The Business of Space

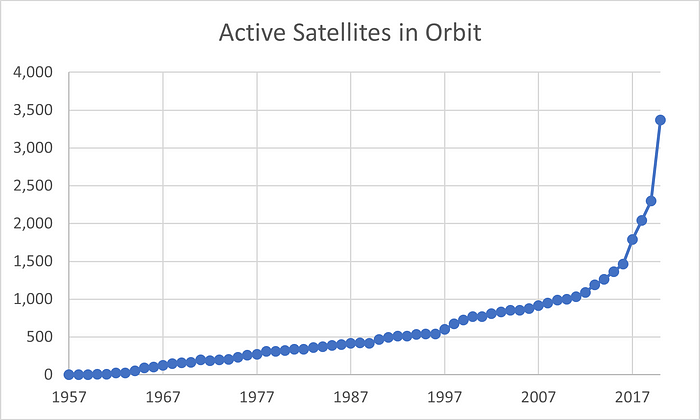

The space sector, and specifically the satellite market, is booming over the last few years. The number of satellites in orbit has surged, and in 2020 there were more than 3,000 active satellites orbiting overhead.

Although there are quite a few use cases for satellites, two comprise the majority — communications and earth observation. So, satellites in orbit are either looking at the Earth or relaying messages around and to the Earth. And, while some of these satellites are government satellites, many are owned commercial enterprises.

So, I was curious — satellite data and space-based communications are undeniably useful, but are they good businesses today? Let’s dive into the numbers and learn a bit more about the business of space!

Communications: A niche market transforming into a small market

Satellite communications is a market that is receiving a lot of buzz lately due to the major investments made by SpaceX (Starlink) and OneWeb. In fact, these two constellations have accounted for ~2/3 of satellite launches over the last few years.

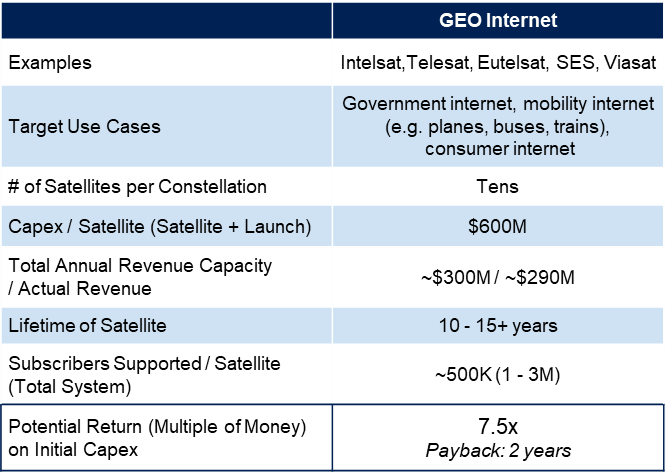

Traditionally, “satellite internet” has referred to massive satellites in geostationary (GEO) orbit, 20K miles above the Earth, from companies like Intelsat, Telestat, and Eutelstat. These provide costly but available internet in areas with limited alternatives for coverage. For example, if you have ever taken a satellite phone with you on a remote vacation, you were using one of these services.

Although most people have likely only used satellite internet sparingly, if at all, these have seemingly been fairly strong businesses. Providers of these services have been able to fill the capacity of their satellites, leading to strong return metrics on the satellites (~2 year payback on capex, 7.5x total return over 15 years).

Low earth orbit (LEO) comms satellite constellations, like Starlink, will have several differences. Rather than launching very expensive, but long-lived, satellites into deep orbit, they will launch cheap and disposable satellites into low earth orbit. Additionally, instead of providing low-bandwidth, “emergency” type services, they will aim to provide high capacity internet for daily use.

The economics of these LEO constellations are not proven, and actually, LEO communications constellations failed back in the 1990s. However, there is reason to think that demand for this high-throughput offering in areas outside of major cities has increased. If these constellations can fill their capacity, they will be very strong businesses, with 1-year payback on the satellites and ~5x return over 5 years.

However, one thing you will note is that these networks, although potentially good businesses, do not have huge subscriber capacity. Even with 1000’s of satellites, Starlink will only have the capacity to offer internet for a few million consumers. So, although this could be a godsend for folks in rural areas without other good options, most consumers will likely not use satellite internet in the near future.

Earth Observation: Are there enough buyers of this data?

The business model of earth observation satellites is simple. Pay to launch a set of satellites, and then get paid to take pictures of areas of interest. Each satellite launched has a certain imaging capacity (for example, it can take pictures of 1,000 sq. kms every day), and ideally will be able to fill most of that capacity with paying customers.

However, today major earth observation companies are “underfilled”, selling <20% of their total imaging capacity (and, in some cases, much less). See below my estimates of the “fill rate” of leading earth observation constellations, based on public filings and specs.

As you can see, the supply of earth observation imagery is outpacing demand today, even when accounting for extensive price discounting. What is driving this?

Well, the main customers of earth observation data today are governments. Maxar, for example, has built a $1B business in earth observation on the back of defense and space agency spend. Commercial spend, on the other hand, has been limited. The largest commercial customers of earth imagery data are large mapping companies (e.g. Google). Besides this, commercial demand has been inconsistent and limited. There just aren’t that many companies that have the need and / or the expertise to buy massive amounts of earth observation data. This has turned most earth imaging constellations, to date, from theoretically very profitable assets into marginal assets.

So, there is empty capacity in space today. Yet, it has also never been easier to launch satellites. SpaceX and other new entrants have brought down the price and increased the availability of launch, while “space as a service” companies like Loft Orbital, AstroDigital, OpenCosmos, and Muon Space provide turnkey services for getting a satellite to space. Leveraging these and other services, companies are planning on launching increasingly capable earth observation satellite constellations over the next 5 years. These new launches will continue to increase resolution and revisit rate, while also providing new types of imagery, including thermal and hyperspectral (which you can see examples of below).

However, what the earth observation market has demonstrated to date is that you cannot just assume “if you build it, they will come”. Although there are some mega-users of satellite data (government, big tech) that understand its value, managing and extracting insights from geospatial data at scale, and then using those insights to drive commercial ROI, is a non-trivial challenge.

So, although there will continue to be innovation in the data coming from space, I see a need for an equal level of innovation in figuring out how to turn this data into commercial value. Companies that are able to create products that leverage satellite imagery to accomplish commercial tasks, such that the commercial buyer does not have to be a geospatial expert to get value from the data, will unlock significant value across an array of industries.

Conclusion: The Final Frontier

Over the next few years, we will continue to see additional innovation in the space sector. These innovations will continue to make it easier to put satellites into orbit and manage them once they are there. These innovations will also increase the connectivity of millions and give us unprecedented views of our world. However, particularly in earth observation, I see an equally pressing need for terrestrial innovation in the use of this data, if this market is going to reach its promise.