Confirmation of Payee (CoP): To be or not to be

‘To CoP, or not to CoP, that is the question

Whether 'tis nobler in the mind to suffer

The slings and arrows of outrageous scams,

Or to take arms against a sea of fraudsters

And by opposing end them delay’

Bank/PSP (Payment Service Provider) not offering Confirmation of Payee (CoP) could be aiding and abetting fraudsters. CoP links the name of the account holder to the Sort Code and account number. Without CoP the name is blank and the fraudster can become anybody, for example HMRC, Royal Mail, Amazon or your solicitor’s name. The Times article on June 4th by Ali Hussain1, showed how little has changed since 2015 when a scammer sent an email to the buyer with the right solicitor’s name but with the fraudster’s bank sort code and account number. The buyer lost £47,000.

The hallmarks of the situation are still here. The payor bank told the buyer that he had authorised the payment. The payee bank, being requested by the payor bank to return the money found no money in the account as it was immediately transferred away. While the buyer found out the real name on the account, the owner was out of the country and could not be pursued.

The scammers have adjusted to the Payment System Regulator’s mandated use of CoP by the top six banks (and three volunteers) by moving to using the other 100 banks for their payee accounts. The scammers are the first to bring up the topic with their victims, politely and not threatening, that their bank does not offer CoP so just to approve the payment2.

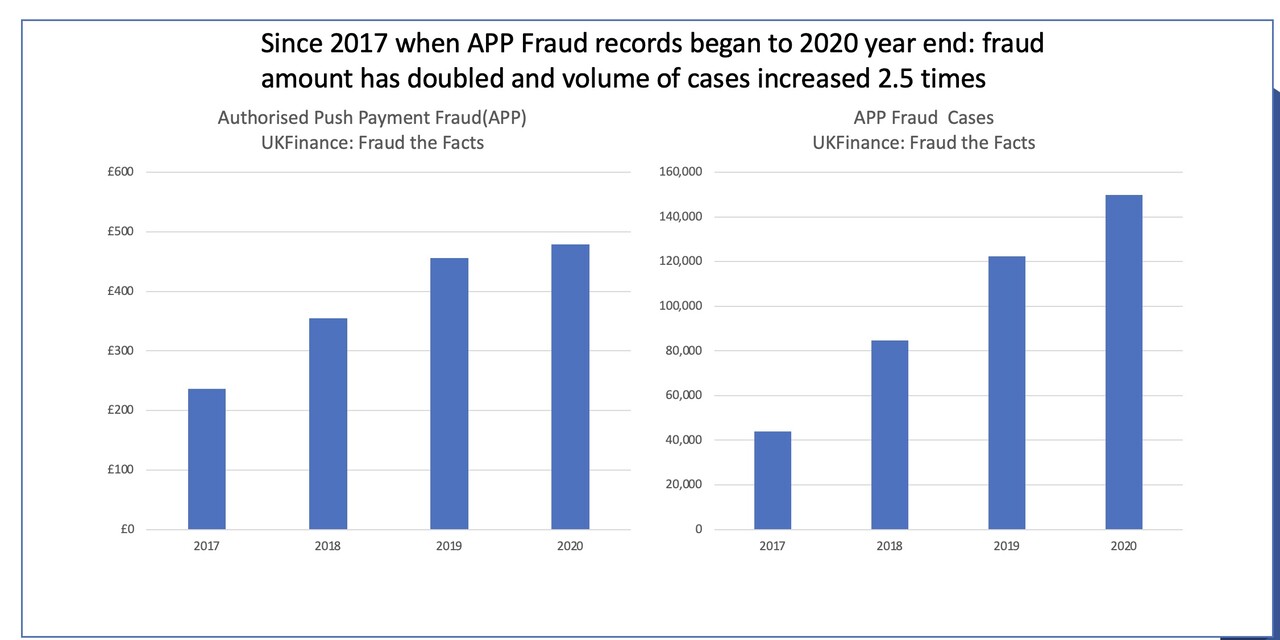

In the last 3 years APP fraud has doubled to £479 million. In the last six months, fraudsters are accelerating their activities in using non-CoP bank/PSP bank accounts, up 30% Q1 2021 from Q4 2020. At this rate APP fraud is likely to be £1 billion business with 300,000 cases per year by 2023/4. This does not include the emotional turmoil of the person being defrauded which cover a wide range of negative thoughts from embarrassment to suicidal.

The banking industry spends millions on fraud defences and case investigations yet the financial and emotional impact to consumers, business and charities is huge. Banks agree fraud is an issue but there are many, many priorities needed to be covered. Being compliant to regulations is one that will always find resources as bank/PSP banking licences are depend on being complicit.

The UK Government created faster payments 10 years ago by making it mandatory for money to move faster for economic growth. Today over fifty countries are implementing faster payments technologies with the UK still leading the world.

The UK has the opportunity to lead in preventing fraud in faster payments by tackling the whole fraud process covering banks, PSP and Open Banking’s Third-Party Providers. By implementing Confirmation of Payee (CoP) across the bank/PSP industry will set the stage for a consistent and uniform process that goes a long way to preventing digital payment fraud. This establishes a new standard in the UK and in all likelihood for the rest of the world.

1 https://www.thetimes.co.uk/article/i-know-who-stole-my-47k-savings-but-no-one-can-help-pqxjq9dmx

2https://www.thetimes.co.uk/article/the-day-i-confronted-my-scammer-7d5x5gsnk

(B2B) Cybersecurity Leader | Data Science | Machine Learning | Researcher

2yExcellent. "At this rate APP fraud is likely to be £1 billion business with 300,000 cases per year by 2023/4."

Technology Influencer, Blogger, Business Coach & Public Speaker. Open Banking/ Open Finance/ SWIFT/ Faster Payments/ Payments innovation.

2yThanks John. A very insiteful article. Faster payments has helped fraudsters no end.

Executive Chairman, RTGS Global

2ygood article John - thanks!

Experienced and tenatious Group Company Secretary

2yThe solution is simple but Banks may not like it. Prevent payments over say £500 from being made to banks and accounts where Confirmation of Payee is not provided or fails. Fraud would drop and adoption rise. Or require those not offering Cop to take the fraud liability. Essentially remove sort codes from Faster Payments and CHAPS that don't provide CoP

GM | NED | Board Advisor - Fintech & Payments

2yThanks John - fair summary. Mark Bish Olivia Armstrong