Doubling Down on Dapper Labs

Today Dapper Labs is announcing a $305 million financing round, with strong participation from our crypto and growth funds. We first invested in Dapper over three years ago when they were working on CryptoKitties. CryptoKitties pioneered an exciting new NFT experience, but also exposed the limitations of the technology of the time, including complex user interfaces and high transaction fees. The Dapper team decided to double down, building a new blockchain called Flow and a new marquee application on top of Flow called NBA Top Shot.

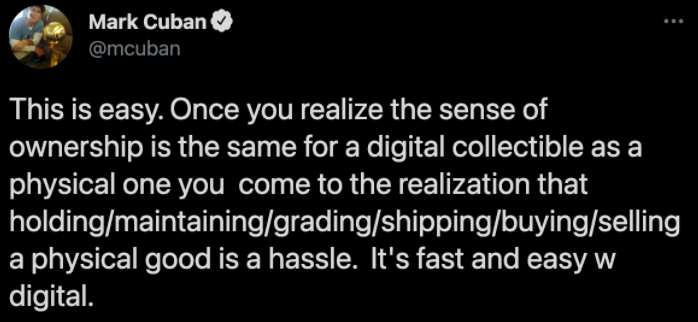

Today, NBA Top Shot is one of the fastest growing marketplaces on the internet, with over $400 million in primary and secondary sales since launching just six months ago. At the heart of Top Shot are digital collectibles called moments which are derived from NBA games. Moments feature on-court video, heroic action shots, game stats, and guaranteed authenticity in limited editions. They are NFTs that live on the blockchain, which means users truly own them: they can keep them, display them, trade them, sell them, or whatever else they want to do, in perpetuity. Because the blockchain is permissionless, third-party developers are building new social and gaming experiences that will make moments even more engaging. Think old school basketball cards, updated for the modern internet.

For the NBA and the league’s players, Top Shot is a new and unique way to connect with fans like never before. NBA players open packs with fans, transact with fans, and advocate for moments to be created based on their own and teammates’ plays. The economics for the NBA and players are superior as well. With physical cards, the NBA may receive a royalty fee upon their initial sale of cards, but no incremental revenue on secondary transactions; with Top Shot, the NBA and the players association receive a commission on both primary and secondary transactions. Given the fan loyalty and engagement it creates, along with the superior economics, we believe most leagues and many other consumer products will embrace NFTs. Dapper has struck deals with UFC, Dr. Seuss, and Warner Music, with many more on the way.

Top Shot wouldn’t be possible without Flow, a blockchain designed from the ground up for games and NFTs. Flow uses a novel proof-of-stake architecture that dramatically reduces fees and environmental impact. It also strongly emphasizes the developer experience, with an accessible programming environment and robust support for application composability. Flow currently has over 1.3 million user accounts and over a hundred known developer groups building on top of it.

We are thrilled to continue our partnership with Dapper as they continue to take NFTs and blockchain gaming mainstream.

###

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.