The promise of providing financial services to underserved communities around the globe is a key motivation for our work, and we’ve been concerned by a counterintuitive trend that’s taken root in Western economies over the past few decades. A growing share of GDP is flowing to the finance sector, but millions remain shut out of basic financial services. Meanwhile, in much of the rest of the world, Chinese fintech has emerged as a leading contender for banking the unbanked. A growing chorus of voices ranging from Senators Cynthia Lummis and Pat Toomey on the right to Senators Elizabeth Warren and Kyrsten Sinema on the left are acknowledging that digital currency may be a powerful tool to help get “more people into the system.”

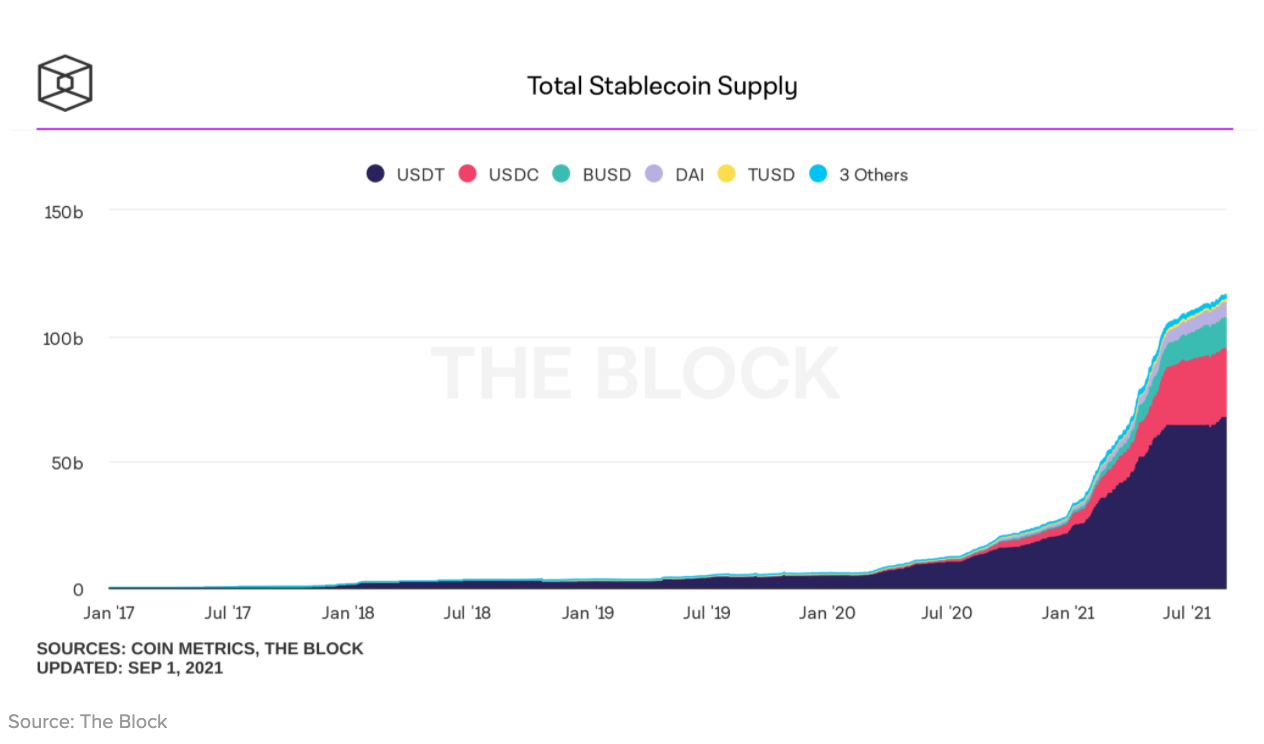

Stablecoins — privately-issued cryptocurrencies that are pegged to a stable asset such as the U.S. dollar — have an important role to play in the next generation of democratized financial services. The total supply of stablecoins has increased from $20B to more than $125B over the past year. Naturally, this staggering growth has prompted interest from lawmakers and regulators. America’s technological and financial edge has always depended on business leaders and policymakers collaborating to ensure that the private sector can experiment and build, while appropriate regulatory regimes help to manage the real downside risks that might otherwise harm consumers.

Good regulation establishes a framework and vision for how technology can affirmatively benefit people.

Along with stablecoin technology, smart, effective stablecoin regulation will be critical in protecting consumers, preventing financial crime, and preserving the safety and stability of the financial system. Policymakers should focus on three core principles when considering such regulation: (1) advancing equitable access; (2) ensuring the integrity of issuers and reserves; and (3) strengthening the technological and operational resilience of stablecoin networks.

There are many different types of stablecoins already — and the market continues to innovate — so one-size-fits-all regulation is a poor choice if we want to take advantage of the technology and curtail its risks. We are still early in this game. The total market cap of stablecoins is approximately that of Starbucks — a company that, coincidentally, operates one of the largest mobile payments platforms in the country. Now is the time to get the right framework in place for how we want to use this technology to benefit society.

Today’s stablecoin landscape

Before we explore these principles in greater depth, we want to set the stage. The value of the three largest stablecoins is up roughly 10x from a year ago.

Legacy firms including Visa, Mastercard, JPMorgan Chase, and Wells Fargo are piloting stablecoin integrations as a way of making their existing infrastructure more efficient. More importantly, stablecoins are also unlocking broader access to financial services by underpinning new consumer finance products that disintermediate the traditional financial sector — the clearest example being their applications in decentralized finance or DeFi. Stablecoins have been a core enabling technology behind the growth of DeFi, which requires low volatility, on-chain assets for use in everyday transactions. Indeed, the concept of “banking the unbanked” may become a relic of the past if stablecoins permit access to core financial services without a bank involved at all.

Stablecoin issuers generally use one of two mechanisms to keep stablecoin value pegged to that of a reference asset:

- Asset-backed stablecoins maintain asset reserves in fiat or crypto as collateral and allow price arbitrage on the demand side to keep prices constant

- Algorithmic stablecoins use the automated execution of smart contracts to maintain price stability

One concern with asset-backed stablecoins is whether the underlying assets are safe, and whether they create touchpointswith the traditional financial system that might result in systemic risk. For algorithmic stablecoins, the main risks today are technological and operational — whether the smart contracts perform as they should, whether they are vulnerable to disruption by malicious actors, and whether the economics and incentives of the protocol have unintended consequences that can be easily identified and appropriately mitigated.

This is important to flag as we move into our policy discussion, since a one-size-fits-all solution doesn’t work to address these very different concerns.

Principles for stablecoin regulation

We believe policymakers should embrace responsibly regulated stablecoins. Leveraging the thriving ecosystem of private stablecoins can help the U.S. act quickly to win the emerging geopolitical arms race in financial innovation. This is a critical consideration. Going forward, a country’s choice of digital infrastructure may be as consequential in shaping its geopolitical orientation as membership in NATO or the Warsaw Pact was in generations past. USD-denominated stablecoins can help ensure the ongoing primacy of the U.S. dollar and the centrality of the U.S. financial system in the world economy.

These points are not universally understood among lawmakers and regulators. Some recent legislative proposals would give the Treasury Secretary discretion to prohibit fiat-backed stablecoins entirely. Others have suggested that the Glass-Steagall Act already provides the relevant authority to the Department of Justice to pursue criminal sanctions against issuers. Rather than leveraging the opportunities presented by dollar-based stablecoins, these approaches would harm core national interests — which brings us to the need for thoughtful regulation.

Good regulation not only deters bad actors and manages downside risks; good regulation establishes a framework and vision for how technology can affirmatively benefit people. With this in mind, we propose three principles for responsible stablecoin regulation: it should advance equitable access, ensure the integrity of stablecoin issuers and reserves, and strengthen technological and operational resilience of stablecoin networks.

Advance Equitable Access

- Build equity into the regulatory architecture. The regulatory framework for stablecoins should first and foremost ensure equal access to all consumers, and that existing barriers to access can be overcome. As Senator Robert Menendez (D-NJ) pointed out in a recent hearing, underbanked Americans, particularly those without ready access to credit cards, struggle to participate fully in the economy. This is due in large part to the costs, inefficiencies, and barriers imposed by the traditional financial system. Instead of replicating the mistakes and limitations of the current financial system, policymakers should embrace stablecoins as a basic building block with which society might begin to lessen or remove these barriers by revamping our underlying financial infrastructure — laying new rails that improve efficiency and competition.

- Increased public awareness and understanding of stablecoins is necessary to ensure that consumers can responsibly benefit from financial innovation. The private sector, government, and civil society all share an obligation to promote transparency and educate consumers so they are fully aware of the risks and opportunities associated with new products and services. The upshot of blockchain-based infrastructure is that consumers can benefit from stronger auditing and disclosure than anything we have in consumer finance today. Traditional disclosure-based regimes can and should be modernized to leverage the benefits of the technology, ensuring that disclosure standards focus on meaningful consumer understanding of the products and services available to them.

Ensure the Integrity of Stablecoin Issuers and Reserves

- Provide a clear and predictable path for issuers to enter the marketplace and meet regulatory expectations. The states, rather than the federal government, have so far led the process of granting licenses to stablecoin issuers as money transmitters. The federal government should also seriously consider the viability of authorizing stablecoin issuers under federal law. The OCC began this process by issuing three conditional National Trust Bank charters to Paxos, Anchorage, and Protego, alongside a raft of guidance related to stablecoins, including on national banks’ authority to custody stablecoin reserves and guidance regarding their authority to use stablecoins as a means of payment. While the Biden Administration is reviewing this activity, regulators should give serious consideration to creating options for new stablecoin issuers to enter the market based on their particular circumstances. For instance, certain stablecoin issuers may seek bank charters (which could accelerate fractional-reserve stablecoin banking) or narrow bank charters (if they are willing to hold only central bank reserves and U.S. treasuries). Meanwhile, some stablecoins are governed by protocols made up of highly auditable smart contracts that create price stability algorithmically without any human involvement. For these protocols a bank charter would be both incongruent and unnecessary. Given this diversity, policymakers should put forward a menu of options for stablecoin regulation that are fit for purpose. There are real world consequences associated with continuing regulatory ambiguity. Regulatory uncertainty led to the closure of a promising project in this space two years ago, and the lack of clarity is continuing to suffocate innovation and drive talent offshore.

- Create a clear framework for how asset-backed stablecoin issuers must audit and disclose their reserves. Since 2018, Circle and the Centre Consortium have released attestations from Grant Thornton LLP on the reserves backing USDC. Regulators should work with issuers and auditors to adopt specific standards that govern what periodic attestation must be provided regarding asset-backed stablecoin reserves. Moreover, regulators should ensure that — like the Grant Thornton reports — disclosures are short and understandable to the average consumer. For their part, stablecoin issuers need to be proactive about ensuring transparency. For decentralized asset-based (crypto collateralized) protocols, the data exists on-chain, so collateral can be verified relatively easily; for those issuers with off-chain assets, disclosures should include regular public audit reports by recognized accounting firms.

- Leverage the compliance benefits of stablecoins. Given their auditability, blockchains provide national security and law enforcement agencies novel ways to detect illicit activities and enforce sanctions. Rapid technological innovation also holds the promise of programming regulatory compliance into smart contracts, reducing or eliminating operational deficiencies that have plagued traditional compliance programs. With the appropriate privacy-first architecture in place, public-private collaboration on stablecoins — such as creating shared analytics tools and data repositories — can significantly improve on the status quo. Contrary to popular belief, the existing system does not do enough to detect or deter such conduct.

Strengthen Technological and Operational Resilience

- Collaborate with market participants on specific guidance regarding crypto-collateralized and algorithmic stablecoin validation and governance. Algorithmic stablecoins have the capacity to unlock great economic potential by creating a stable and decentralized medium of exchange. Many projects in this space are governed by DAOs, which can be challenging for regulators. As a result, policymakers should first focus on working with established participants to develop guidance on appropriate standards for validation of their underlying financial models and governance of their protocols. An enormous amount of thought has been invested in the promises of DAOs governing projects like stablecoins and ways to remedy the attendant risks. Policymakers and regulators have an opportunity to get up to speed and actively engage in this conversation. Moreover, a significant majority of crypto-native stablecoin projects are transparent and auditable with respect to their stabilization mechanisms, which could align naturally with disclosure-based frameworks updated for the realities of the 21st century.

- Favor resilience and redundancy. The conversation about stablecoins goes hand-in-hand with a conversation about CBDCs (central bank digital currencies), cryptocurrencies that are issued by governments and that represent sovereign obligations. Yet CBDCs come with their own set of challenges — particularly around privacy and security. These issues are exacerbated when in the hands of authoritarian regimes. These privacy and security risks can and should be solved, but CBDCs and stablecoins can coexist. The most important objectives should be ensuring that U.S. developers don’t fall behind and that the U.S. dollar remains the base currency for this emerging industry. Fostering a range of USD-backed stablecoin projects will support these objectives, and enhance resilience of our financial infrastructure by avoiding a single point of failure.

***

Stablecoins are uniquely positioned to be the cornerstone of a better, more inclusive financial system. Constructive engagement between the public and private sectors has been the cornerstone of America’s success in building a financial sector that is both trusted and dynamic. There’s no reason this can’t continue to be true as the financial sector undergoes its most radical transformation in a century.