weave the individual data points into meaningful patterns.

Clients include a range of Fortune 100 companies, with notable customers including NBCUniversal Media LLC, Burger King, PayPal Holdings Inc., Peloton Interactive Inc., Cisco Systems Inc., Atlassian plc and Instacart.

In an interview with theCUBE (below), Silicon Angle Media’s live streaming studio in March, Jennifer Johnson, chief marketing and strategy officer at Amplitude, explained that the company provides a missing link between digital products and business revenue.

“Once you’ve spent all this time and money and effort and probably millions of dollars … actually transforming, you have to optimize it. You have to figure out what digital products and digital investments you’re making,” Johnson said. “You build a product, you put it out to market and revenue comes out the other end. But how do you know if you’re building the right things in the first place?”

Coming into its direct listing, Amplitude has raised $336.9 million in venture capital funding, according to Crunchbase. Investors include GIC, IVP, Battery Ventures, Sequoia Capital, Sorenson Capital, Benchmark and Lead Edge Capital.

THANK YOU