During the 2nd week of April, RealT customers began reporting that PayPal was declining their debit card transactions when attempting to purchase tokens on the RealT site. While some users were still able to pay with their PayPal balance, others reported that all attempts to pay with PayPal were being blocked.

Our web dev team did some troubleshooting with the PayPal plugin, and we also reached out to PayPal support, but found no clear answer. PayPal’s service page reported some outages, and the emergence of COVID19 obviously impacted PayPals support staff, so we assumed this was a transient issue.

PayPal was our only fiat-payment gateway, so this was not the news we wanted to hear, especially during the middle of the COVID19 fears, where markets are in turmoil and small businesses and start-ups are under increased pressure.

We then released our next property, 8342 Schaefer, on April 17th. The Schaefer property had tokens priced at just $51, our lowest ever, in an effort to further reduce the barrier to entry into fractionalized real estate, and make it easier for payment processors to process the smaller payments.

The very next day, April 18th, PayPal blocked all payments on the RealT website through their platform, and sent us the following email:

After slowly restricting more and more payments on the RealT website, PayPal informed us that our account has been ‘permanently limited’ and that ‘there will be no appeal process’. Their cited reason was ‘excessive risk’

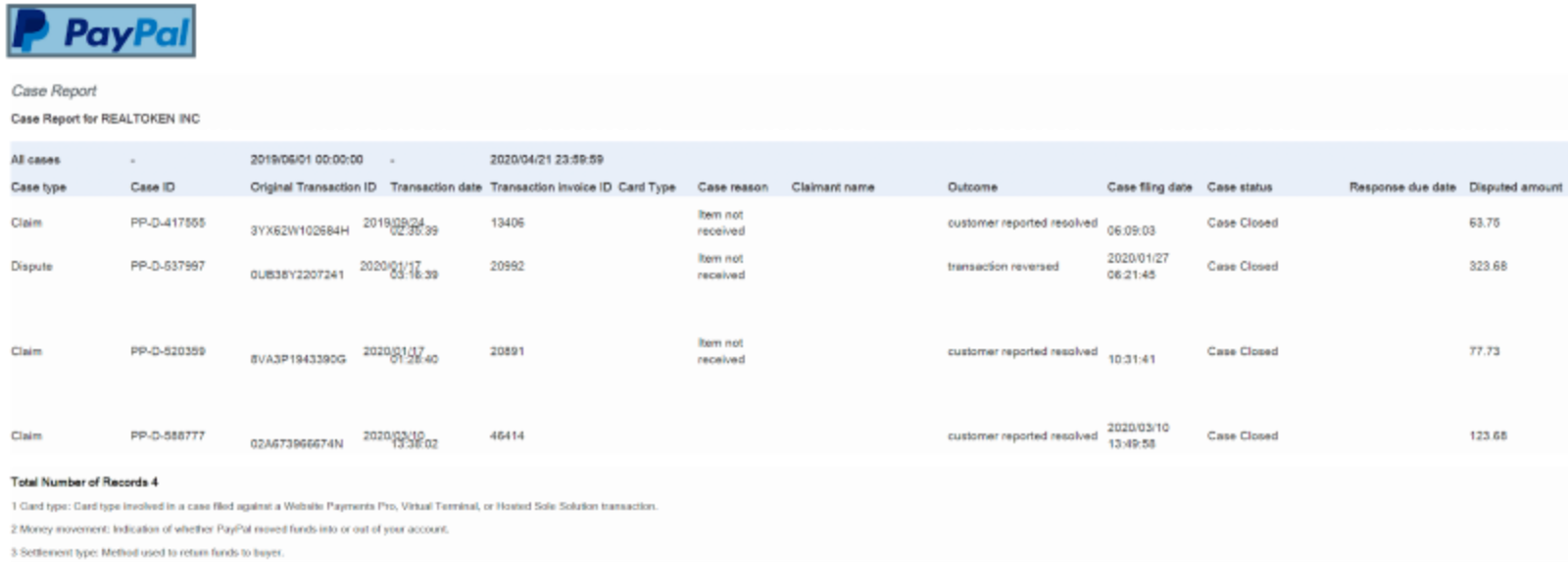

PayPal gets to decide what is ‘excessive risk’ with their own measuring-stick. However, in over 1 year of operation, RealT has had 4 total dispute claims. 3 were resolved in-house, and 1 resulted in a charge-back. The total value of all 4 of these orders is $590, and only $323 were reversed in total.

This is with over $800,000 of total payments made through PayPal. Much risk! So excessive!

Most everyone in the world has a PayPal account, which makes it a great way to collect payment for a digital product that is settled on an internet settlement network (Ethereum). Up to this point, 62% of all purchases on RealT were made via PayPal.

At RealT, we are very fortunate to work inside an industry that centers around permissioness value transfer and payment settlement, and this has been a humbling reminder about some of the core principles of the ethos of the DeFi revolution: permissionless access to money, payments and financial services.

Can a business survive on crypto alone?

While this was not an experiment we would ever intentionally run, PayPal blocking RealT from their service gave us an opportunity to test a thesis: “What would happen if we became a crypto-only company?”.

As incoming fiat payments to RealT dropped to 0, we saw large elasticity in the payment method from RealT customers. The drop in revenue coming from PayPal was matched by an equally large, if not larger, increase in revenue coming from our Coinbase Commerce merchant.

While the news that PayPal removed RealT from its platform was worrying and demoralizing for RealT, this was immediately followed by a 238% increase in orders that used Coinbase Commerce for payment! As it turned out, a large percentage of RealT customers were ready to switch!

In the the 3rd week of April, the first full week without PayPal payments, RealT has its most new-user signups ever. The new property that had just become available, 8342 Schaefer, was a huge hit, and flew off the shelf! RealT had its best 1-week of sales ever, and 100% of that revenue was entirely crypto revenue. While relying on Coinbase Commerce alone, 8342 Schaefer was the fastest property ever sold on Ethereum!

While more payment merchants are always better, the fact that RealT was able to hit ATH in both sales and new user signups, with ONLY crypto as a payment mechanism, is insanely bullish for the crypto-space at large.

Some Lessons:

- We are reminded why censorship resistant & permissionless money is important. How can you expect for innovation to occur, when access to payment infrastructure is gated? The ability to accept incoming payments in DAI is critical infrastructure.

- RealT has some of the most entry-level crypto-users. Tools like Coinbase Commerce, Argent Wallet, and USDC/DAI are truly ground-breaking innovations for companies like RealT that need strong customer UX for onboarding new clients. With PayPal pulling the rug out from under RealT and its customers, we were able to see how many were ready to make the full transition! Turns out, it was a lot!

- Having more options for payments is always good, but having RealT’s ATH in sales using JUST crypto is a huge sign of confidence for the industry, and crypto-first businesses.

What’s Next?

Like many companies in the crypto-space, RealT’s goal is to turn non-crypto people into crypto-people. While it is very reassuring to know that we are able to live with crypto alone, onboarding the next 1M people into the crypto world is still going to require traditional payment mechanisms that can span the fiat<>crypto worlds.

We are putting the finishing touches on our payment integration with Wyre, which will re-enable debit and credit card transactions at checkout.

ACH transfers for U.S. customers, and SEPA transfers for European customers are not far behind!

In order grow crypto larger, there needs to be larger, more dependable highways of value transfer from the legacy world, to the new world. If PayPal is not willing to pave that path, then on a matter of principle, RealT is happy to be a Wyre customer and support them in their endeavors in stitching these two worlds together!