More than 20 million — or 49.7 percent — of the almost 41 million renters in the U.S. are considered cost-burdened, according to a recent report from Apartment List.

A household is commonly considered to be “cost-burdened” if the cost of rent takes up 30 percent or more of the household income.

To see how the top 25 cities with the most renters fare in cost-burden rate, check out the slideshow at the top of the story.

Houston mirrored many of the national trends around affordability. Almost one in two renters in Houston pay 30 percent or more of their income on rent — with 24.5 percent, or nearly one in four households, paying 50 percent or more.

With a cost-burden rate of 49.3 percent, this means there are 434,102 households in Houston paying 30 percent or more of their income to housing.

From 2017 to 2018, Houston saw the cost-burden rate increase by 0.9 percentage points with an additional 19,668 cost-burdened households, while the overall number of renter households increased by 24,144 to 879,696.

One of the causes of the increase in cost-burdened households was the disparity between how fast median rent and median renter income grew. In the one-year period, Houston renters saw the median rent go up 2.15 percent, while median renter income actually decreased 0.25 percent, according to the report.

From 2008 to 2018, the difference between the two was larger; the median rent increase by 16.1 percent, while income grew only 11.4 percent.

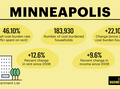

Among the nation's 25 largest metros, there are only six where renters could comfortably afford median rent with the metro’s median income, according to the report. Those metros are Charlotte, North Carolina; Dallas; Minneapolis; Phoenix; San Francisco; and St. Louis.

Apartment List Chief Economist Igor Popov calls the reversals in positive trends over the past couple years a troubling sign.

“I think it's more of a continuation of some of the troubling trends and affordability that we've been seeing … over the last few years,” said Popov. “We kind of took a little bit of a U-turn to go back in the wrong direction on affordability with this latest census release.”

Popov said that while the data gives good insight on housing trends, there are a lot of nuances that must be understood.

Apartment List sourced the data in its report from the Census American Community Survey.