Robo-advisor Unhedged has raised $500,000 in a pre-seed round ahead of the release of the fintech’s investor app.

The round was backed by Canadian venture capital firm Loyal VC, plus 18 individual investors, predominantly through founder Peter Bakker’s MBA network.

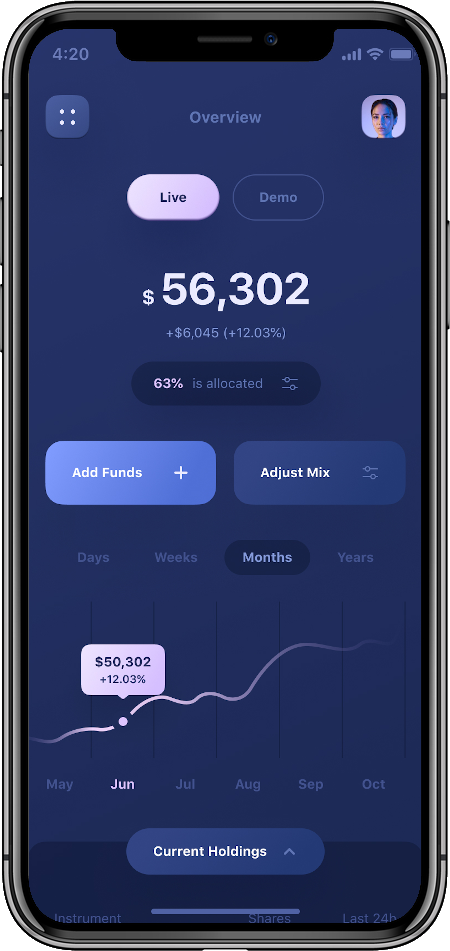

The raise is being used to build the headcount, as well as enabling the team build out and launch their first user-facing app, called Unhedged app, offering robo-advice.

Unhedged founder Peter Bakker.

Founder Peter Bakker has spent more than a decade building algorithms to trade in overseas financial markets.

He said Unhedged’s mission of “bringing ‘algorithmic returns’ to everyday investors using AI” has resonated with angel investors and early-adopters.

“For those aiming to outperform the market, Unhedged will put a now familiar user-friendly face on algorithmic investing,” he said.

“We’ve done extensive testing on the three algorithms we’re taking to market and believe investors are going to be drawn to the uniqueness of our offering. The algorithms have many advantages over humans – they simply read the data and make moves, they’re always ‘on’ and never emotional.”

The serial entrepreneur he got into options trading after a successful exit from a prior venture. He wanted to build an algorithm that could mimic the success his father, a former F-16 fighter pilot, had with day trading.

By 2018, Bakker developed hundreds of algorithms that were popular on Quantopian, a then-community of professional and self-taught quants building and sharing open-source trading algorithms. Around that time he started layering AI into his aglorithms.

He confesses that goal of beating his dad’s trading record still eludes him, but four of those algorithms performed strongly in extensive back-testing.

The Unhedged app will bring an exciting new dimension to the robo-advisor landscape for Australian investors, Bakker says and one potential source of funds Bakker is targeting in a low interest rate environment is mortgage offset accounts.

“It used to be a great investment but now it only yields a saving of 3%. How can you retire on a return of 3%? People need to find higher yielding investments, but let the advancement in technology help to balance risks properly,” he said.

“We believe Unhedged is a step in the right direction.”

Bakker said fintech startups and robo-advisors that have emerged in recent years have done a great job in bringing instruments like ETFs to everyday investors, but the remain passive investments and more could be done to deliver better returns safely.

“We believe that the wealth management industry needs to work toward performance-based structures instead of getting paid for doing little. That’s why the majority of our fees only get charged when you overperform the benchmarks,” he said.

Unhedged will charge a 0.49% fee for assets under management when there’s more than $5000 in your fund, plus a $4.99 monthly usage fee. And if you beat the market using Unhedged, the app takes a 20% clip of that additional return.

The 20% overperformance charge is in line with the industry standard.

“Unhedged is on edge of AI/machine learning and robo-investing, but we do this to push the envelope of what is possible,” Bakker said.

The algorithms operate in a fund structure – a unit trust – governed by an AFSL. Investors can assign money to the algorithms and that will change their mix inside the fund.

Unhedged has a new CTO, Glenn Vanbavinckhove, an ex-CERN researcher turned hedge fund quant, as the fintech looks to launch its first AI-powered algorithmic investing service for sophisticated investors next month, followed by the mobile app for retail investors in July.

More details on Unhedged are available here.

Trending

Daily startup news and insights, delivered to your inbox.