Two top House Democrats are pushing the CEOs of ExxonMobil, Chevron, BP and Shell to scrap their stock buyback and dividends during the war in Ukraine and shift funding for those shareholder rewards towards lowering prices at the gas pump.

“As Vladimir Putin’s illegal war against Ukraine is raising gas prices and hurting Americans at the pump, fossil fuel companies are taking advantage of the crisis by raking in record profits and spending billions of dollars to enrich their executives and investors,” House Oversight Chairwoman Carolyn Maloney and Rep. Ro Khanna, chair of the environment subcommittee, wrote in a letter Monday.

The lawmakers called for the four oil companies to suspend stock buybacks and dividends for “the duration of the Ukraine crisis” and “immediately use those funds to help Americans suffering from high prices at the pump.”

“Big Oil must immediately stop profiteering off the crisis in Ukraine,” the lawmakers wrote.

Beyond spending on new supply of oil and gas, the lawmakers urged the oil companies to make “meaningful investments” in solar, wind and other forms of clean energy to address the climate crisis.

‘Fleeced at the pump’

The oil industry is strongly opposed to the proposal.

“This is another example of a gimmick rather than a real policy solution. I dismiss it,” Mike Sommers, CEO of the American Petroleum Institute, told CNN in a phone interview on Tuesday.

Sommers argued policymakers should focus on encouraging more domestic production, including authorizing a new five-year plan to add supply from the Gulf of Mexico. The API head noted that just six months ago Khanna slammed US oil executives at a hearing for failing to cut production to address the climate crisis.

“This is a member of Congress who has proven he’s a lot more interested in political grandstanding than actually tackling the roots of American supply constraints,” Sommers said.

Khanna responded on Tuesday, by explaining he is in favor of boosting production in the short term but is looking for a renewable energy “moonshot” in the longer term.

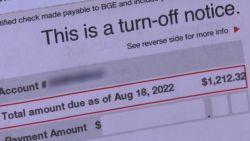

“Big Oil is to blame for the price volatility and sudden increase of gas by 46 percent,” Khanna told CNN in an email, adding that oil companies should be taxed on their excess profits. “Many Americans are livid that they are getting fleeced at the pump while Big Oil pockets billions.”

A Shell spokesperson told CNN that Gretchen Watkins, president of Shell USA, plans to address this and other issues at a hearing later this week.

Exxon (XOM), Chevron (CVX) and BP (BP) did not respond to requests for comment.

In a statement last week, Chevron noted that it announced plans in December to increase capital spending by 20% this year, translating to more than $8 billion of investments in its US upstream and downstream businesses. Chevron added that it expects to grow production in the Permian Basin beyond 1 million barrels per day.

$44 billion on buybacks and dividends

The spotlight on buybacks and dividends comes the oil industry faces scrutiny from critics, including President Joe Biden, for failing to invest enough of their profits in new supply that would ease near-record gas prices.

Although some politicians blame high gas prices on environmental policies and regulation, oil executives themselves have recently pointed the finger at Wall Street.

Fifty-nine percent of oil executives said investor pressure to maintain capital discipline is the primary reason publicly traded oil producers are restraining growth, according to a Federal Reserve Bank of Dallas survey released late last month. Shareholders would prefer oil companies return cash through dividends and buybacks, instead of spending on expensive drilling projects that would add supply.

Exxon, Chevron, BP and Shell spent more than $44 billion through buybacks and dividends last year and plan to spend at least another $32 billion on the shareholder rewards this year, according to the letter from House Democrats. All four companies have announced plans to ramp up share buybacks, the letter said.

Of course, suspending buybacks and, especially dividends, could make it even harder for oil companies to attract the capital required to fund expensive drilling programs.

The CEOs of Exxon, Chevron and senior executives from other major oil companies are scheduled to testify before Congress at a hearing on Wednesday titled “Gouged at the gas station: Big Oil and America’s pain at the pump.”