A national, bipartisan campaign by state legislators

Creating an agreement among states to phase out corporate tax giveaways and implement best practices in economic development

Starting with an end to poaching businesses from other member states

Filed in 15 states this year so far; passed the Utah House last year!

Legislative Leaders for a Level Playing Field

Our Work

The bill

State legislators around the country are working to pass similar bills to create a national Agreement to Phase Out Corporate Giveaways. The compact would outlaw the worst form of corporate welfare: poaching an existing business in another state with taxpayer money. Under the bill, no state could offer taxpayer dollars to induce a facility in another state that has joined the agreement to move to the offering state.

The board

To overcome the prisoners dilemma of every state wanting to get out of the wasteful game of competing for jobs with taxpayer dollars but none wanting to unilaterally disarm their entire program, the agreement creates a Board of appointees from each state that will draft standard amendments to the compact for states to consider implementing for incremental improvements to phase out the giveaways over time.

The process

Legislators from both parties and around the country have come together to liberate their states from the endless cycle of subsidizing big companies at the expense of everyone else. This site is a resource to keep open lines of communication as bills move through their legislative processes in 2020.

Take action now: click to tell your legislators to join the campaign and support the bill.

States with filed legislation

2021 session

- Alabama House HB367 (Sorrell)

- Arizona Senate SB1701 (Mendez)

- Connecticut House HB6176 (Elliott)

- Delaware House HB10 (Kowalko)

- Florida House HB983 (Eskamani)

- Hawai’i Senate SB359 (Gabbard)

- Hawai’i Senate SB531 (Rhoads)

- Hawai’i House HB16 (Takumi)

- Illinois Senate SB674 (Villivalam)

- Illinois House HB95 (Halpin)

- Illinois House HB145 (Morgan)

- Iowa House HF598 (Mascher)

- Massachusetts House HD4009 (Mark)

- Michigan Senate SB524 (Ananich)

- Michigan House HB4971 (Johnson)

- New York A3718 (Kim)

- Pennsylvania House HB873 (Rabb)

- Rhode Island Senate S46 (Bell)

- Rhode Island House H5316 (Place)

- Utah Senate SB190 (McCay)

- West Virginia Senate SB95 (Romano)

2020 session

- Alabama House HB132 (Sorrell)

- Arizona Senate SB1482 (Mendez)

- Connecticut House HB5460 (Elliott)

- Delaware House HB288 (Baumbach)

- Florida House HB917 (Eskamani)

- Hawai’i House HB1610 (Takumi)

- Hawai’i Senate SB2003 (Rhoads)

- Hawai’i Senate SB2751 (Gabbard)

- Illinois Senate SB2502 (Villivalam)

- Illinois House HB4138 (Morgan) (House audio committee here)

- Iowa House HF2065 (Mascher)

- Maryland House HB525 (Stewart)

- New Hampshire House HB1132 (Plett)

- New York Assembly: A8675 (Kim)

- Rhode Island House H7404 (Place)

- Utah House HB270 (Roberts) – Passed House!! Audio committee testimony

- West Virginia Senate SB121 (Romano)

2019 session

- Arizona Senate: SB1322 (Mendez)

- Illinois Senate: SB203 (Hutchinson)

- Missouri House: HCR 48 (Lavender)

- New York Senate: S3061 (Salazar)

- New York Assembly: A5249 (Kim)

- West Virginia: SB 643 (Romano)

Contact

Get in touch with state legislative leaders directly on social media

- Arizona Senator Juan Mendez

- Arizona Rep Athena Salman

- Alabama Rep Andrew Sorrell

- Connecticut Rep Josh Elliot

- Delaware Rep Paul Baumbach

- Delaware Rep John Kowalko

- Florida Rep Anna Eskamani

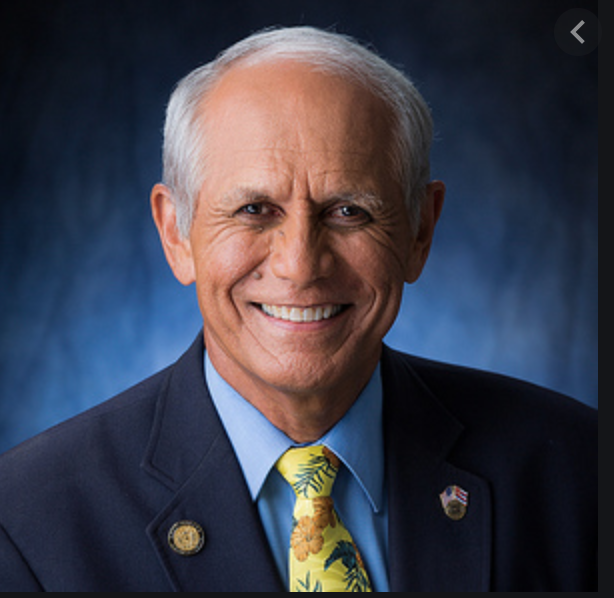

- Hawai’i Senator Mike Gabbard

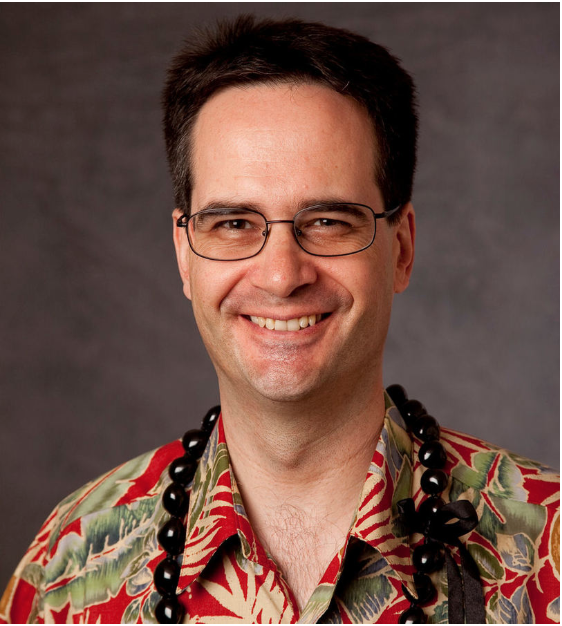

- Hawai’i Senator Karl Rhoads

- Illinois Senator Ram Villivalam

- Illinois Rep Bob Morgan

- Maryland Rep Vaughn Stewart

- New York Rep Ron Kim

- New York Rep Phil Steck

- New York Senator Julia Salazar

- Pennsylvania Rep Chris Rabb

- Pennsylvania Rep Sara Innamorato

- RI Senator Samuel Bell

- RI Rep David Place

- Utah Rep Marc Roberts

Send a Message to the coalition

Reports and press

- Boondoggle Newsletter: Michigan’s Midwestern Pact. Boondoggle Newsletter 6/21

- Center Square Michigan: Bills aim to end taxpayer handouts to out-of-state companies 6/21

- Pittsburgh Post-Gazette: Pennsylvania needs an interstate compact to end corporate handouts 3/21

- Bloomberg: Eleven states file bills to curtain tax incentive poaching 2/21

- Boston Globe: Unlikely duo back bill to curb ‘corporate welfare’ A conservative Republican and a progressive Democrat call for an interstate compact to prohibit the ‘poaching’ of businesses 2/21

- Rhode Island House Republicans: RI House Republican and progressive Senate Democrat unite on compact 2/21

- Andrew Yang (presidential and NYC mayoral candidate) applauds the compact on Twitter 1/21

- Detroit News (Dick DeVos and Matt Haworth): Business tax breaks unfairly waste Michigan’s money 12/20

- Orlando Sentinel (Anna Eskamani): End corporate socialism in Florida so free markets can thrive 12/20

- Chicago Tribune: Fake jobs, fake news, fake FoxConn comes further into focus 11/20

- 10 steps states should take to end corporate giveaways 5/20

- Podcast: Interstate compact on tax incentives, Evershed Sutherland, 3/20

- Forbes: States seek tax incentives truce after Amazon HQ2, Tax Notes 3/20

- Deseret News: Utah bill seeks deal to stop enticing companies with millions in tax dollars. 2/20

- The Hill: States, cities rethink tax incentives after Amazon HQ2 backlash 2/20

- Bloomberg: Behind Amazon’s HQ2 Fiasco: Jeff Bezos was jealous of Elon Musk 2/20

- Stamford Advocate Editorial: Call a truce to economic border wars 1/20

- QC Times: New bill is part of national effort to phase out corporate tax incentives 1/20

- One Illinois: Bill seeks to end state competition in corporate subsidies 1/20

- Wall Street Journal: Economists Question the Benefits of Targeted Tax Breaks. States pay $30 billion a year to lure firms, but study finds incentives don’t seem to drive wider job growth. 1/20

- Journal of Economic Perspectives: Economists study on state of firm-specific tax incentives (referenced in WSJ story above) 1/20

- Mercatus Center testimony before the Utah legislation in 9/19

- CityLab: After Amazon HQ2’s retreat, New York State lawmakers target corporate welfare 9/19

- Prospect: Kansas and Missouri call a truce in corporate-welfare border war 8/19

- Mackinac Center: An interstate compact to eliminate corporate welfare 5/19

- Governing: With Amazon out of New York, some lawmakers seek multistate ban on corporate tax breaks 2/19

- Roll Call: State lawmakers seek ban on Amazon-like incentives 2/19

- Los Angeles Times editorial: Amazon played cities for suckers 9/18