[orc]India once again topped the list of countries with the largest inward remittances as per a new World Bank report. The remittance amount has increased by 14% in one year.

India has yet again topped the list of countries with the largest remittances in the world. The total remittance across the globe amounted to a whopping $529 billion in 2018 as per the latest reports of Knomad’s Migration and Development brief of the World Bank group.

Remittances to India up 14% in the last one year

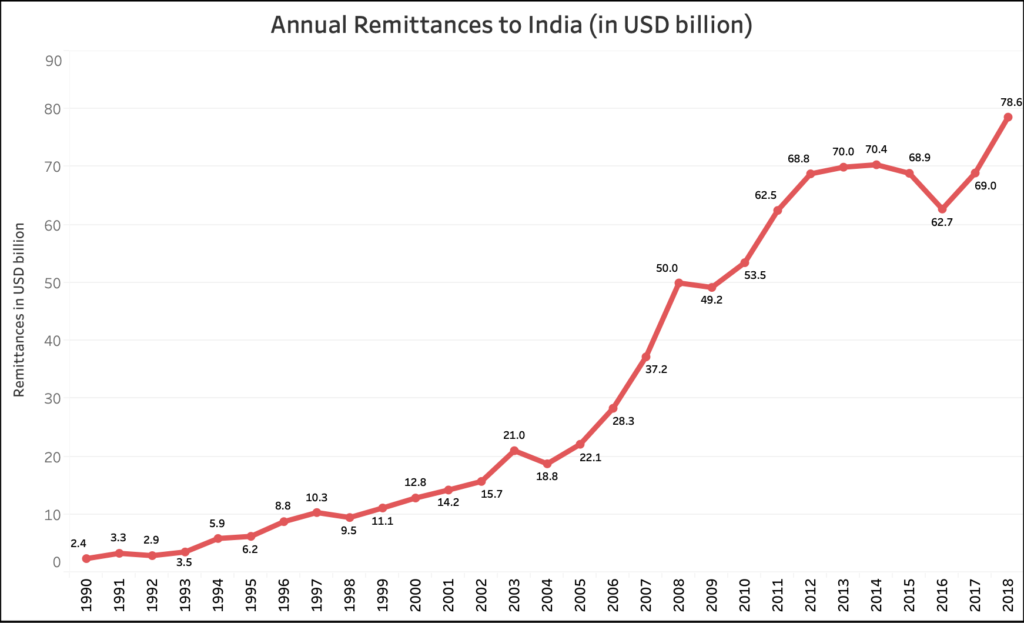

It is a known fact that India has the largest diaspora in the world. In line with this, remittances to India have increased to $78.6 billion in 2018 compared to $68.9 billion in the preceding year, a substantial increase of 14%. This also represents a 25% increase compared to the low of $62.7 billion in 2016. Remittances to India have increased continuously since 1990 except for decrease in a few years. Remittances to India also make up for 11.4% of the total global remittance inflow.

As per the latest data, the flow of remittances to low and middle income countries has also shot up from 8.8% in 2017 to 9.6% in 2018. It has overtaken both the Foreign Direct Investment and Official Development Assistance to these countries.

Remittances- money which is sent back home by migrant workers- contribute by and large to the development of an economy. For some countries, like Kyrgyz Republic, Tonga, Tajikistan and Haiti, remittances constitute more than 30% of their GDP.

40% of International Migration were of Asian Origin

World Migration Report of 2018 shows that 40 % of the international migrations of the world were of Asian origin. India and China have the largest number of migrants living abroad. Of the top 20 migration corridors from Asia, the largest corridor is from India to United Arab Emirates. About 3.5 million Indians were residing here in 2015. Other important migratory movements from India have been to Pakistan (can be attributed to partition in 1947 as per the report), USA and Saudi Arabia.

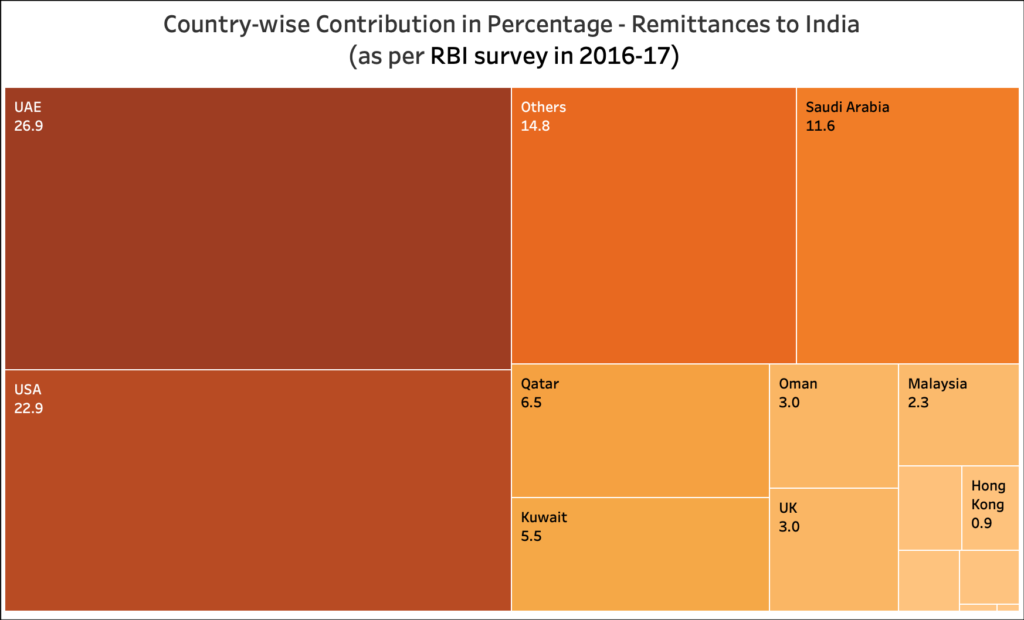

Gulf region (Middle-East) alone contributes more than 50% of the total remittances to India.

According to the Reserve Bank of India’s fourth round of survey of authorised dealers on India’s inward remittances in 2016-17, 26.9% of the remittances to India have been from the UAE. Another 22.9% contribution has come from the USA. Following them are Saudi Arabia and Qatar which contribute 11.6% and 6.5% respectively. Kuwait is next on line with 5.5% followed by Oman and the UK with 3% each. In other words, the contribution from the Middle-East (Gulf) countries alone constitutes more than 53.5% of the total remittances to India. This is not surprising considering that majority of the NRI population lives in the Gulf region. Of the total NRI population of India which is more than 13.1 million as per MEA data, 23.6% are in UAE, 21.4% in Saudi Arabia and 9.8% in USA. The Middle-Eastern countries account for more than 60% of the NRI population.

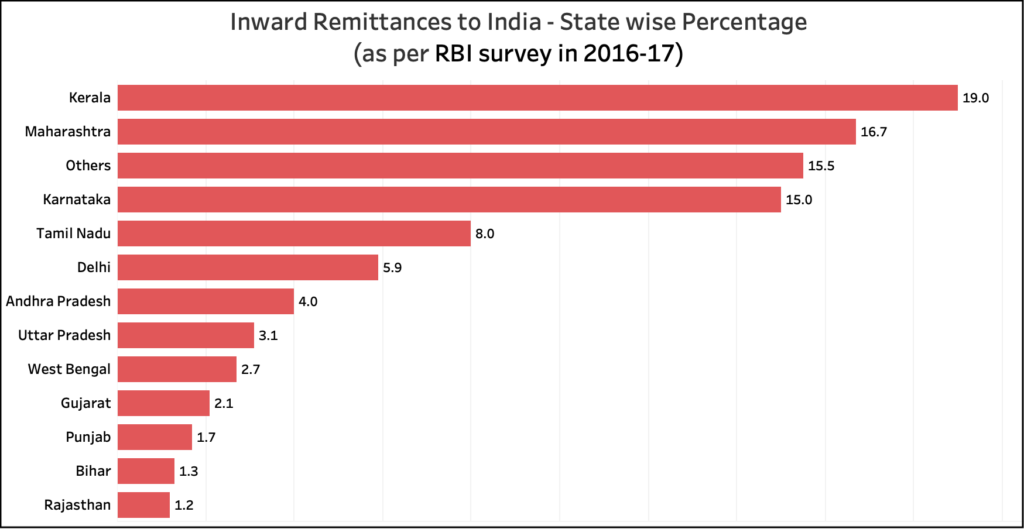

19% of the total inward remittance to India goes to Kerala

State wise analysis of remittances reveals that 58.7% of the total remittances go to four states- Kerala, Maharashtra, Karnataka and Tamil Nadu. While Kerala has the largest share of 19%, Assam, Chhattisgarh, Himachal Pradesh, Uttarakhand, Jammu and Kashmir and Jharkhand together constitute only 1%. Puducherry and Chandigarh account for 0.2% inward remittance each which is more than that of some states. The others category (15.5%) is where banks could not identify the specific destination of the remittance.

More than 50% of the remittance amount used for Family Maintenance

The most preferred channel of remittance for about 75.2% of the transactions was through Rupee Drawing Arrangement since the cost of transaction through this mode is lesser compared to the rest. Rupee Drawing Arrangement (RDA) is a channel to receive cross-border remittances from overseas. Under this arrangement, the Authorised Category I banks enter into tie-ups with the non-resident Exchange Houses in foreign countries. Remittances are made through these exchange houses.

It was also found in the survey that, 59.2% of the remittance amount received in India were used for family maintenance- for consumption of the family. 20% was used as deposits in banks while 8.3% was used to invest in equity shares, land, property etc.

About 74.2% of the transactions took place through private sector banks in India. The percentage of transactions that took place through public sector banks and foreign banks are 17.3% and 8.5% respectively. RDA is less expensive in the case of private and foreign banks as compared to public sector banks as per the survey. In terms of the transaction size, 70.3% of the transactions were greater than or equal to $500. Only 2.7% of the transactions were lesser than $200.

How far are we from the SDG of 3% transaction cost on remittance?

One of the targets of Sustainable Development Goal (SDG) 10 (Goal 10: Reduce inequality within and among countries) is to reduce the transaction costs of migrant remittances to less than 3% and eliminate the remittance corridors with costs higher than 5% by 2030.

The objective of this goal is to bring down disparities and inequalities in accessing basic human necessities like healthcare and education that exist within a country as well as among countries. Since migrants and their remittances play a pivotal role in the economic development of both- source and destination countries, policies in favour of them will help in attaining this goal.

The global average transaction cost to send $200 in the first quarter of 2018 was 7.1%. In the case of India, it was 5.8%. The global cost is 2.36 times the SDG target of 3% which is to be achieved within the next eleven years. This cost is dependent on various factors including the destination, amount, exchange rates, mode of remittance, market competition and more

The positives of remittance include reduction in poverty, improved access to healthcare and education, healthier lifestyle, increased financial literacy and asset accumulation and so on. The overall well-being of households too, can witness a positive change. But, with remittances come a culture of dependency on host countries, which is a risk. Economic problems or the enforcement of strict rules against migrants in host countries such as US, Gulf regions and Europe which host huge population of migrants may result in economic problems in the destination countries like India.

About the RBI Survey: The survey conducted by RBI for this study included responses from 42 of 80 authorised dealers in India which deal in foreign exchange transactions. These 42 dealers account for 98.3% of total remittances reported in 2016-17. Three major Money Transfer Operators were also surveyed using a different questionnaire for this survey.

Featured Image: Remittances to India