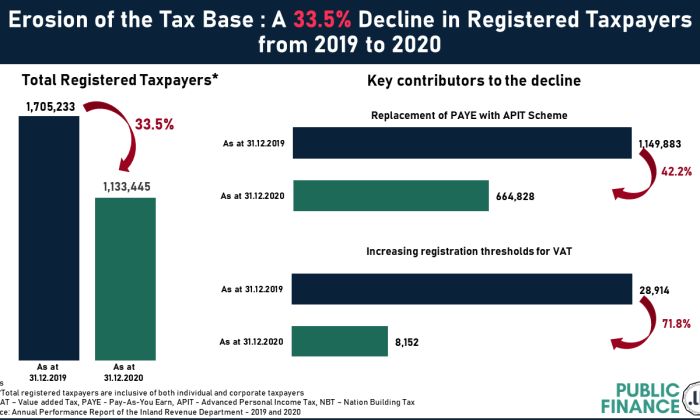

There has been a decline in Sri Lanka's tax base between 2019 and 2020 with 33.5% decline in the number of registered taxpayers (corporate and individual) in the country. This decline is most probably associated with the major changes in tax policy introduced in December 2019, particularly the increase in thresholds for Value Added Tax (VAT) and the abolition of Pay As You Earn (PAYE) tax.

On 01st January 2020, the mandatory PAYE Tax on any employment receipts to any resident or non-resident person was removed and on 01st April 2020 was replaced by the Advance Personal Income Tax (APIT) which is an optional scheme. The tax-free threshold for personal income tax was also increased from LKR 500,000 per annum to LKR 3,000,000 per annum, reducing a large number of tax payers from Sri Lanka's tax base.

Further on 01st January 2020, the threshold for VAT registration was increased from LKR 12 million per annum to LKR 300 million per annum and an exemption for VAT was provided to the Information technology and enabling services.

With the abolition of PAYE employees are expected to file their own income tax returns if their annual income is above the tax-free threshold. However, the increase in individual income tax files between 2019 and 2020 was just 11,607, which is insignificant when compared to the decline in PAYE/APIT registered taxpayers of 485,055